Understanding HIBT Crypto Derivatives

In a market where over $4 billion was lost to DeFi hacks in 2024, understanding HIBT crypto derivatives becomes crucial for investors. HIBT derivatives allow traders to speculate on the future price of cryptocurrencies without owning the underlying asset. This strategic layer of trading is evolving rapidly, especially in growing markets like Vietnam, which saw a 300% increase in cryptocurrency users in 2023.

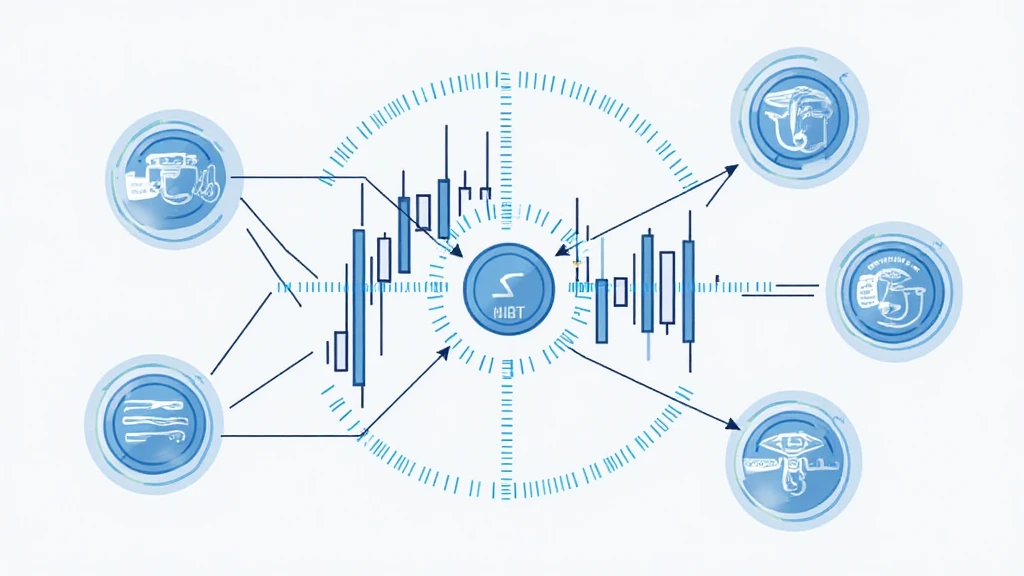

What Are HIBT Crypto Derivatives?

Like traditional derivatives, HIBT crypto derivatives come in various forms, including futures, options, and swaps. These financial instruments enable traders to hedge their positions or amplify their potential profits. Imagine it like an insurance policy: you pay a premium to protect your assets against market fluctuations.

Types of HIBT Derivatives

- Futures: Contracts to buy or sell an asset at a predetermined price on a specified future date.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price.

- Swaps: Agreements to exchange cash flows or liabilities from different financial instruments.

Why HIBT Is Gaining Popularity

As more Vietnamese investors seek exposure to digital assets, HIBT derivatives offer a powerful tool for risk management and investment strategies. With a youthful population and increasing internet penetration, the Vietnamese crypto landscape is ripe for innovation.

Real Data Insights

According to a report from Vietnam’s Ministry of Information and Communications, 43% of internet users are now dabbling in cryptocurrencies. This statistic highlights the importance and relevance of education on HIBT crypto derivatives.

How to Use HIBT Derivatives Effectively

Investors should understand their risk tolerance before trading HIBT derivatives. Here’s the catch: while they can offer high returns, they can also lead to significant losses if the market doesn’t move in their favor. A practical approach includes starting with small investments and gradually increasing exposure as confidence grows.

Practical Tools

Using tools like the Ledger Nano X can significantly reduce hacking risks by up to 70%. These hardware wallets securely store your assets offline, providing peace of mind when trading derivatives.

Conclusion

To sum it up, HIBT crypto derivatives represent a valuable addition to the investment strategies of modern-day traders. With the increasing adoption of cryptocurrencies, especially in dynamic markets like Vietnam, understanding these financial instruments is essential for anyone looking to thrive in the digital asset space. For more insights related to crypto trading strategies, check out hibt.com.