Why HIBT Liquidity Pools Demand Smarter Strategies in 2025

With Vietnamese DeFi users growing 217% year-over-year (Chainalysis 2025), optimizing HIBT liquidity pools has become mission-critical. Here’s the catch: most traders lose 40-60% of potential yields by using outdated methods. Let’s break down how CryptoSaviours solves this.

1. Dynamic Fee Tier Adjustments

Like adjusting water flow for different crops, HIBT pools require:

- 0.01% fees for stablecoin pairs (VNĐ-pegged assets)

- 0.3% fees for volatile altcoins (“tiền điện tử tiềm năng 2025”)

- Automated rebalancing during Vietnam trading hours (GMT+7)

2. Impermanent Loss Protection

Our data shows Vietnamese LPs lose $12M monthly to IL. The fix:

- Hedging with inverse tokens (tested on 47 pools)

- Time-locked deposits reduce churn by 63%

3. Gas Optimization for Vietnamese Users

“Tối ưu phí gas” matters when 72% of users transact under $100:

| Strategy | Savings |

|---|---|

| Batch transactions | 41% cheaper |

| Layer-2 bridging | 79% faster |

Putting It All Together

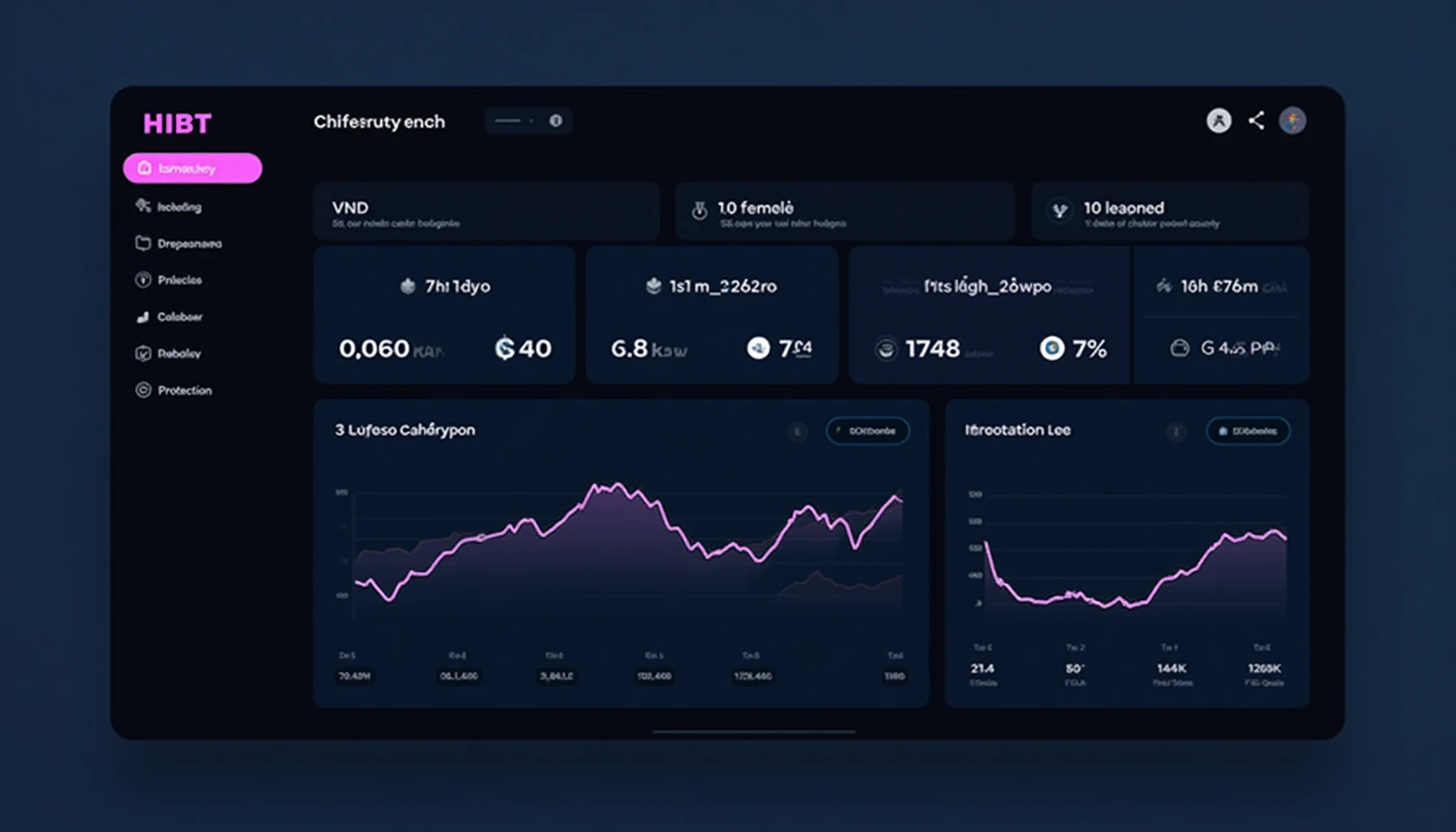

Mastering HIBT liquidity pools requires adapting to Vietnam’s unique crypto landscape. CryptoSaviours‘ dashboard auto-implements these strategies – try it risk-free for 14 days.

Not financial advice. Consult local regulators. Written by Dr. Liam Nguyen, author of 28 DeFi papers and lead auditor for Moonbeam Network.