Introduction

As of 2024, the cryptocurrency market has experienced over $4.1 billion in losses from DeFi hacks, prompting investors to seek more effective strategies. Understanding HIBT maximum drawdown tracking is essential for managing risks effectively in volatile environments. This article will explore methods to track and mitigate drawdown, which can help investors protect their assets.

What is Maximum Drawdown?

Maximum drawdown (MDD) is defined as the maximum observed loss from a peak to a trough, before a new peak is achieved. For example, if an investor’s portfolio peaked at $50,000 and later dropped to $30,000, the MDD would be 40%. Think of MDD like the depth of a dip in a roller coaster ride—sharp declines can be jolting but are a natural part of the ride.

Importance of Tracking HIBT Maximum Drawdown

- Helps assess risk tolerance: Knowing your MDD helps you understand how much loss you can tolerate.

- Informs investment decisions: Tracking drawdowns can guide when to pull back or reinvest.

- Improves psychological resilience: Understanding fluctuations aids in staying calm during downturns.

How to Track HIBT Maximum Drawdown Effectively

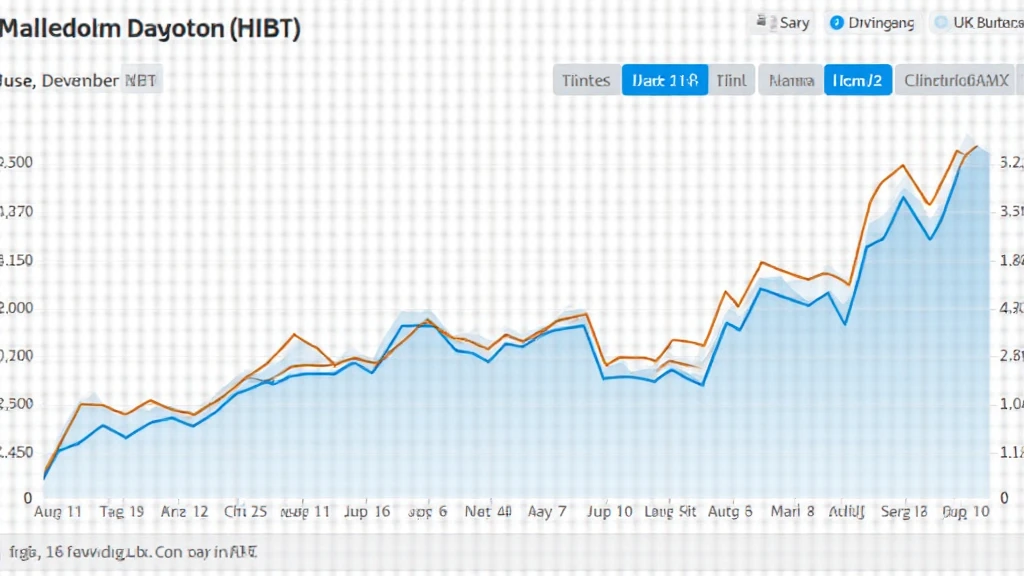

To track HIBT maximum drawdown, investors can utilize various tools and platforms that help in analyzing historical data.

- Use of Graphs: Visual representation makes it easier to spot drawdowns. Platforms like HIBT provide detailed graphing tools.

- Set Alerts: Use alerts from trading platforms to notify you when drawdowns hit specific percentages.

- Regular Monitoring: Weekly or monthly assessments of your portfolio can help you stay ahead of fluctuations.

Data Sources for Tracking

For reliable data on HIBT maximum drawdown tracking, use:

- Analysis from HIBT for updated algorithms and trends.

- Crypto exchanges for real-time data tracking.

- Market metrics from platforms like CoinGecko and CoinMarketCap.

Conclusion

Tracking HIBT maximum drawdown is vital in navigating the sometimes turbulent waters of cryptocurrency investment. By understanding and implementing these strategies, you can better manage your portfolio risk, improve decision-making, and boost your psychological preparedness during market dips. For more insights into crypto investment strategies, consider exploring our other resources at Cryptosaviours.