2025 Meme Coin Utility: The Future of Digital Assets

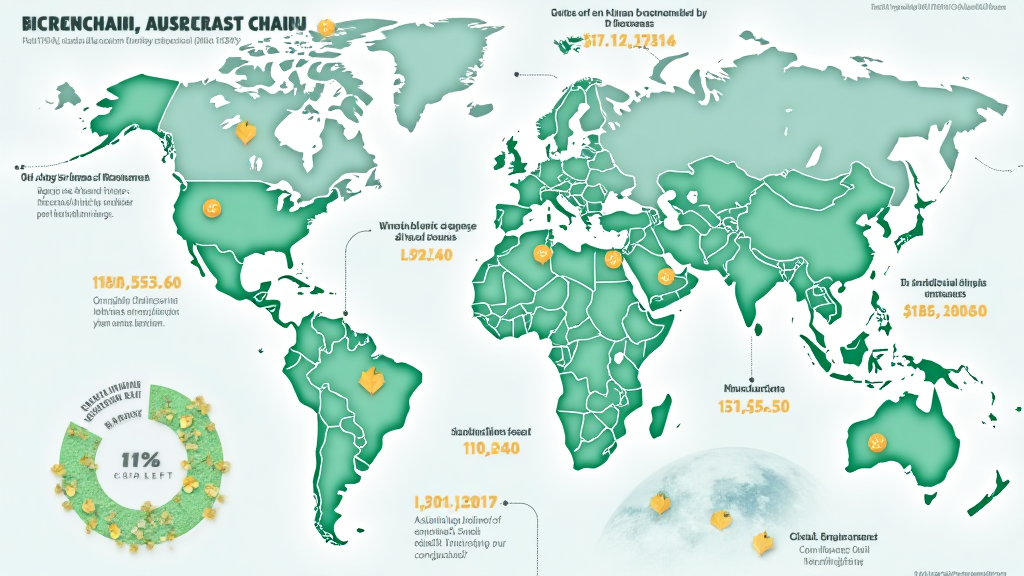

2025 Meme Coin Utility: The Future of Digital Assets The world of meme coins is evolving in 2025, as highlighted by Chainalysis data showing a significant trend towards enhanced utility features. This shift aims to address the perception that meme coins are merely humor-driven assets. With 73% of meme coins lacking practical use cases, the […]

2025 Meme Coin Utility: The Future of Digital Assets Read More »