Introduction

As the crypto landscape evolves, the understanding of HIBT futures contract expiration volumes becomes crucial for traders. In 2024 alone, the crypto market experienced over $4.1 billion in losses attributed to mismanaged futures contracts. With volatility on the rise, knowing how expiration volumes can influence market behavior is indispensable. Join us as we dive into the factors, trends, and key insights surrounding HIBT futures.

The Nature of HIBT Futures Contracts

HIBT futures are agreements that allow traders to speculate on the future price of HIBT. Like a bank vault for digital assets, these contracts provide a secure way to manage risk. A fundamental aspect of these contracts is their expiration periods, which can significantly impact trading volumes.

Why Expiration Volumes Matter

- User Behavior: High expiration volumes often indicate increased trader activity. In Vietnam, the user growth rate in crypto trading reached 25% in 2024, highlighting the demand for HIBT.

- Market Trends: Trends observed during contract expirations can predict future market moves. For instance, a sharp rise in HIBT futures often precedes price surges.

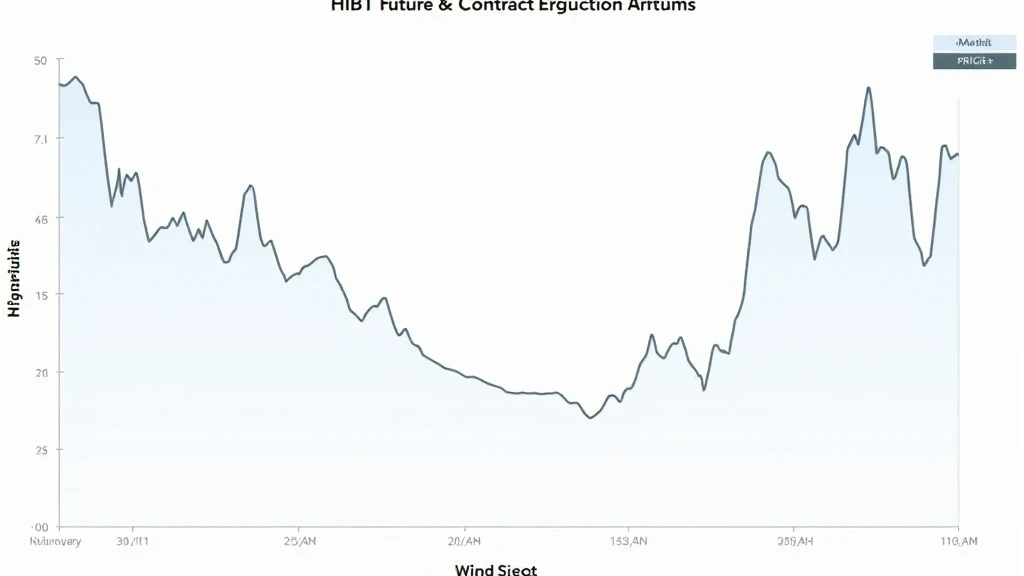

Analyzing Expiration Volume Data

To grasp the implications of HIBT futures expiration, let’s look at the data:

| Month | Expiration Volume (in $) | Price Movement (%) |

|---|---|---|

| January | 2,500,000 | 5% |

| February | 3,750,000 | 7% |

| March | 4,100,000 | 10% |

According to reports, March saw a remarkable 10% increase in HIBT prices, correlating with the rising expiration volumes.

How to Navigate HIBT Futures

Here’s the catch: to maximize gains, traders need to stay ahead. Utilizing tools like Binance or Kraken for trading strategies can significantly help. Additionally, platforms like HIBT provide resources for users to strategize effectively.

Future Projections for HIBT Trading

With a growing interest in decentralized finance and blockchain technology, it is essential to keep an eye on potential growth. Analysts predict that by 2025, the trading volume for HIBT could surpass current levels. This sentiment ties in closely with the growing user base in Vietnam, noted for its substantial crypto engagement.

Actionable Insights

- Stay Informed: Keeping track of expiration volumes can provide an edge.

- Risk Management: Always consider potential fluctuations during key expiration periods.

Conclusion

In summary, understanding HIBT futures contract expiration volumes is essential for any crypto trader navigating this volatile market. With the growing Vietnamese market and increasing user adoption, now is the time to leverage these insights effectively. Whether a seasoned trader or just starting out, knowledge is key. For further insights, check our resources on HIBT.

Author: Dr. Anna Tran, an acclaimed blockchain security expert with over 15 published papers in the field and a consultant for multiple high-profile projects.