Crypto Market Cycle Prediction: Insights for Investors

As the cryptocurrency landscape continues to evolve, understanding the crypto market cycle prediction becomes imperative for traders and investors alike. With the volatility of digital assets, accurately anticipating market trends can lead to significant financial opportunities. A staggering $4.1B was lost to DeFi hacks in 2024, showcasing the need for informed investment choices.

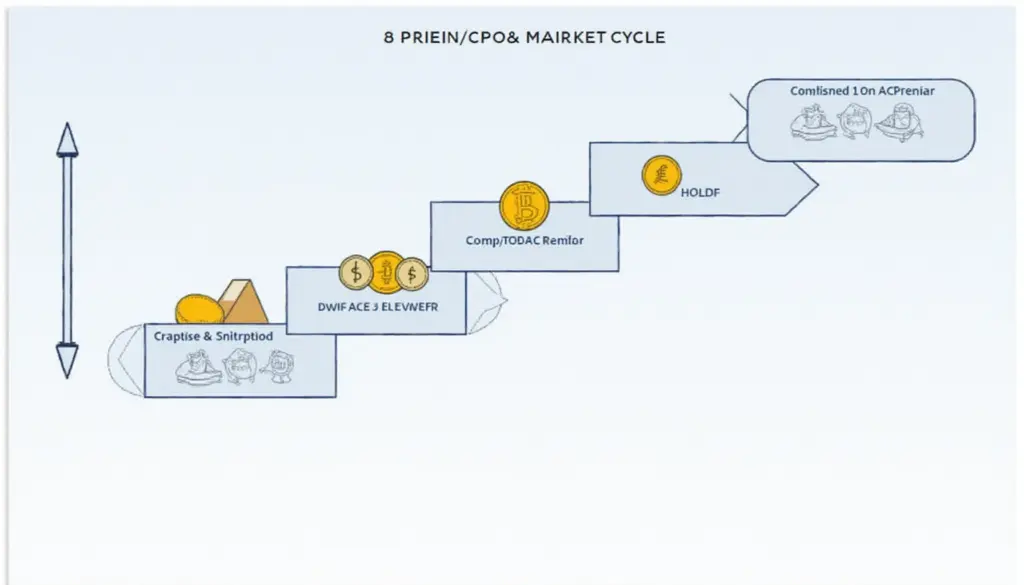

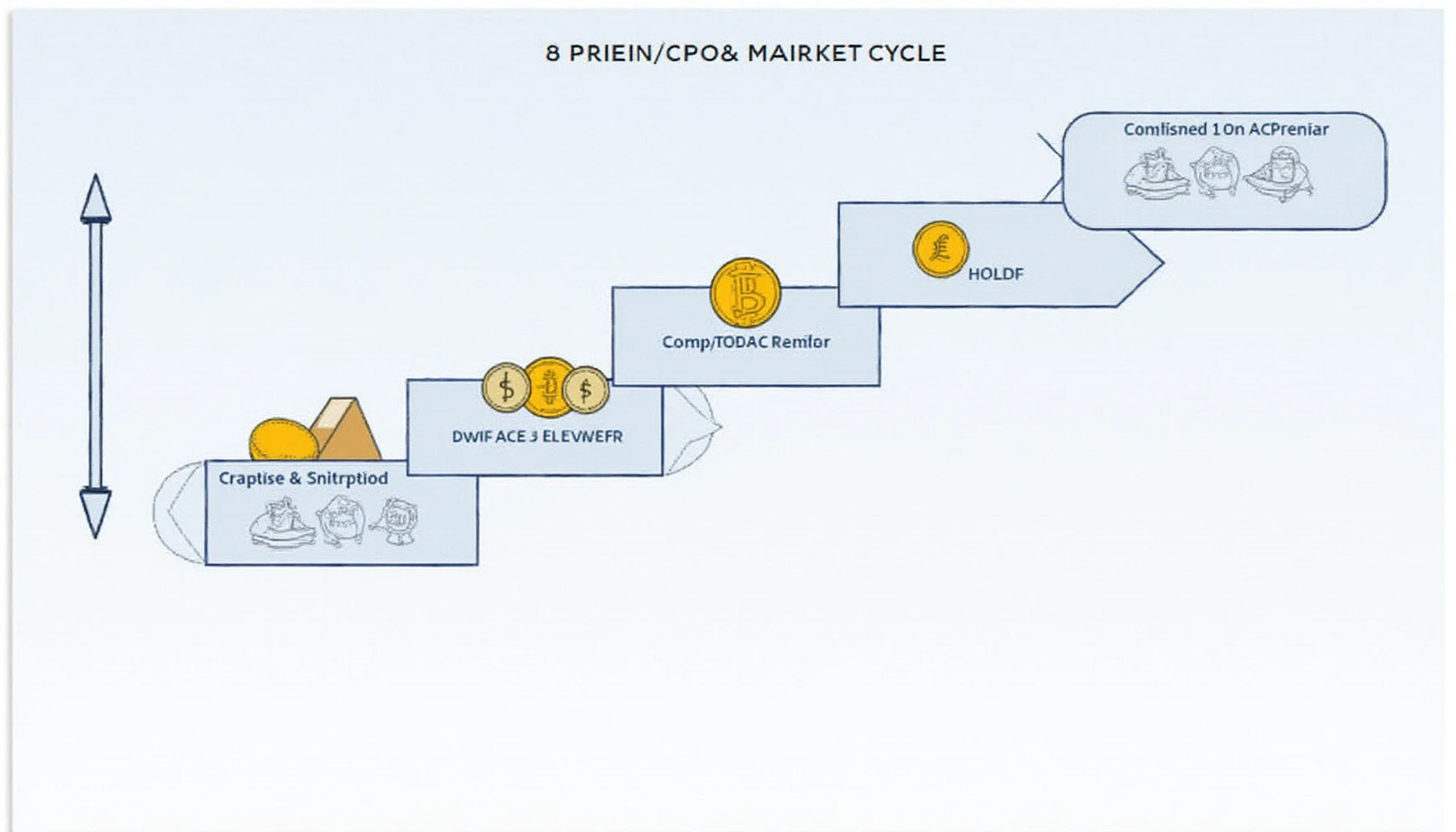

The Stages of Crypto Market Cycles

When discussing market cycles, it’s crucial to identify their stages:

- Accumulation: After a significant price decline, investors begin to purchase at lower prices, anticipating future growth.

- Markup: The market experiences positive sentiment, leading to price increases and increased participation.

- Distribution: At this peak stage, savvy investors sell to capitalize on high prices before a correction begins.

- Markdown: As market conditions turn negative, prices begin to fall, leading to fear and uncertainty.

How to Predict Market Cycles

To forecast these cycles effectively, consider utilizing various analytical tools and techniques:

- Technical Analysis: Chart patterns, moving averages, and momentum indicators provide insights into potential future price movements.

- Sentiment Analysis: Tools that gauge market sentiment can help predict short-term trends influenced by investor psychology.

- On-chain Metrics: Metrics such as trader behavior and transaction volume can indicate bullish or bearish trends.

The Importance of Data

According to Chainalysis 2025, over 65% of Vietnamese crypto users engage in trading activities, indicating a significant interest in understanding market cycles.

Utilizing Strategies in Vietnam’s Crypto Market

With the rapid growth of digital currencies in Vietnam, it is crucial for investors to implement robust predictive models. Here are a few tips:

- Monitor Global Trends: Economic factors and regulations worldwide can impact the Vietnamese market.

- Engage with the Community: Collaborating with local investors and experts offers practical insights that may influence market direction.

- Stay Informed: Keep abreast of news related to blockchain advancements and global adoption rates.

Conclusion

Understanding crypto market cycle prediction is vital for any serious investor. By employing a combination of technical, sentiment, and on-chain analysis, you position yourself to better navigate the volatile waters of cryptocurrency. As the Vietnamese market continues to grow, staying informed will be essential for success.

For those looking to safeguard their investments, tools like Ledger Nano X are recommended to reduce risks significantly.

Always remember; this is not financial advice. Consult local regulators for guidance on your specific situation.