2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have vulnerabilities, which raises significant concerns among cryptocurrency users and investors.

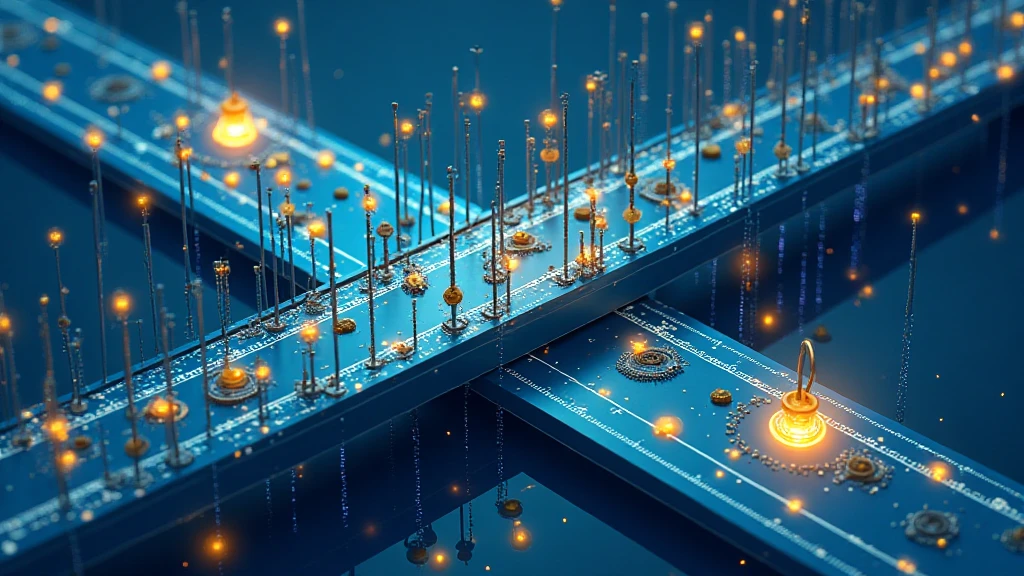

Understanding Cross-Chain Bridges

Think of cross-chain bridges like currency exchange booths at an airport. They help you swap one type of currency for another, just like these bridges allow different blockchain networks to communicate. But, just as some currency booths might not give you the best rates or might even charge hidden fees, cross-chain bridges can also come with risks, particularly vulnerabilities that bad actors might exploit.

Risks Associated with Vulnerable Cross-Chain Bridges

Just like you wouldn’t want to use a shady currency exchange booth, engaging with an insecure cross-chain bridge can put your assets at risk. The potential losses could be massive, as hackers often target these weak points, stealing funds from unsuspecting users.

Best Practices for Ensuring Security

To safeguard against these risks, it’s essential to understand the best practices. Always make sure to conduct thorough audits before using any cross-chain bridge. This can mean checking reviews, asking questions in community forums, and looking for audit certifications that indicate the bridge has been reviewed by a trusted security firm.

The Importance of Compliance and Regulation

As regulations evolve, particularly in regions such as Singapore, understanding compliance becomes crucial. The ongoing trends in DeFi regulation suggest that by 2025, companies will face stricter scrutiny, which emphasizes the need for security audits as a part of their compliance toolkit.

In conclusion, utilizing the HIBT price monitor can provide crucial insights into the security landscape of cross-chain bridges. Protect your assets and ensure safe transactions in the rapidly evolving crypto space. For detailed strategies and data, download our security toolkit now!