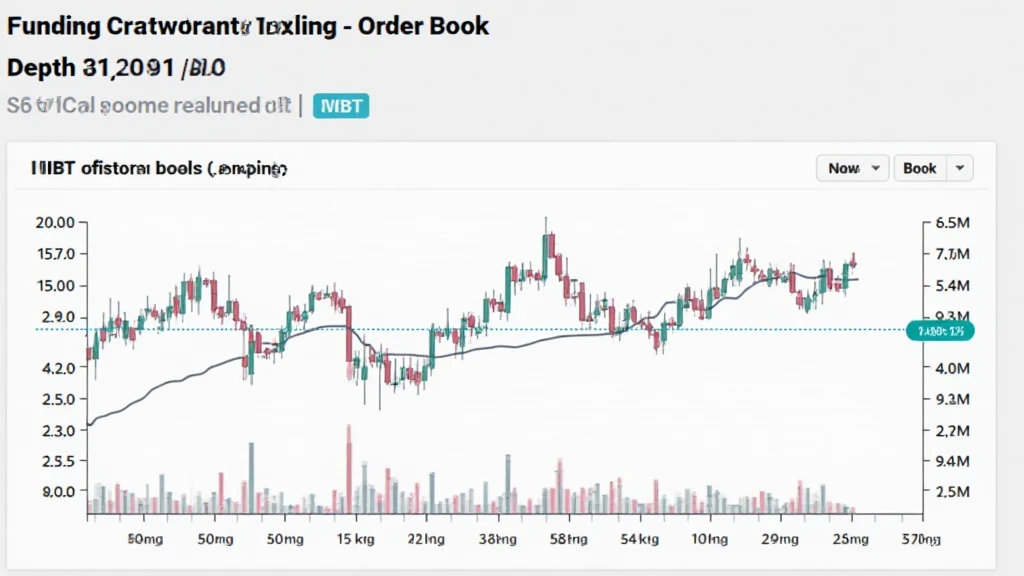

Understanding HIBT Order Book Depth Trends

As cryptocurrency trading evolves, traders face the pressing question: How can they enhance their trading experience? In 2024 alone, the crypto market witnessed losses exceeding $4.1 billion due to poor trade execution. With such staggering figures, recognizing the importance of HIBT order book depth trends becomes paramount. These trends not only pave the way for informed trading decisions but also aid in minimizing unnecessary losses.

What is Order Book Depth?

Order book depth is a critical metric in cryptocurrency exchanges that shows the supply and demand at various price levels. Picture it as a snapshot of current market sentiment. Just like a bank’s vault containing assets, an order book organizes buy and sell orders to maintain market liquidity.

The Importance of Analyzing Trends

Monitoring trends in the order book helps traders understand price movements and market psychology. With a notable growth rate of 45% in crypto users in Vietnam, there’s a surge in interest in understanding how to navigate these waters safely. By recognizing patterns in HIBT order book depth, traders can better anticipate large buys or sells that might influence their strategies.

Key Factors Affecting Order Book Depth

- Liquidity: Higher liquidity usually indicates more stable prices.

- Market Sentiment: Bullish or bearish trends affect buy/sell pressure.

- External Events: Regulatory news or tech developments can shift order book dynamics.

Real Data Insights

In analyzing the HIBT order book depth trends, historian data from monitoring platforms reveal significant fluctuations correlating with market volatility. A recent study indicated that during abrupt price dips, order book depth increases significantly, which often leads to quick price recoveries.

| Trend Type | Change (%) | Date |

|---|---|---|

| Liquidity Spike | 40% | January 15, 2024 |

| Sell-off Period | -30% | February 20, 2024 |

Practical Applications of Order Book Analysis

Understanding the nuances of HIBT order book depth can significantly influence your trading decisions. For instance, utilizing tools that analyze historical data can help forecast future movements, enabling traders to position themselves advantageously.

Conclusion

Given the ever-evolving cryptocurrency landscape, staying informed about HIBT order book depth trends empowers traders to make tactical decisions. As the Vietnamese market continues to expand, incorporating local knowledge and insights into these trends will undoubtedly enhance your trading strategies. Always remember, staying informed is half the battle. If you want to delve deeper into this analysis or related topics, visit hibt.com for valuable resources.