Cryptocurrency Exchange Regulation: Understanding the Landscape

With over $4.1 billion lost to DeFi hacks in 2024, cryptocurrency exchange regulation is more crucial than ever. The value of implementing robust regulatory frameworks cannot be understated, especially as digital currencies gain popularity.

The Necessity of Regulation

Regulating cryptocurrency exchanges is vital to ensuring investor protection, promoting market integrity, and preventing illegal activities. Like a bank vault for digital assets, effective regulations safeguard users from fraud and theft.

Global Trends in Cryptocurrency Regulation

- Increased Compliance: Countries are enhancing their regulations to align with global standards.

- Focus on Security: Investors favor exchanges with solid security measures in place.

- Market Adaptation: Exchanges are pivoting to meet local regulatory demands, especially in emerging markets like Vietnam.

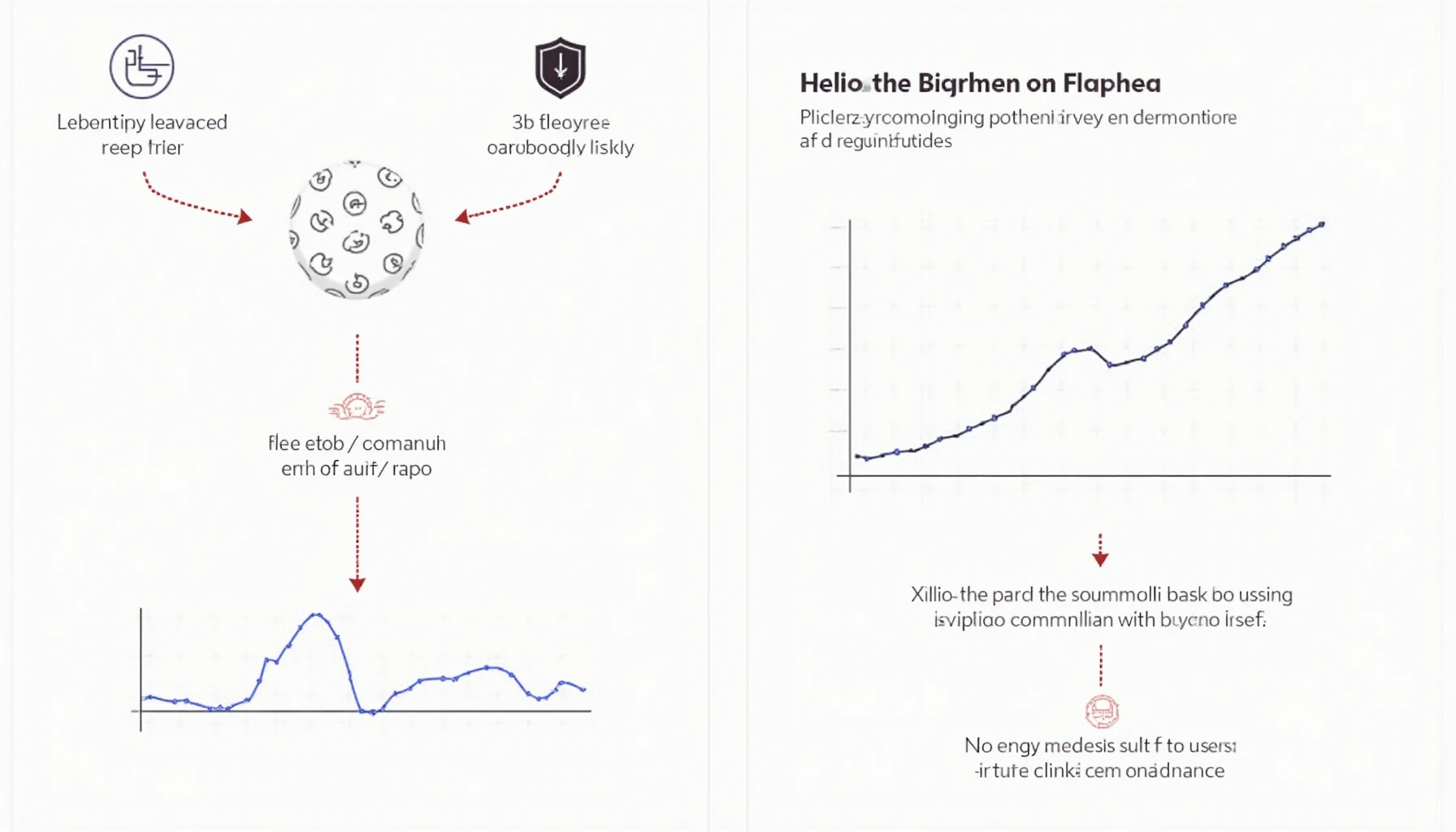

Vietnam’s Dynamic Market

Vietnam’s cryptocurrency landscape is rapidly evolving, with a user growth rate of over 60% in 2025. This growth indicates the necessity of localized regulations to protect investors and foster innovation in digital finance. Here’s the catch: as user numbers rise, so do potential risks.

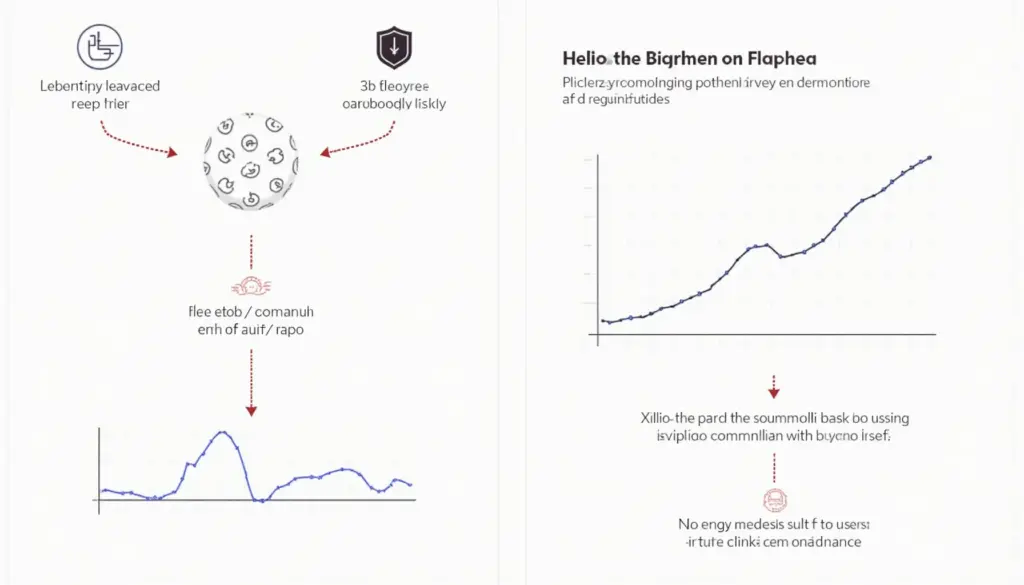

Implementing Regulatory Frameworks

Here’s how countries can implement effective cryptocurrency exchange regulations:

- Develop Clear Guidelines: Regulations should be comprehensive, covering licensing, reporting, and operational procedures.

- Enhance Transparency: Exchanges must disclose their financial practices to regulatory bodies and the public.

- Encourage Industry Collaboration: Governments should engage with industry players to create feasible strategies.

Emerging Challenges

Despite the growing regulatory frameworks, challenges remain. For instance, decentralized finance poses significant threats to traditional regulatory approaches. Understanding and adapting to these new models is paramount. The challenge resembles fitting a square peg in a round hole!

Future of Cryptocurrency Regulations

Looking ahead, the trajectory of cryptocurrency exchange regulation will concentrate on maintaining user trust and ensuring market stability. A crucial facet will be addressing emerging technologies, like blockchain security standards, with an eye to future-proofing regulations.

As highlighted by Hibt.com, staying abreast of trends is essential. Download our security checklist to secure your digital assets!

Conclusion

In summary, cryptocurrency exchange regulation is vital for safeguarding the integrity of the market, particularly in vibrant regions like Vietnam. Understanding the landscape of regulations is integral to making informed investment decisions. With the right measures in place, we can ensure a resilient ecosystem for future growth.

Cryptosaviours is dedicated to keeping you informed about developments in cryptocurrency regulations and market trends.