Introduction: Are You Aware of Cryptocurrency Market Manipulation?

With over 320 million cryptocurrency users globally, many are unaware of the signs of market manipulation. A recent report from Chainalysis indicated that up to 25% of trading volume in certain cryptocurrencies could be attributed to manipulative practices. How can you protect your investments?

Understanding Market Manipulation in Cryptocurrency

Market manipulation refers to practices that distort the true price of an asset. In cryptocurrencies, common forms of manipulation include:

- Wash trading: Traders buy and sell the same asset to create misleading volume.

- Pump and dump: Coordinated efforts to inflate asset prices before selling them off.

- FUD marketing: Spreading fear, uncertainty, and doubt through misinformation.

Identifying Signs of Manipulation

Knowing the warning signs can help you make informed decisions. Look for these indicators:

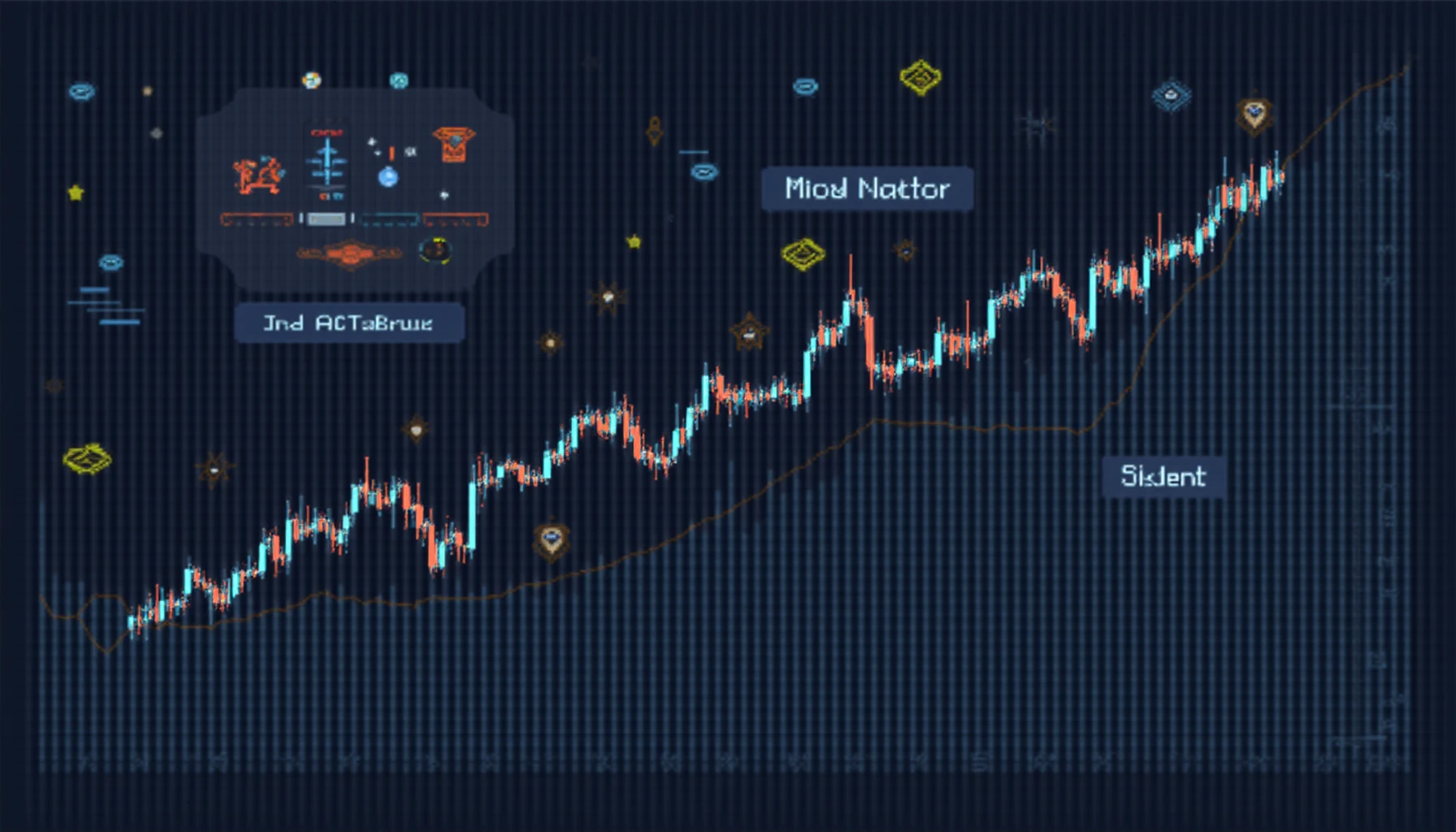

- Sudden price spikes without substantial news or market trends.

- Unusual trading volumes that drastically exceed the historical norms.

- Price patterns that appear too perfect or repetitive.

Tools for Detection of Market Manipulation

Fortunately, there are tools you can use to identify potential manipulation:

- Blockchain analysis tools: Platforms like Chainalysis and Glassnode provide insights into trading behaviors.

- Price alerts: Setting alerts on price movements can help you catch irregularities quickly.

- Social media monitoring: Watching trends on platforms like Twitter or Reddit can reveal untimely hype or fear.

Regulatory Perspective and Compliance

As the cryptocurrency market matures, regulatory bodies are increasing scrutiny over manipulative practices. In regions like Singapore, the Monetary Authority of Singapore (MAS) has issued guidelines aimed at reducing manipulative trading. Always remain compliant with local regulations, and consult legal advice when necessary.

Conclusion: Stay Informed and Proactive

Understanding and detecting cryptocurrency market manipulation is crucial for any investor. Equip yourself with the right tools and knowledge to safeguard your assets. For a deeper understanding, consider downloading our comprehensive market analysis guide now!

Note: This article does not constitute investment advice. Please consult your local regulatory authority before making any investment decisions.