What is Tokenized Real Estate?

Have you ever wondered how digital currencies can be integrated with real estate investments? Tokenized real estate refers to the process of creating digital tokens on a blockchain that represent ownership or shares in a real-world property. This innovation allows for fractional ownership, making it easier for average investors to participate in the real estate market.

Benefits of Tokenized Real Estate

- Enhanced Liquidity: Traditionally, real estate transactions can take weeks or even months. With tokenization, transactions occur on a blockchain, potentially making trading those tokens faster and more efficient.

- Lower Barriers to Entry: Investors can buy fractions of a property, which lowers the initial investment required. Instead of needing hundreds of thousands of dollars, you could invest even a few hundred in a token.

- Global Access: Tokenized real estate can attract international and local investors alike, broadening your investment pool.

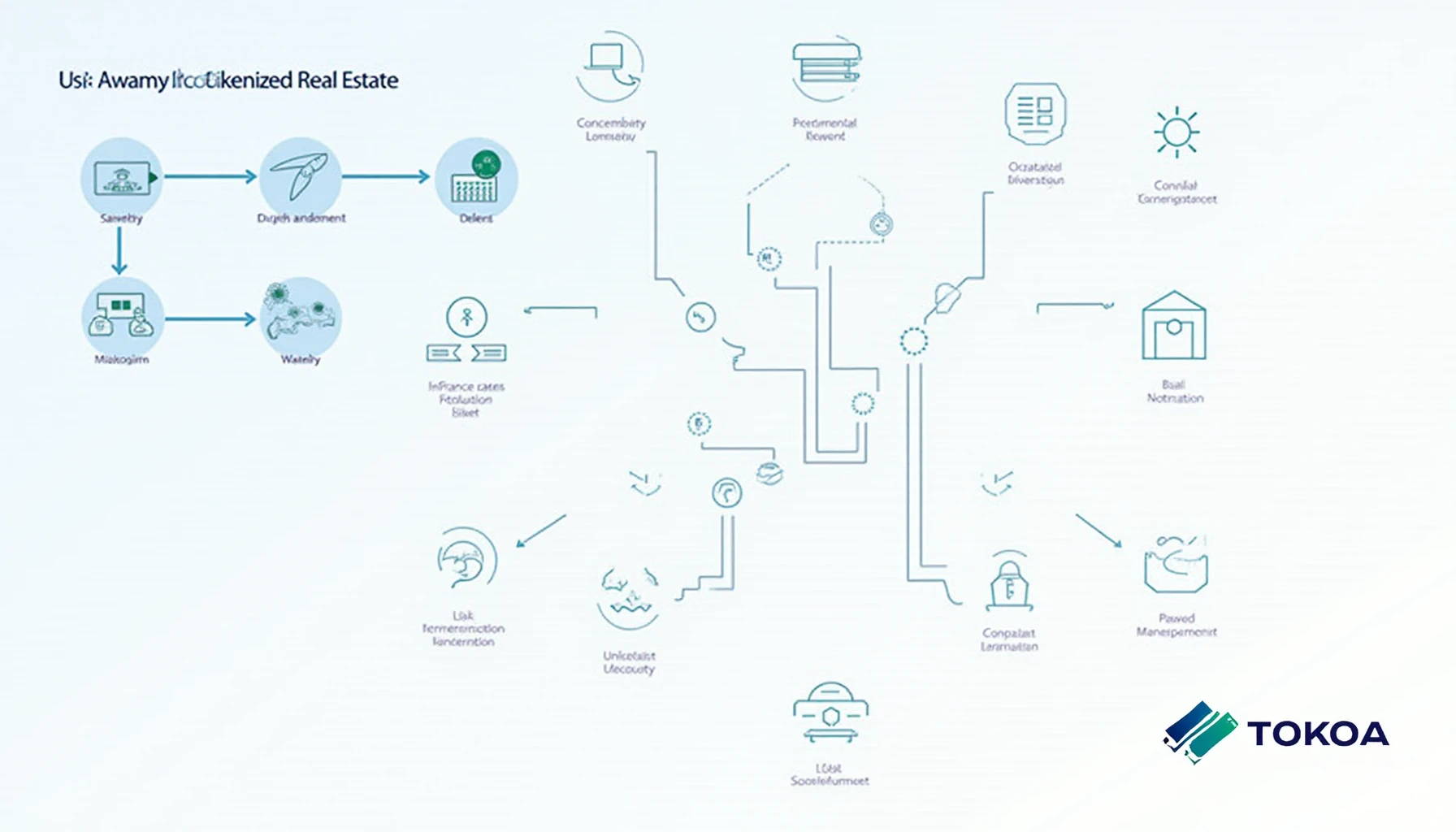

How Does Tokenization Work?

For a better understanding, think of a pie chart divided into several slices. Each slice represents a share of a property, and each slice can be bought or sold individually as tokens on a blockchain. The blockchain technology ensures that transactions are secure, transparent, and traceable.

According to a recent Chainalysis report, the tokenized real estate market is expected to grow by 40% by 2025 in the Asia-Pacific region alone, indicating a significant trend towards digital investments.

Challenges and Risks

- Regulatory Hurdles: The tokenization of real estate is still relatively new, meaning regulations may vary significantly depending on your region.

- Market Volatility: The value of property tokens may fluctuate widely, similar to other digital currencies.

Conclusion: The Future of Real Estate Investment

In summary, tokenized real estate offers a plethora of opportunities for those looking to diversify their investment portfolio while participating in the digital currency trading landscape. However, it’s vital to understand the risks involved. For anyone considering this investment avenue, seeking advice from a local regulatory authority can be beneficial.

Take the Next Step: If you’re intrigued by tokenized assets, explore platforms that facilitate such investments to potentially reap future profits.

Disclaimer: This article does not constitute investment advice. Please consult local authorities before making any financial decisions.

For more insights, visit our related articles on how to safely store cryptocurrencies and 2025’s most promising altcoins.