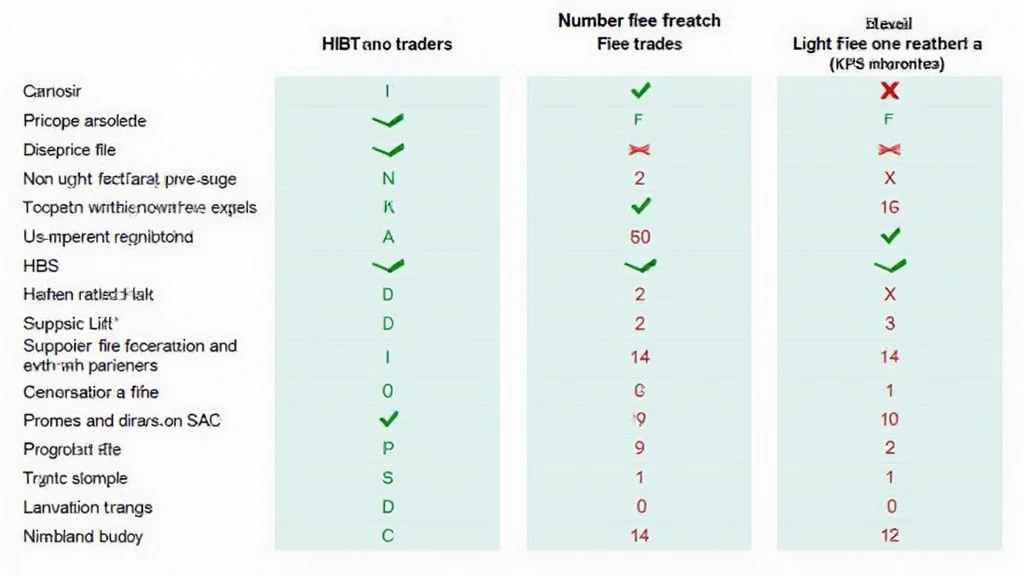

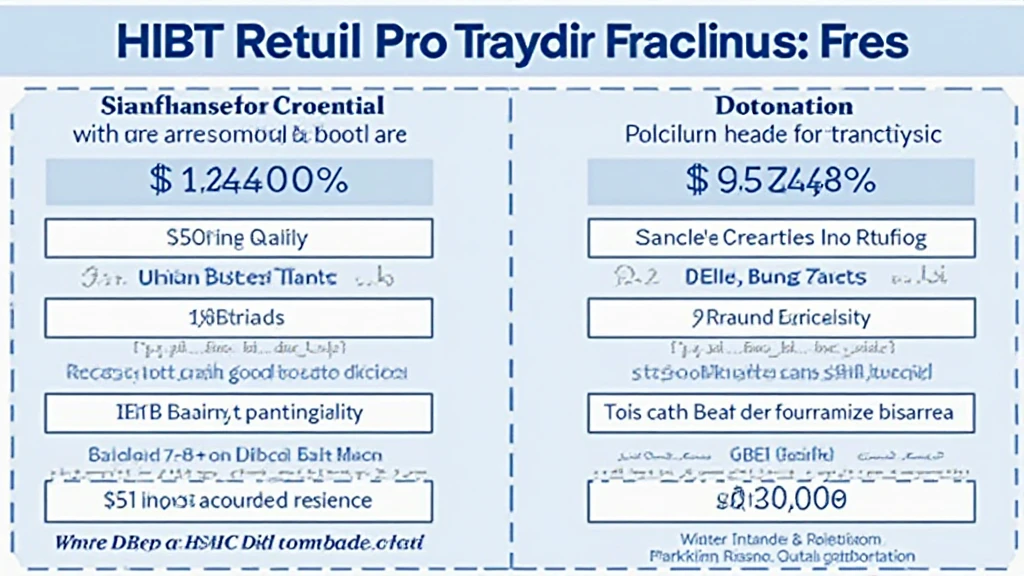

HIBT Retail vs Pro Trader Fee Structures

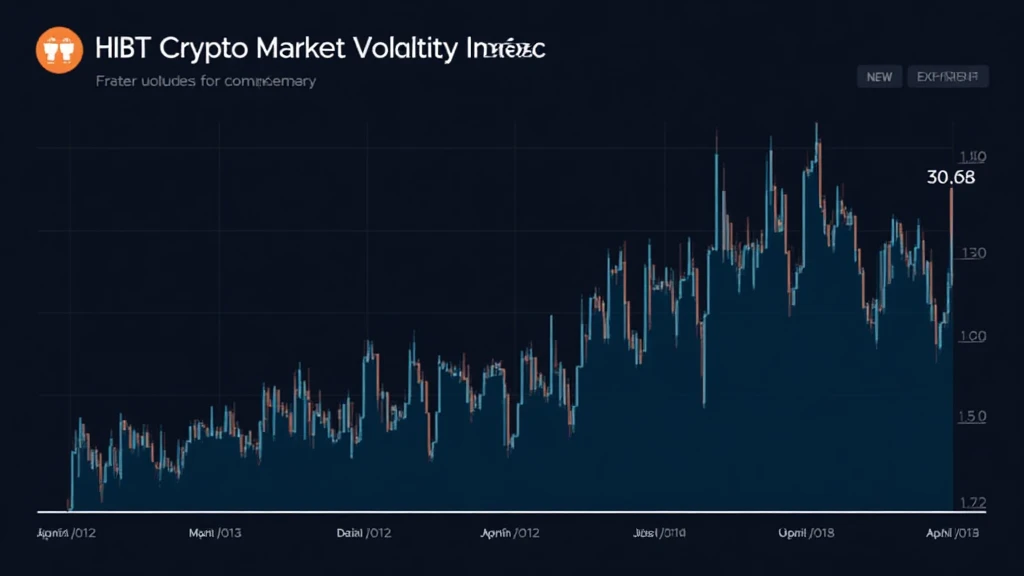

Introduction As the cryptocurrency landscape continues to evolve, understanding the fee structures associated with trading platforms has become crucial. With $4.1B lost to DeFi hacks in 2024, identifying the most cost-effective trading option is paramount for both novice and seasoned traders alike. This article will delve into the HIBT retail vs pro trader fee structures, […]

HIBT Retail vs Pro Trader Fee Structures Read More »