Introduction

With the rapid rise of cryptocurrency adoption in Vietnam, along with an impressive 40% increase in users over the past year, understanding cryptocurrency tax optimization is essential. Unwise tax handling could lead to hefty penalties; therefore, it’s crucial to leverage effective strategies to minimize tax liabilities legally.

Understanding the Taxation Landscape

Cryptocurrency taxation is not yet universal, but various jurisdictions are adopting different models. In Vietnam, digital currencies are considered commodities, and any capital gains from trading them are taxable. Similar to how you’d follow laws related to traditional investments, it’s vital to pay attention to your crypto taxes.

Tax Classifications of Cryptocurrencies

- Short-Term vs Long-Term Gains: Gains on assets held for less than one year are usually taxed at higher rates.

- Staking Rewards: Income received from staking is also tax-relevant and needs to be reported properly.

Documentation and Record-Keeping

Here’s the catch: Good documentation makes auditing smart contracts and preparing for tax season less stressful. Keeping track of every transaction is like maintaining a meticulous bank ledger.

Utilize Tax Software

Consider investing in reputable tax software like Koinly or Cryptotrader.tax, which help automate the computing of your tax obligations.

Tax Strategies for Optimization

Implementing effective strategies can significantly alter your tax liabilities:

Minimize Taxable Events

- Avoid unnecessary selling.

- Utilize crypto lending platforms to leverage your assets without triggering a tax.

Timing Your Transactions

Timing can make a difference; for instance, selling in a low-income year can save you money. Just like finding the right moment to cash in a winning lottery ticket, be strategic about your sales.

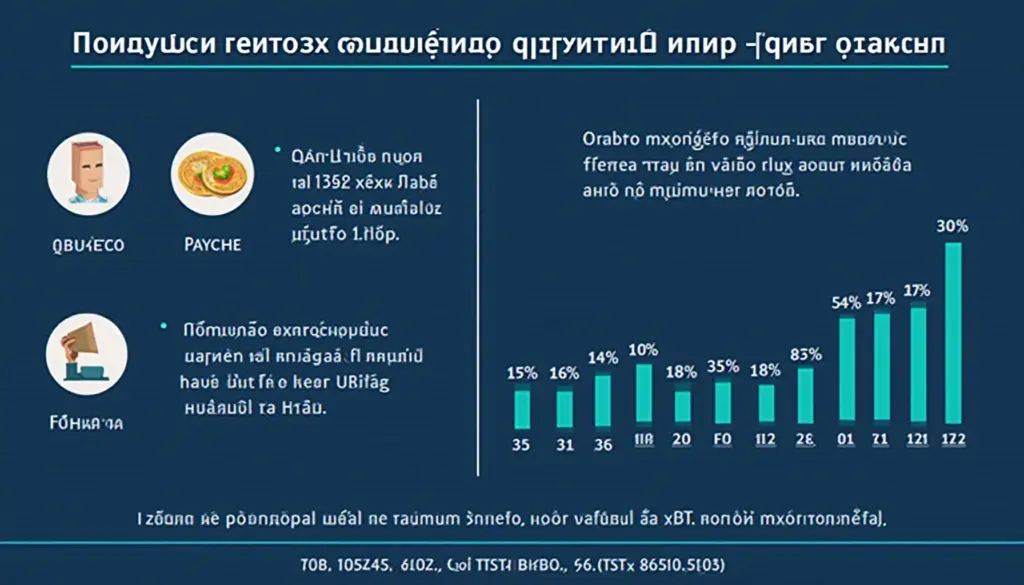

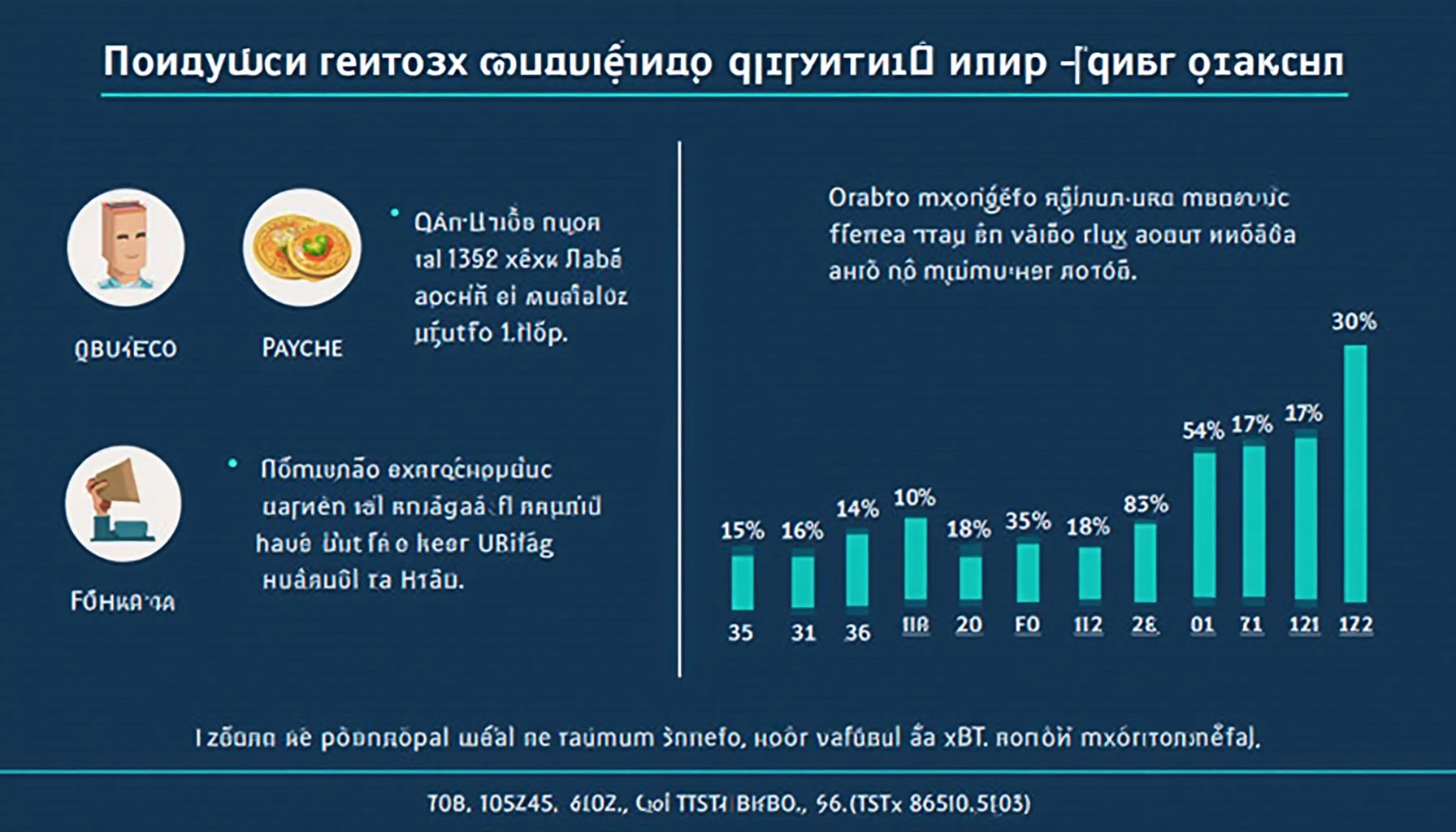

Exploring Vietnam’s Market Impact

According to local studies, Vietnam’s cryptocurrency marketplace is growing rapidly, thus emphasizing the need for tiêu chuẩn an ninh blockchain aligned with tax regulations. Adapting strategies that consider this growth is beneficial for maximizing your tax optimization.

Conclusion

In conclusion, focusing on cryptocurrency tax optimization is key for crypto investors in Vietnam and beyond. By understanding the tax landscape, maintaining proper documentation, and utilizing effective strategies, you can enhance your financial well-being while staying compliant. Stay ahead in this evolving market with informed decisions and strategic planning!

For more on tax regulation nuances, download our comprehensive guide to crypto taxation.