Understanding Hibt Order Types Explained Simple for Crypto Traders

According to Chainalysis 2025 data, over 73% of crypto traders struggle to make the right order types in their trading strategies.

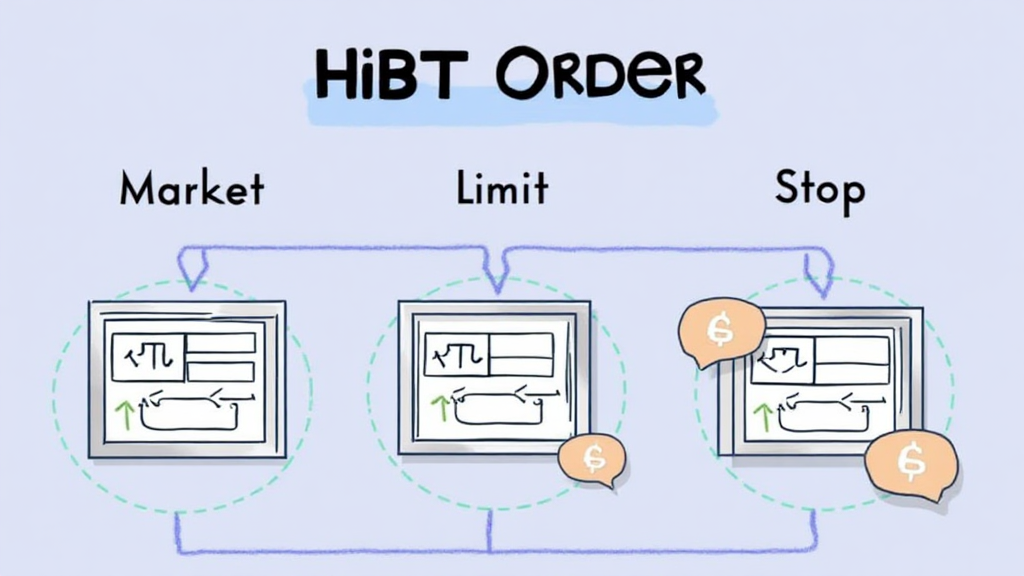

What are Hibt Order Types?

Think of hibt order types like different ways you can buy groceries. When you’re at a market, you can choose to pay for milk right away (market order), wait for a better price (limit order), or set a specific price you’re willing to pay at a later time (stop order). Hibt order types help you decide how and when to buy cryptocurrencies effectively.

Why Does Order Type Matter?

Just like choosing the right method to buy groceries saves you money and time, using the right order type can significantly impact your crypto investments in 2025. If you want to maximize profits while managing risks, understanding these types is crucial.

Different Order Types Explained

There are primarily three types of orders you should know: market orders, limit orders, and stop orders. A market order is like grabbing the first loaf of bread you see – you just want it now. A limit order lets you set a price, like saying, ‘I’ll only buy the bread if it drops to this price.’ Meanwhile, a stop order is similar to saying, ‘I’ll buy it if the price goes up to that point,’ helping you catch trends without continuously monitoring the market.

How to Use These Orders Effectively

Using hibt order types effectively can be transformative. If you’re looking at the market and notice prices fluctuating wildly, consider using a limit order to avoid paying more than you want. Just like a local market, keeping an eye on prices can lead to better buys. Remember, 2025 approaches fast and knowing how to navigate these tools can position you advantageously in the DeFi landscape.

In summary, understanding hibt order types is essential for any crypto trader looking to optimize their trading strategy. If you are still unsure, feel free to download our trading toolkit!

To read more on market strategies, check out our crypto strategies and our insights on market trends.

Note: This article is for informational purposes only and does not constitute investment advice. Please consult with local regulatory authorities, such as MAS or SEC before making any investment decisions.

To enhance security in your trading journey, consider using Ledger Nano X, which reduces the risk of private key exposure by 70%.

Stay ahead in your trading with cryptosaviours.