Introduction

With the value of synthetic derivatives markets projected to reach $20B by 2025, it is essential for crypto enthusiasts and investors to understand their dynamics and implications. These markets enable users to trade assets that mirror the value of real-world commodities, currencies, and stocks, bringing new opportunities for risk management and price discovery in the volatile crypto space.

What Are Synthetic Derivatives?

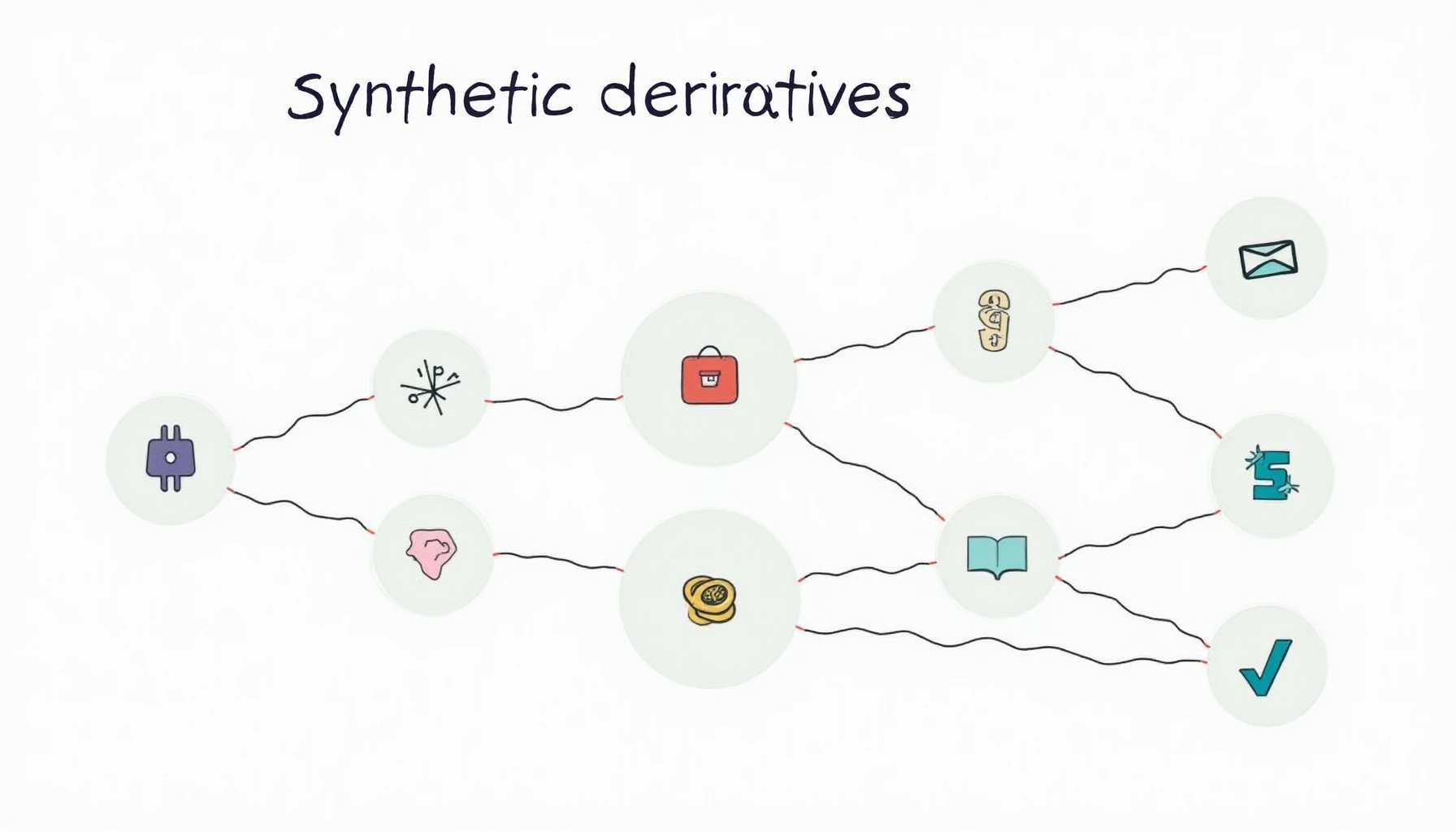

Synthetic derivatives are financial instruments that derive their value from other assets, offering a flexible way to trade. Think of them as virtual contracts that reflect the real-time price movements of underlying assets. In a similar way to how options and futures work in traditional finance, synthetic derivatives provide exposure without the actual ownership of assets.

Benefits of Synthetic Derivatives in Crypto

- Enhanced Liquidity: Synthetic derivatives can increase market liquidity, akin to a bank vault that allows multiple users to secure their assets efficiently.

- Risk Management: These instruments help users hedge against market volatility, providing a form of financial insurance.

- Access to Broader Markets: Traders can gain exposure to various asset classes without the need for direct investment.

Market Trends and Growth Potential in Vietnam

Vietnam’s crypto landscape is evolving rapidly, with a reported user growth rate of 43% in 2024. As local investors start to embrace synthetic derivatives, platforms like HIBT are preparing to offer more tailored products for this market segment. Additionally, increased regulatory clarity will bolster adoption and implementation.

Understanding Trading Strategies

Traders often utilize strategies such as arbitrage and spread trading with synthetic derivatives. For example, arbitrage might involve taking advantage of price discrepancies between synthetic derivatives and their underlying assets. This practice illustrates how traders can profit without holding the actual asset.

Challenges in Synthetic Derivatives Trading

While synthetic derivatives have their advantages, they come with challenges. Regulatory scrutiny is increasing, and users should be aware of the legal landscape in their jurisdictions. Furthermore, the mechanisms that underlie these derivatives can be complex, requiring a solid understanding to mitigate risks effectively.

Conclusion

As synthetic derivatives markets continue to grow and innovate, they present exciting opportunities for traders and investors alike. Recognizing both the potential and challenges of these instruments will be crucial for navigating the future of crypto trading. Engage with platforms like cryptosaviours to stay updated on market trends and best practices.

For more information, consult local regulations and seek professional advice before engaging in synthetic derivatives trading.