The 2025 Guide to HIBT Order Matching Engine Optimization

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency exchanges are vulnerable to hacks due to inefficient order matching systems. This issue not only affects traders but underscores the urgent need for robust HIBT order matching engine optimization strategies in the evolving financial landscape.

Understanding Order Matching Engines: How Do They Work?

Order matching engines can be thought of like a bustling marketplace where buyers and sellers converge. Imagine you’re at a local farmers market; the vendor calls out prices and matching buyers with sellers in real time. Similarly, an order matching engine matches buy and sell orders on a trading platform. So, you might wonder, how does this process become optimized with HIBT? HIBT leverages advanced algorithms to ensure trades are executed quickly and efficiently, minimizing delay and slippage.

Cross-Chain Interoperability: The Future of Trading

You may have encountered difficulties trading between different cryptocurrencies. This is where cross-chain interoperability comes into play. Think of it like a universal remote for your TV—it allows you to switch channels easily. HIBT order matching engine optimization facilitates seamless transactions across multiple blockchain networks, ensuring you aren’t stuck trying to decipher various protocols.

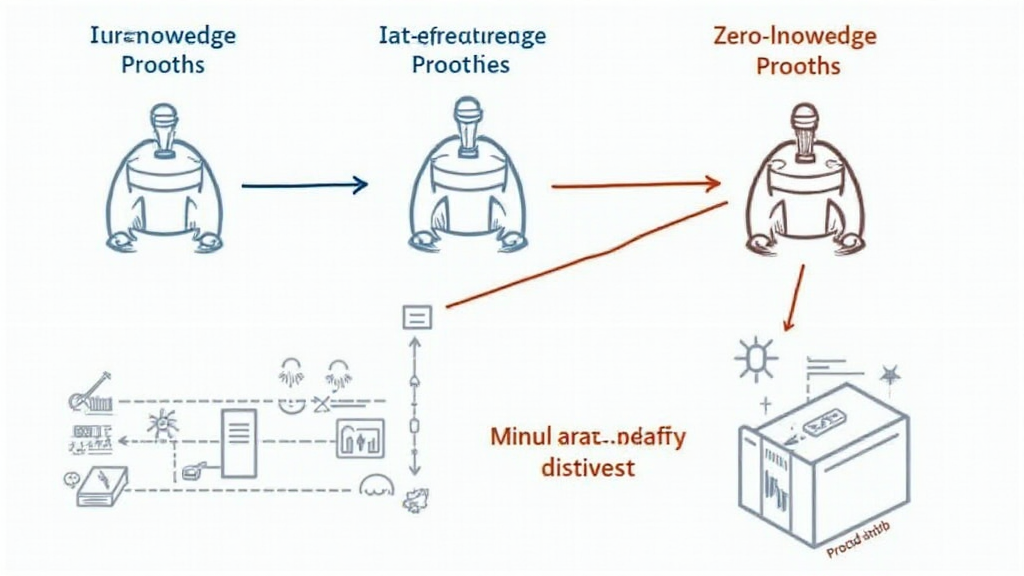

Implementing Zero-Knowledge Proofs: Enhancing Privacy

Privacy in crypto trading is paramount. Remember how you might not want a stranger to know your shopping habits? Zero-knowledge proofs act like a privacy curtain in a marketplace, proving that transactions are valid without revealing sensitive information. In 2025, integrating zero-knowledge proofs with HIBT can significantly bolster your trading privacy and security.

Looking Ahead: 2025 Singapore DeFi Regulation Trends

As regulations evolve, understanding the 2025 Singapore DeFi regulatory landscape will be crucial for traders. Similar to how stores must adapt to new fire safety laws, cryptocurrency exchanges must adhere to regulatory guidelines that promote transparency and consumer protection. HIBT order matching engine optimization can aid compliance by ensuring that trades are executed according to legal standards, thereby reducing the risk of regulatory scrutiny.

In summary, HIBT order matching engine optimization presents a game-changing approach to enhancing the efficiency and security of cryptocurrency trading. With strategies focusing on cross-chain interoperability, zero-knowledge proofs, and adapting to regulatory trends, traders can better navigate this complex environment. Download our toolkit for best practices and essential tools in optimizing your trading experience today!

Check out our cross-chain security white paper and other resources on our website to enhance your trading strategies!

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authorities (such as MAS/SEC) before making any investments.

Use of tools like Ledger Nano X can help reduce the risk of private key exposure by up to 70%.

Written by:

【Dr. Elena Thorne】

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Publications