Introduction: What Are Oracle Manipulation Risks?

Did you know that around 50% of smart contract users are unaware of oracle manipulation risks? This lack of awareness can jeopardize digital assets significantly. As blockchain technology evolves, so do the complexity and vulnerability of oracles, which serve as data feed mechanisms for decentralized applications (dApps) and smart contracts. Understanding these risks is crucial for engaging securely with digital currencies.

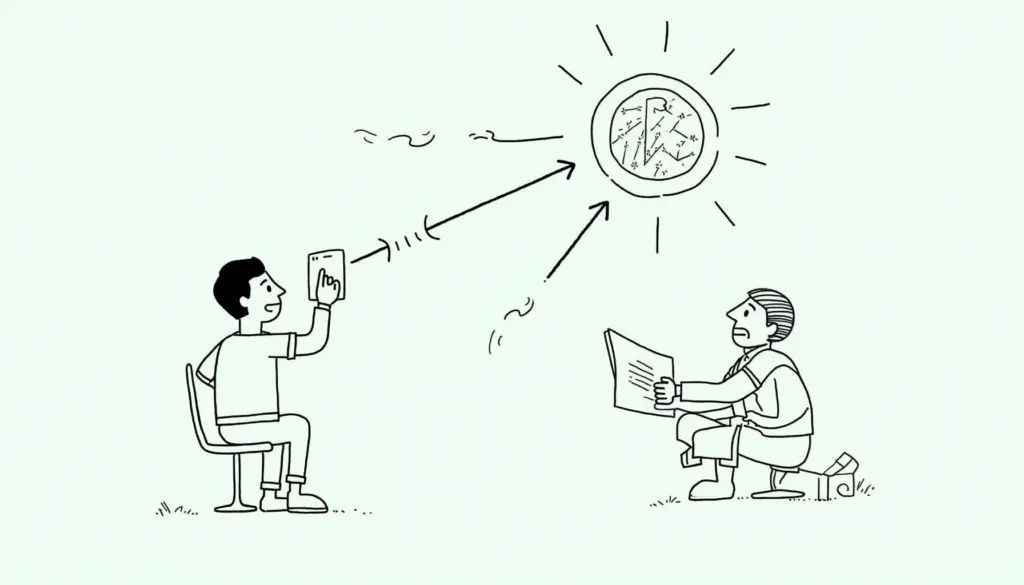

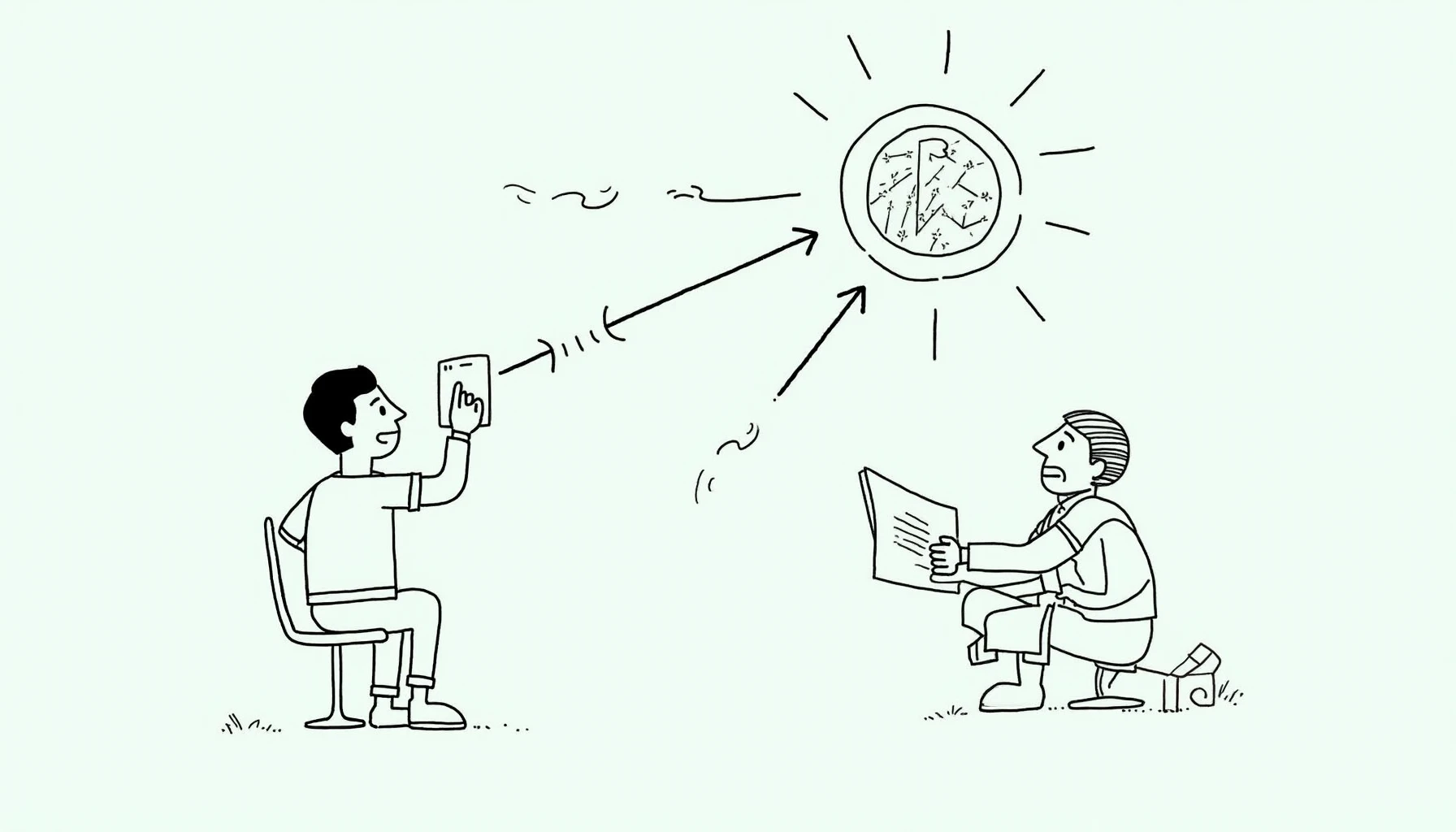

What Are Oracles and Their Role in Blockchain?

Oracles act as bridges between off-chain data and the blockchain. They augment smart contracts by providing real-world data essential for functionality. For example, decentralized finance (DeFi) platforms utilize price oracles to determine asset values for transactions. However, this dependence on external data creates a risk—should the oracle be compromised, it could lead to financial losses.

Types of Oracle Manipulation Risks

There are several types of oracle manipulation risks you should be aware of:

- Data Integrity Risks: If an oracle feeds inaccurate or misleading information, it can skew smart contract executions.

- Sybil Attacks: Attackers can create multiple identities to manipulate the data being reported to the oracle.

- Privileged Access Risks: Some oracles allow specific entities to alter data, creating a potential for abuse.

How to Protect Against Oracle Manipulation Risks?

Safeguarding your investments requires a proactive approach:

- Use Decentralized Oracles: Opt for decentralized oracles, like Chainlink, which distribute data across multiple nodes and mitigate single points of failure.

- Smart Contract Audits: Regular audits by reputable firms are essential, particularly for crucial DeFi projects.

- Implementing Redundancy: Using multiple oracles for crucial data can help ensure accuracy and reduce reliance on any single source.

Real-World Examples

Consider a scenario where a price oracle reports inflated cryptocurrency values. A smart contract based on these prices might liquidate collateral positions incorrectly, leading to severe losses. This has happened in the past, reminding users how crucial accurate oracle data is to the integrity of blockchain smart contracts.

Conclusion: Stay Informed and Secure

Understanding oracle manipulation risks is vital in the world of digital currency trading and blockchain technology. With over 5 million DeFi users projected by 2025, being aware of these risks and implementing protective measures can save you from potential losses. Don’t wait until it’s too late—ensure you are protected today!

For more insights on blockchain technology and securing your digital assets, check our other articles on how to safely store cryptocurrency and the rise of oracle technologies in blockchain.