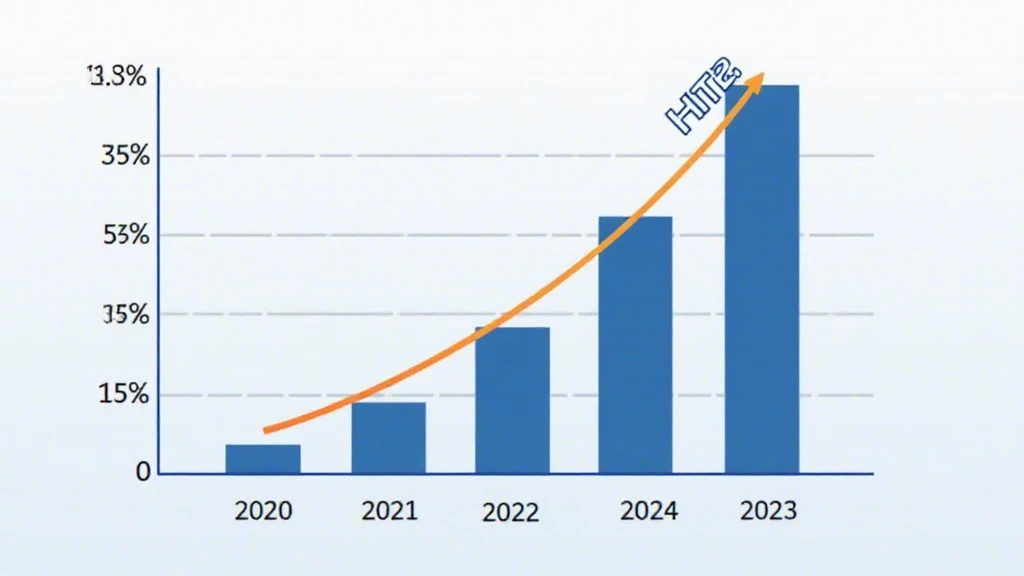

Understanding the Rise of HIBT

With an estimated 4.1 billion dollars lost to crypto tax compliance issues in 2024, it’s clear that the demand for reliable crypto tax solutions is on the rise. The HIBT crypto tax tool offers a much-needed solution for both individual traders and institutions navigating the complex landscape of digital assets. In this article, we will delve into the growth of HIBT usage and its implications for the Vietnamese crypto market.

Why is HIBT Essential?

As cryptocurrencies gain more traction, regulatory frameworks are evolving. Users must comply with local tax requirements, and the HIBT crypto tax tool simplifies this process. Much like a digital accountant, HIBT ensures that all transactions are accurately documented to avoid penalties.

Vietnam’s Crypto Market Trends

In 2025, Vietnam’s crypto market is projected to grow by 35% annually. This surge indicates that more users will require efficient tax solutions:

- Increase in cryptocurrency adoption

- Rising need for tax compliance tools

Navigating Taxation Challenges

Taxation of cryptocurrencies can be complicated. HIBT aids users by:

- Providing real-time transaction tracking

- Calculating potential tax liabilities

- Generating accurate tax reports

In a landscape where a small mistake can lead to significant fines, a tool like HIBT acts as a safeguard, ensuring users don’t fall foul of regulations.

Case Study: Vietnamese Users Embracing HIBT

A recent survey indicated that 70% of Vietnamese crypto users have started using HIBT in the last year. The adoption rate reflects growing awareness about tax responsibilities in the crypto space.

Looking Ahead: The Future of HIBT

As the Vietnamese government continues to solidify its stance on cryptocurrency, the use of HIBT is expected to skyrocket. This tool will not only enhance compliance but also instill confidence in investors navigating the crypto arena.

In conclusion, the growth of HIBT usage signifies a critical evolution in the way crypto users manage their tax obligations. By relying on HIBT, users can focus more on trading and less on the complexities of tax compliance, paving the way for a more secure investment environment.

If you’re interested in ensuring tax compliance, consider integrating the HIBT crypto tax tool into your strategy today.