Introduction: The Cross-Chain Challenge

In 2025, Chainalysis data reveals that an alarming 73% of cross-chain bridges exhibit vulnerabilities. These weaknesses pose significant risks for traders and investors navigating the growing decentralized finance (DeFi) landscape. Understanding the hibt cross‑chain trading risk management guide becomes crucial for anyone interested in safeguarding their investments.

H2: What is Cross-Chain Trading?

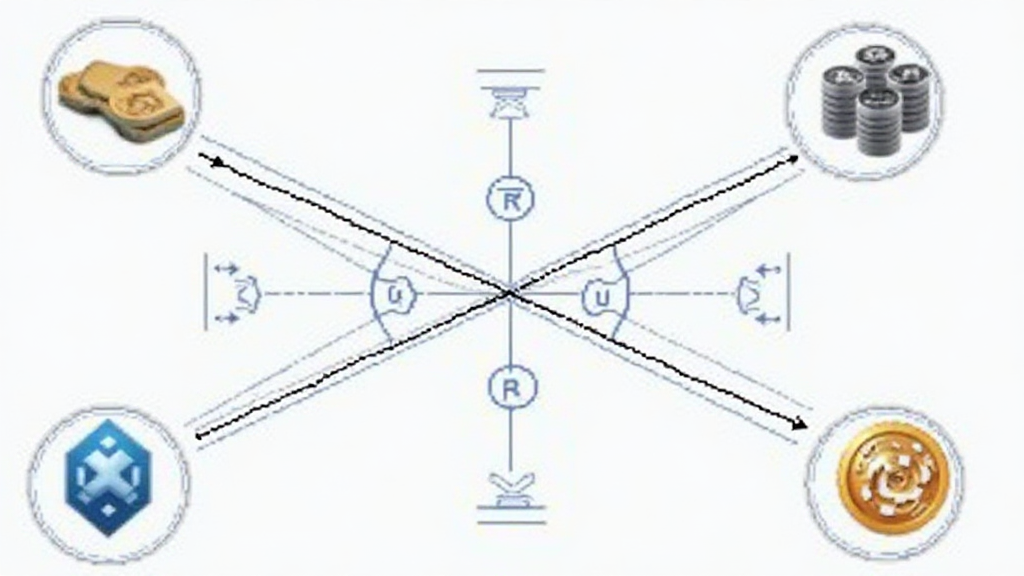

Cross-chain trading allows users to engage with multiple blockchain networks, similar to how a currency exchange kiosk operates, converting one currency into another. For instance, if you’re trying to exchange USD for EUR, you go to a kiosk – cross-chain trading is just like that, but for digital assets across different blockchains.

H2: Identifying Risks in Cross-Chain Trading

Just as currency kiosks can sometimes shortchange you, cross-chain bridges come with inherent risks. One common issue is smart contract vulnerabilities, which can be exploited by hackers. According to CoinGecko’s 2025 data, nearly 60% of cross-chain hacks are due to insecure smart contracts. Experts recommend thorough audits to mitigate these risks. Remember, even the smallest oversight can lead to significant losses.

H2: Mitigating Risk with Zero-Knowledge Proofs

Imagine if you could verify your identity without revealing personal details, much like showing your ID without giving away your birthday. Zero-knowledge proofs do just that for blockchain transactions, enhancing security by allowing for verification while keeping sensitive data private. Implementing these protocols can significantly lower risks in cross-chain trading.

H2: The Future of Cross-Chain Interoperability

Looking forward to 2025, the importance of interoperability between blockchains will evolve. As more transactions occur across different platforms, the demand for robust risk management strategies will surge. Regulations, like those anticipated in Singapore, will shape how cross-chain trading operations are conducted. Staying informed will be vital for traders who want to thrive in this dynamic environment.

Conclusion: Take Action!

To summarize, understanding the risks associated with cross-chain trading and employing strategies from the hibt cross‑chain trading risk management guide is essential. For a toolkit that helps in minimizing these risks, consider downloading our comprehensive resource. Don’t leave your assets unprotected!