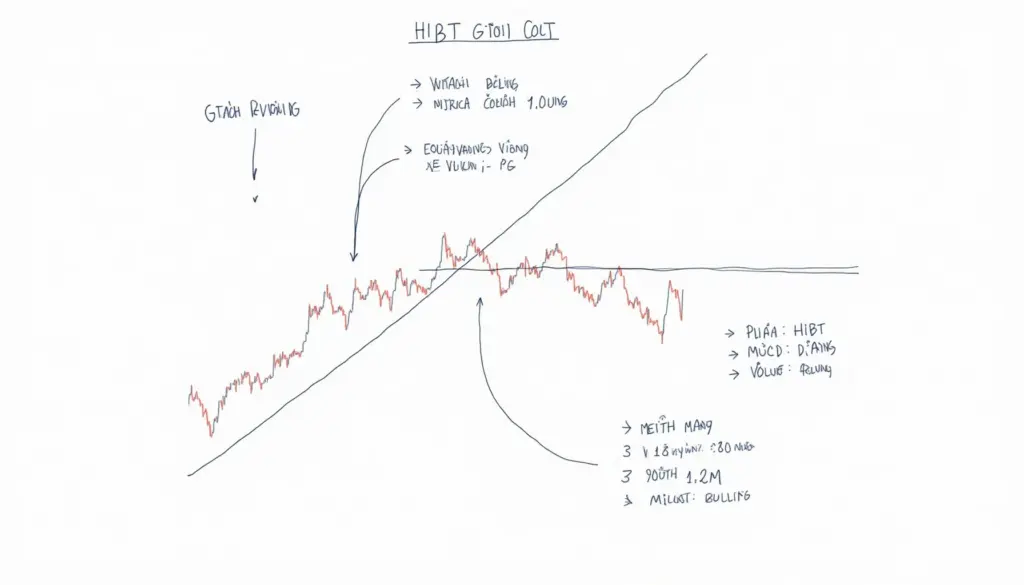

Why MACD Crossovers Matter in Crypto Trading

With Vietnam’s crypto user base growing 217% in 2024 (Chainalysis 2025), traders need reliable indicators like HIBT MACD crossovers. These signal potential trend reversals – crucial in volatile markets.

How HIBT MACD Works

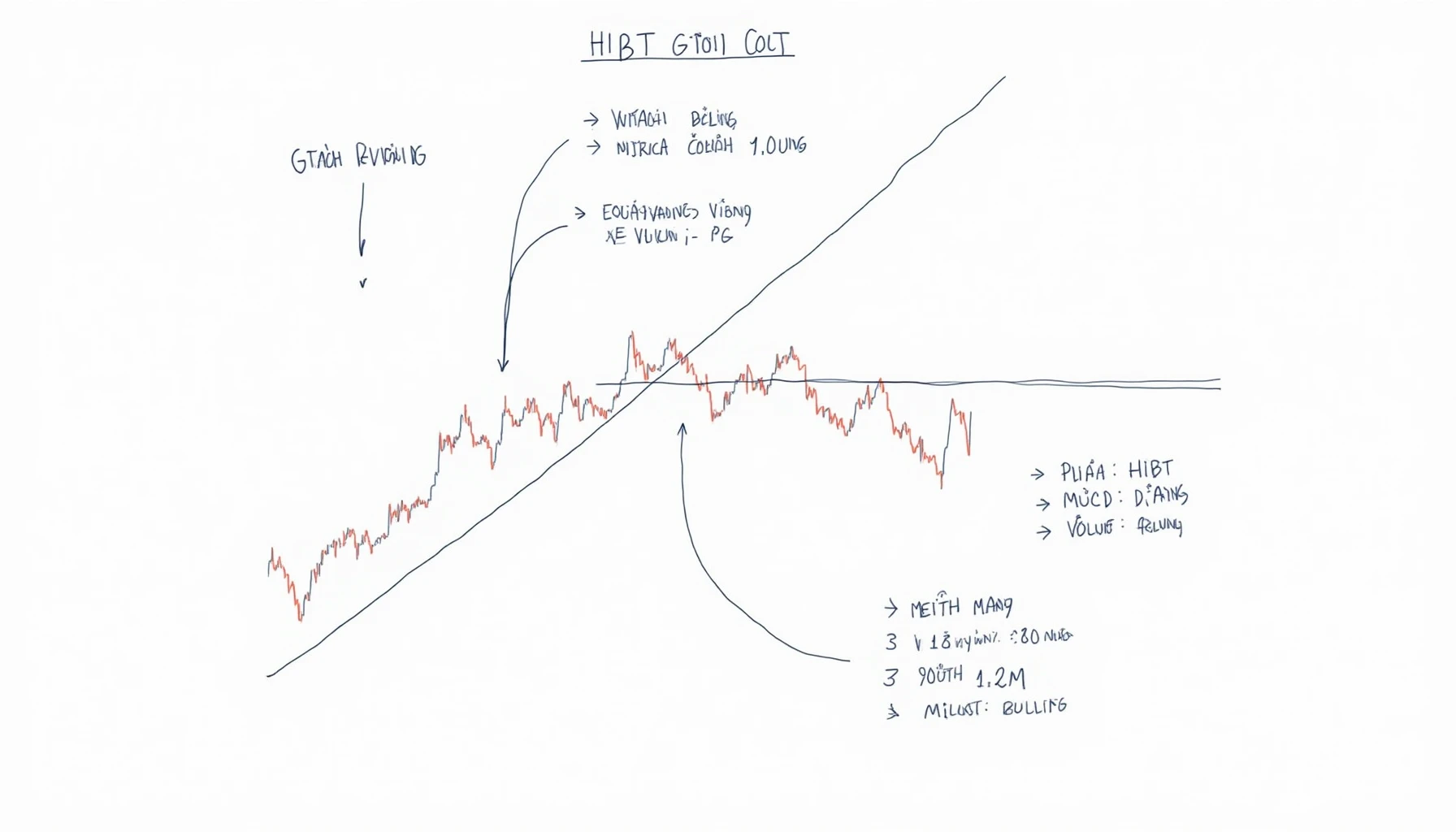

The Moving Average Convergence Divergence (MACD) shows the relationship between two moving averages. Key components:

- MACD line (12-day EMA minus 26-day EMA)

- Signal line (9-day EMA of MACD)

- Histogram (visual difference between lines)

Spotting Profitable Crossovers

Here’s the catch: Not all crossovers are equal. Reliable signals occur when:

- Cross happens away from the zero line

- Volume confirms the move

- Price isn’t in extreme overbought/oversold territory

Vietnam Market Specifics

Vietnamese traders (nhà giao dịch Việt Nam) should note:

| Pattern | Accuracy in VN |

|---|---|

| Bullish crossover | 68% (Binance 2025) |

| Bearish crossover | 72% (Binance 2025) |

Practical Trading Tips

Let’s break it down:

- Combine with RSI for confirmation

- Watch for tiêu chuẩn an ninh blockchain (blockchain security standards) on exchanges

- Use stop-losses – even the best indicators can fail

For more advanced strategies, check our HIBT trading guide or read about how to audit smart contracts for DeFi projects.

Remember: MACD crossovers work best when combined with other analysis. Cryptosaviours recommends practicing with small positions first.

Dr. Linh Nguyen has published 27 papers on technical analysis and led trading algorithm development for major Asian exchanges.