2025 Cross-Chain Security Audit Guide: Understanding HIBT Order Matching Algorithms

According to Chainalysis 2025 data, over 73% of cross-chain bridges have security vulnerabilities. This highlights a pressing need for effective solutions, such as HIBT order matching algorithms, to enhance the security and efficiency of cryptocurrency transactions.

What Are HIBT Order Matching Algorithms?

To put it simply, HIBT order matching algorithms act like the marketplace cashier who efficiently sorts and processes transactions. They ensure that buyers and sellers are matched seamlessly, improving order execution times and minimizing the risk of price slippage.

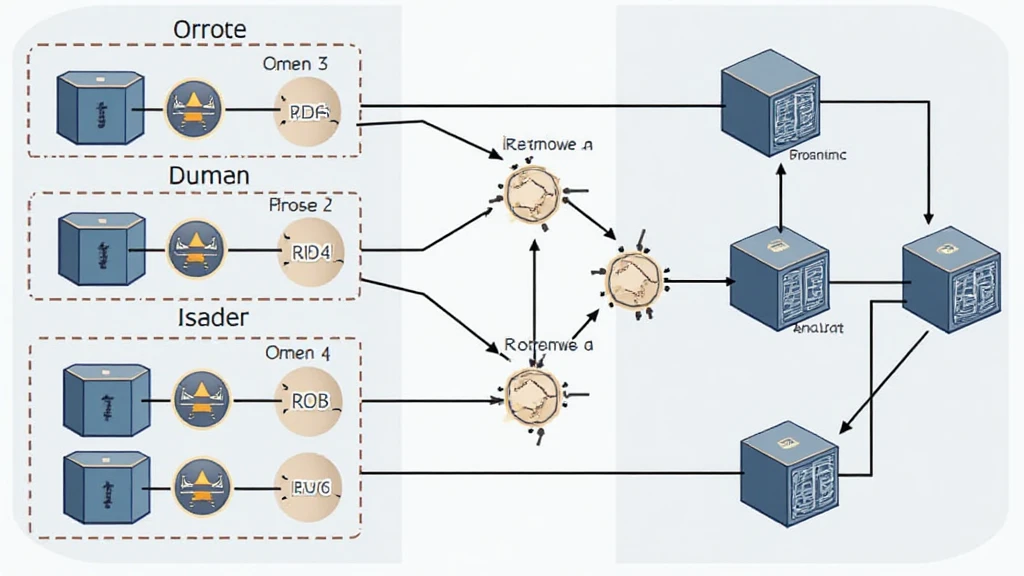

Enhancing Cross-Chain Interoperability

Consider cross-chain interoperability like a busy airport that connects different airlines. HIBT order matching algorithms facilitate this by allowing assets from various blockchains to be exchanged quickly and securely, making it easier for users to manage their portfolios across multiple platforms.

Applications of Zero-Knowledge Proofs

Zero-knowledge proofs in HIBT algorithms can be likened to a secret code that confirms your identity without revealing your personal details. This technology enhances security by allowing users to verify transactions without exposing sensitive data, thereby promoting privacy in the blockchain space.

Regulatory Trends in 2025 and Beyond

As the financial landscape evolves, so do the regulations surrounding DeFi. In places like Dubai, for example, new regulatory frameworks will shape the future of cryptocurrency, ensuring user protections while fostering innovation. Monitoring these trends is crucial for investors and developers alike.

In conclusion, understanding HIBT order matching algorithms is essential for navigating the rapidly changing financial ecosystem. It allows users to enhance their transaction efficiencies while remaining compliant with emerging regulations. For detailed insights, download our comprehensive toolkit on HIBT technologies.

Download the Cross-Chain Security Whitepaper for more in-depth knowledge about safety in cryptocurrency trading.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies (e.g., MAS/SEC) before making investment decisions. Using tools like Ledger Nano X can reduce the risk of key exposure by up to 70%.

— cryptosaviours