Introduction: Are You Ready to Dive into Crypto Mining?

Did you know that there are over 1,800 cryptocurrencies with millions of enthusiasts eager to mine them? However, only a fraction of the current 5.6 billion crypto holders truly know how to set up a mining operation. Starting your own crypto mining farm could be a lucrative venture, but where do you begin?

Understanding Crypto Mining: What You Need to Know

Before you set up a mining farm, it’s crucial to understand what crypto mining entails. In simple terms, mining is the process through which transactions are verified and added to the public ledger of cryptocurrencies, known as the blockchain. For example, without miners, Bitcoin and other digital currencies would cease to function. Here are a few key concepts:

- **Hash Rate**: The measure of computational power used per second.

- **Mining Difficulty**: A measure of how hard it is to mine a block.

- **Proof of Work**: The algorithm used by Bitcoin to validate transactions.

Step-by-Step Guide to Start Your Mining Farm

Let’s break down the process into manageable steps:

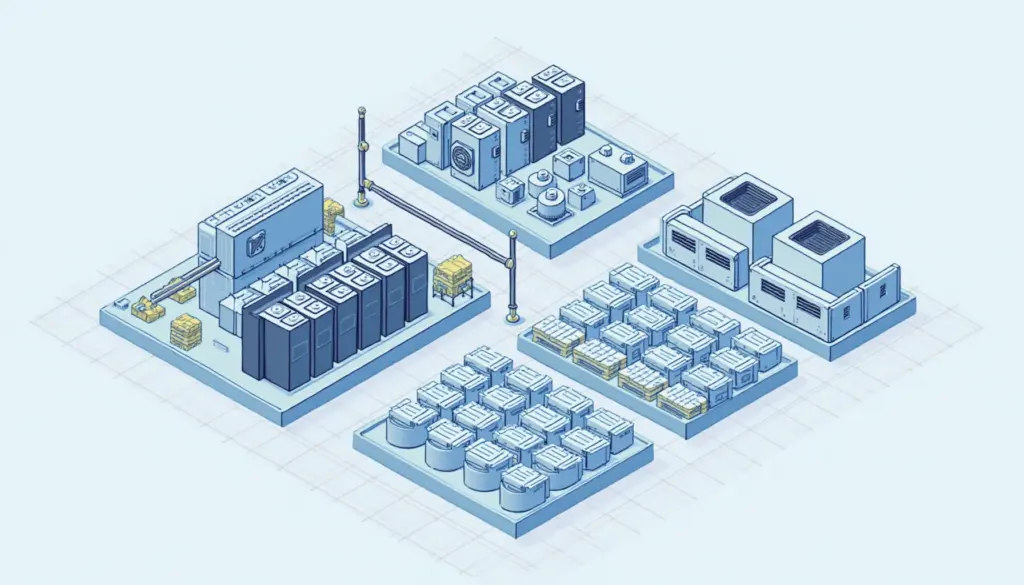

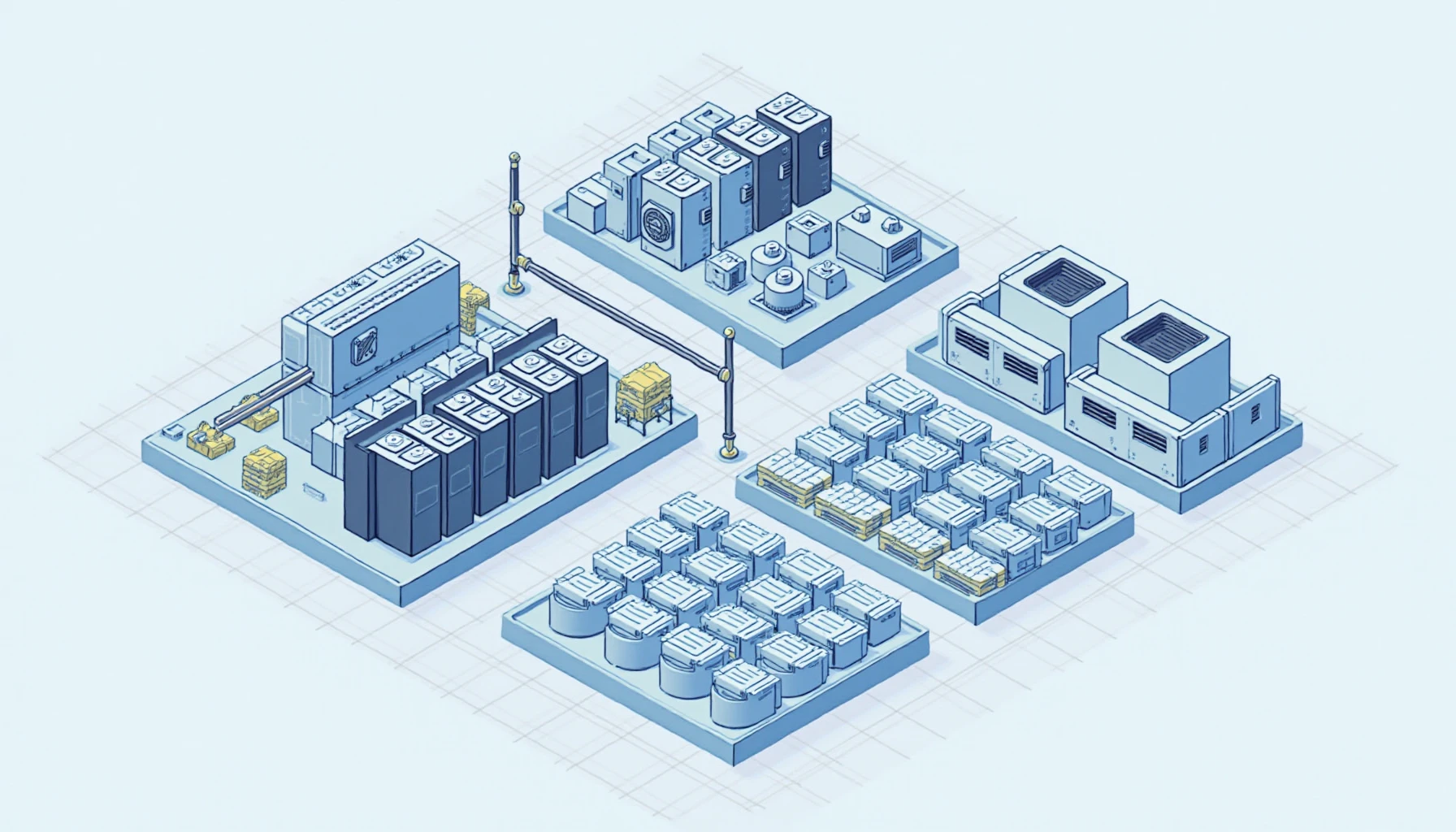

- Research Mining Equipment: Depending on your budget, you can either opt for ASIC miners (Application-Specific Integrated Circuits) or rig-based mining setups using GPUs (Graphics Processing Units). High-quality brands include Bitmain Antminer and NVIDIA.

- Select the Right Location: The best mining locations often have low electricity costs. Areas in North America and Eastern Europe are popular for their competitive electricity prices.

- Set Up Your Mining Hardware: You’ll need a cooling system to prevent overheating. Be sure to include proper ventilation in your setup.

- Choose a Mining Pool: If you’re just starting, joining a mining pool will increase your chances of earning rewards. Popular pools include Slush Pool and F2Pool.

Evaluating Costs and Rewards

Starting a mining farm requires both an upfront investment and ongoing operational costs:

- Initial Setup Costs: Includes mining hardware, cooling systems, and additional infrastructure.

- Operating Costs: Monthly expenses such as electricity, internet, and maintenance.

- Potential Returns: According to recent data, a well-optimized mining rig can return a profit within the first year depending on market conditions.

Staying Compliant and Safe

As a new miner, ensure that you are aware of legal regulations concerning cryptocurrency mining in your location. For example, regulations surrounding crypto taxation vary globally, with places like Singapore providing clear guidelines for miners.

Disclaimer: This article does not constitute financial advice. Consult local regulatory agencies before proceeding with any investment.

Conclusion: Take the Next Step

Setting up a mining farm involves careful planning, significant investments, and commitment. By following the steps outlined above and conducting thorough research, you can position yourself for success in the burgeoning field of cryptocurrency mining. Remember, caution is key!

Ready to start? Check out our guide on crypto security aimed at helping miners stay safe and compliant!