Understanding HIBT Futures Contracts

As cryptocurrency trading becomes increasingly prevalent, the need for effective delivery methods for HIBT futures contracts stands out. Did you know that the number of crypto users in Vietnam has skyrocketed, with a growth rate of over 40% in the last year? This surge emphasizes the importance of secure trading practices.

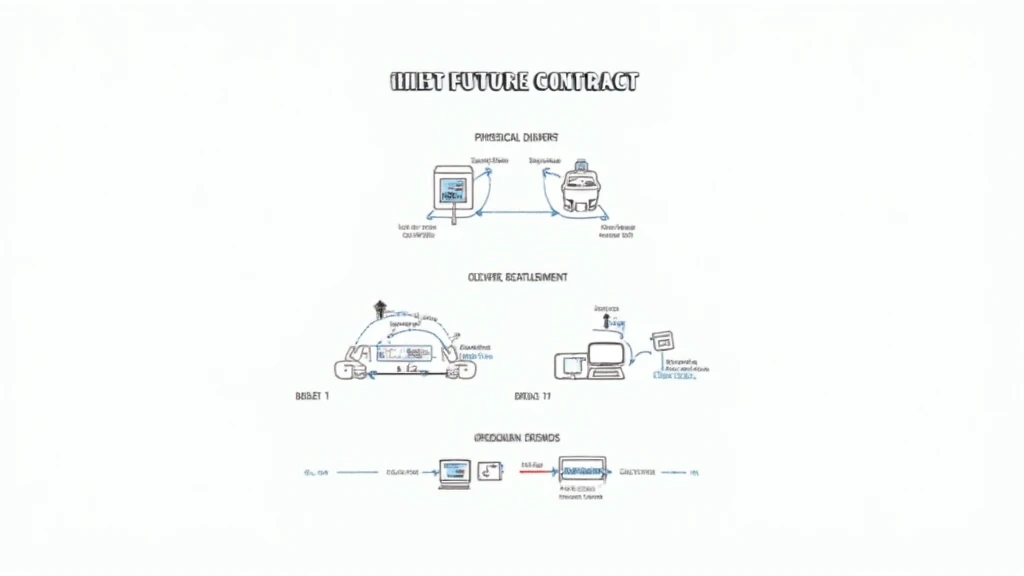

Delivery Methods for HIBT Futures Contracts

There are several methods to deliver futures contracts in the HIBT market. Each method caters to different trading styles and user preferences. Here’s an overview:

- Physical Delivery: This method involves the actual delivery of the underlying HIBT assets at the contract’s expiration. Similar to receiving a parcel in the mail, it’s essential for traders who prefer holding physical assets.

- Cash Settlement: More common in futures markets, cash settlement allows traders to settle contracts in fiat or stable coins without transferring the underlying assets. Think of it like paying a bill instead of exchanging goods directly.

- Offsetting Trades: Traders may opt to close their positions before expiration by entering opposing trades. It’s like taking one step back to move forward, ensuring the trader doesn’t end up with physical delivery.

Pros and Cons of Each Method

Understanding the benefits and drawbacks of each delivery method can enhance trading strategies for users:

| Delivery Method | Pros | Cons |

|---|---|---|

| Physical Delivery | Control over assets, potential for appreciation | Storage costs, security concerns |

| Cash Settlement | Convenient, lower transaction costs | No asset ownership, potential market fluctuations |

| Offsetting Trades | Reduces risk, no need for delivery | May lead to buying and selling fees |

Future of HIBT Futures Contracts

With the increasing complexity of cryptocurrency markets, understanding delivery methods is crucial. By 2025, predicting how the regulatory environment will evolve is essential. According to Chainalysis, the market size for HIBT could increase exponentially with enhanced trading conditions.

Conclusion

Choosing the right delivery method for HIBT futures contracts is vital for effective trading. As the landscape continues to evolve, it’s crucial to leverage reliable exchanges and platforms. For more insights and resources, visit hibt.com. Stay ahead of the curve in the thriving crypto market!

Please note, this is not financial advice. Always consult with local regulators when trading or investing in cryptocurrency.