2025 HIBT Remittance Crypto Use Insights

As we move into 2025, the financial landscape continues to evolve, particularly in the realm of cryptocurrency remittances. According to recent Chainalysis data, a staggering 73% of cross-chain bridges are vulnerable to attacks. This raises critical questions about the security and efficiency of remittances using cryptocurrencies like HIBT.

Understanding HIBT Remittances

Imagine you’re at a market, wanting to exchange your local currency for another. The counter you approach is a cross-chain bridge, allowing you to swap your money between different currencies seamlessly. HIBT serves as a digital currency that streamlines this process, enhancing the way remittances are handled globally. Its use significantly cuts down transaction times and costs, making it an efficient option for both individual and business transactions.

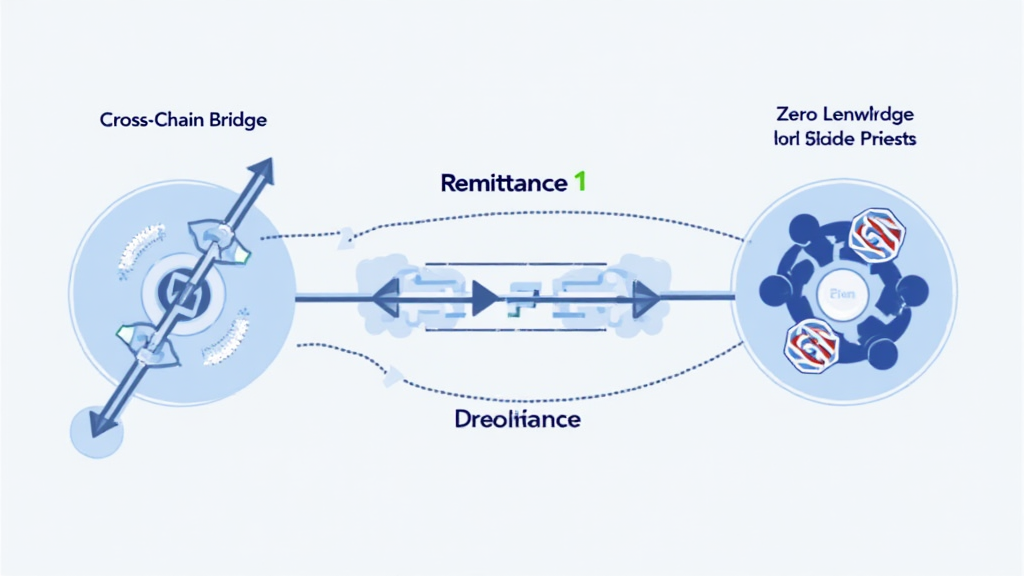

Cross-Chain Interoperability Explained

Cross-chain interoperability can often feel complex, but let’s break it down. Think about it like using public transport to get from one city to another. Each mode of transport (like HIBT) needs to communicate with others (like Bitcoin, Ethereum, etc.) to ensure smooth transfer. In 2025, improvements in this technology will facilitate faster and cheaper remittances, addressing the frustrations currently faced by users.

The Role of Zero-Knowledge Proofs

You might have come across the term zero-knowledge proofs and wondered what it means. Consider it like showing someone a hidden treasure without revealing its exact location. In the world of HIBT, this technology ensures that transaction parties’ details remain confidential while confirming the validity of the transaction. This adds an additional layer of security that is indispensable for remittance services.

Future Trends in HIBT Use

Looking ahead, local regulations in regions like Dubai will shape how HIBT can be utilized for remittances. With the implementation of clear guidelines, the crypto scene in this affluent region is likely to thrive, attracting more investors and users. Understanding these regulations is paramount for anyone considering HIBT as their primary remittance crypto.

In conclusion, as we delve deeper into 2025, HIBT remittance crypto use is set to revolutionize how we perceive and execute cross-border transactions. The advancements in technology and regulatory clarity will undoubtedly lead to safer and more efficient options for users worldwide. For more insights, don’t forget to download our toolkit on secure remittance methods.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority such as MAS or SEC before proceeding with any investments.