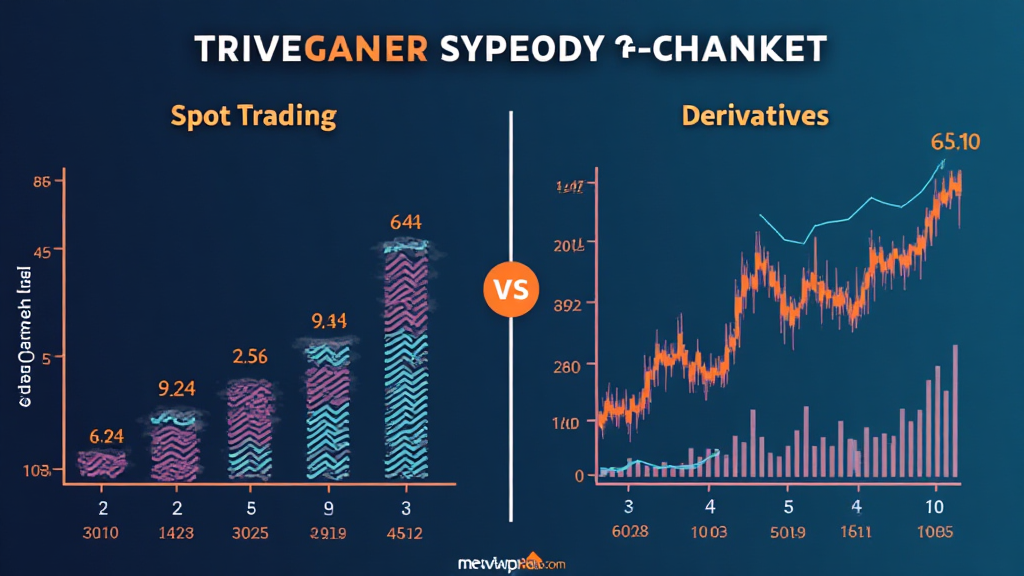

Spot Trading vs Derivatives: Understanding the Differences

According to Chainalysis, 73% of global spot trading platforms face security flaws. As we dive into the financial world, the debate between spot trading vs derivatives becomes increasingly relevant, especially for investors in rapidly evolving markets.

What is Spot Trading?

Spot trading can be likened to a traditional market where you buy and sell goods on the spot. Imagine walking into a farmer’s market and purchasing fresh vegetables. You pay the vendor right there and take your vegetables home immediately. In the context of crypto, spot trading means you buy cryptocurrencies outright at the current market price.

Understanding Derivatives in Crypto

On the other hand, derivatives are like making a deal to buy fresh veggies next week at today’s price. You’re not purchasing the vegetables now but betting on what their price will be next week. In the crypto world, derivatives allow investors to speculate on the future price of digital currencies without owning them outright.

Benefits and Risks: Spot Trading vs Derivatives

Spot trading is straightforward and assumes you own the asset, which provides immediate ownership benefits, such as voting rights in some blockchain networks. However, it lacks flexibility in terms of leveraging investments. Derivatives, however, offer the ability to amplify your investment returns but come with heightened risk. A bad bet can lead to significant losses, similar to a failed investment in a future vegetable harvest.

Why Choose One Over the Other?

Your choice between spot trading vs derivatives boils down to your investment goals. Are you looking for short-term gains with spot trading, or do you prefer to hedge risks using derivatives? Do you want to understand the 2025 Singapore DeFi regulation trends? Knowing your goals and risk tolerance is essential when making this decision.

In conclusion, balancing the advantages and disadvantages of spot trading vs derivatives will guide your trading strategy. If you’re venturing into these financial waters, consider using reliable tools like the Ledger Nano X to mitigate risks such as private key exposure, which can be reduced by 70%.

For more insights and to explore effective trading strategies, download our comprehensive toolkit today!