As the world of cryptocurrency continues to evolve at a rapid pace, many investors and enthusiasts are turning their attention toward Bitcoin price prediction 2025. With its unique attributes and the growing influence of blockchain technology, Bitcoin (BTC) remains the most recognized digital asset globally. Understanding the potential value of Bitcoin in the coming years is crucial for anyone looking to invest or simply stay informed about the cryptocurrency landscape.

Bitcoin (BTC) Price Prediction 2025: A Comprehensive Overview

To forecast Bitcoin’s price in 2025, we must first explore the underlying factors contributing to its valuation. Several elements play pivotal roles in determining the trajectory of Bitcoin’s future price movements. This section will provide an extensive overview of these influences while laying the groundwork for understanding how high or low Bitcoin may trade in 2025.

An essential aspect of price prediction is recognizing that Bitcoin does not operate in isolation. The broader context of market forces, technological advancements, regulatory frameworks, and public sentiment significantly influences Bitcoin’s price.

Historical Performance of Bitcoin

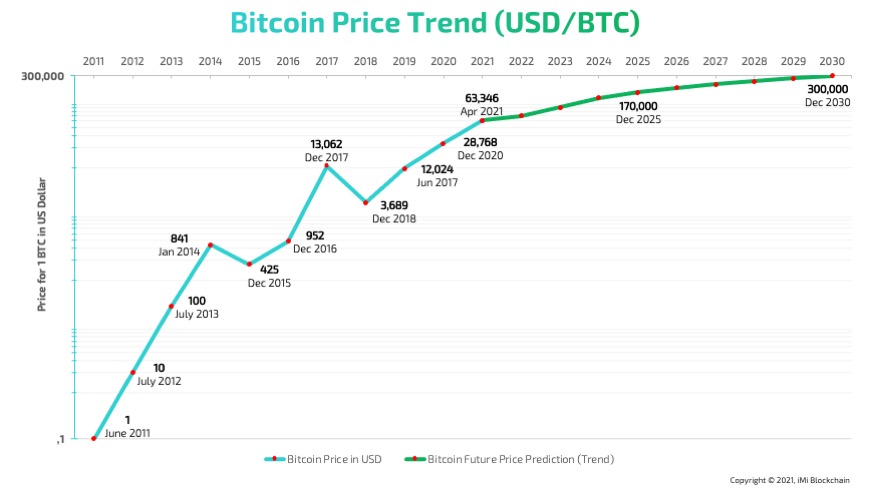

Examining Bitcoin’s historical performance can provide invaluable insights into its potential future price. Over the past decade, Bitcoin has experienced dramatic highs and lows.

For instance, after reaching nearly $20,000 in late 2017, the price plummeted to around $3,000 by the end of 2018. However, it rebounded spectacularly, hitting over $60,000 in April 2021 before undergoing corrections again.

Such volatility raises questions about what could happen in the coming years. Will Bitcoin follow similar patterns, or will new developments lead to more stability? Historical price trends indicate that despite periods of decline, Bitcoin tends to recover due to its scarcity and increasing adoption.

Supply and Demand Dynamics

The fundamental economic principle of supply and demand heavily influences Bitcoin’s price. The total supply of Bitcoin is capped at 21 million coins, creating a deflationary asset. As more people become interested in owning Bitcoin, the demand increases while the available supply remains fixed.

This unique situation creates upward pressure on prices, especially as more institutional investors begin accumulating Bitcoin as part of their portfolios. Additionally, events such as Bitcoin halving—which occurs roughly every four years—reduce the rate at which new Bitcoins are minted, further constraining supply.

Technological Advancements

Technological innovations and improvements within the Bitcoin ecosystem can also shape its price trajectory. Developments like the Lightning Network aim to enhance Bitcoin’s scalability, making transactions faster and cheaper.

As Bitcoin becomes more user-friendly and integrated into everyday financial systems, it may attract retail investors and institutions alike, potentially driving up demand and, consequently, the price. Furthermore, continued advancements in blockchain technology could bolster Bitcoin’s utility beyond a mere store of value.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies remains fluid and unpredictable. Governments worldwide are still grappling with how to treat Bitcoin and other digital assets regarding taxation, trading, and consumer protections.

A favorable regulatory framework that promotes innovation could help foster growth in the cryptocurrency market. Conversely, stringent regulations might deter investment and negatively impact Bitcoin’s price.

Keeping a close watch on regulatory developments in key markets—such as the United States, Europe, and Asia—will be essential for predicting Bitcoin’s price in 2025.

Factors Influencing Bitcoin’s Potential Value in 2025

Now that we’ve established some foundational knowledge about Bitcoin’s historical performance and the elements influencing its price, let’s delve deeper into the specific factors that could shape Bitcoin’s potential value in 2025.

Global Economic Conditions

The global economy plays a significant role in shaping investor behavior. Economic downturns often drive individuals to seek alternative assets as hedges against inflation.

In the context of Bitcoin, this means that if traditional markets experience instability, Bitcoin could see increased demand as investors view it as a safe haven. Conversely, a stable and thriving economy could lead to diminished interest in cryptocurrencies, affecting Bitcoin’s price negatively.

Institutional Adoption

Increasing institutional interest represents one of the most significant drivers of Bitcoin’s value. Major companies and financial institutions have begun investing in and integrating Bitcoin into their operations.

Examples include Tesla and MicroStrategy, both of which have added substantial amounts of Bitcoin to their balance sheets. If this trend continues, primarily driven by large-scale investors entering the market, Bitcoin may witness an escalation in price leading up to 2025.

Competing Cryptocurrencies

The emergence of competing cryptocurrencies can pose risks to Bitcoin’s dominance in the market. Alternative coins (altcoins) often offer innovative solutions and features that Bitcoin doesn’t, attempting to capture market share.

If successful, these altcoins could siphon off investments from Bitcoin, causing its price to stagnate or decline. Staying informed about the competitive landscape and emerging technologies will be critical in gauging Bitcoin’s potential value moving forward.

Market Sentiment

Market sentiment is another crucial factor impacting Bitcoin’s price. The psychological aspect of trading cannot be underestimated; fear and greed often drive market movements.

Positive news, endorsements from influential figures, or major milestones in Bitcoin regulation can create bullish sentiment, while negative headlines may evoke panic selling. Monitoring social media trends and news cycles can provide insights into the market’s mood and help predict potential price shifts.

Expert Forecasts: Bitcoin Price Targets for 2025

With various analysts and experts offering their perspectives on Bitcoin’s future, gathering accurate forecasts can assist investors in making informed decisions. In this section, we’ll explore several expert predictions regarding Bitcoin’s price by 2025.

Bullish Predictions

Many seasoned analysts remain optimistic about Bitcoin’s long-term prospects. Some predict that Bitcoin could surpass $100,000 per coin by 2025 due to factors like increased institutional adoption, inflation concerns, and the culmination of its long-term growth trajectory.

One prominent figure, planB, who is known for his Stock-to-Flow (S2F) model, suggests that Bitcoin could reach between $288,000 and $500,000 in the next bull cycle.

Bearish Predictions

Conversely, there are voices of caution. Some analysts warn that Bitcoin might struggle to maintain its high valuations due to increased competition and regulatory challenges.

They argue that Bitcoin could settle at around $30,000 or less if adverse market conditions arise. Given Bitcoin’s volatile nature, even bearish scenarios should not be dismissed outright.

Conservative Estimates

Several experts take a more middle-ground approach, forecasting Bitcoin to range between $60,000 and $80,000 by 2025. These estimates consider the potential for sustained growth while acknowledging inherent risks in the marketplace.

Consulting various expert opinions can serve as a guiding tool but should be approached with a healthy dose of skepticism, given the unpredictable nature of crypto markets.

Technical Analysis: Charting Bitcoin’s Trajectory Towards 2025

Understanding technical analysis can empower investors to make educated decisions based on price charts and patterns. This section focuses on the methodologies used to analyze Bitcoin’s price movements and project future trends.

Support and Resistance Levels

Identifying support and resistance levels is fundamental in technical analysis. Support levels indicate where buying interest may emerge, preventing the price from declining further. Conversely, resistance levels signify where selling pressure may arise, capping upward price movements.

Currently, key support levels for Bitcoin are around $40,000, while resistance levels hover near $60,000. Should Bitcoin break through these levels, it could signal a shift in market sentiment, leading to price surges or declines.

Moving Averages

Moving averages smooth out price data, helping traders identify trends over specific periods. The 50-day and 200-day moving averages are commonly used to assess Bitcoin’s price momentum.

If the 50-day moving average crosses above the 200-day moving average, a “golden cross” may occur, signaling a bullish trend. Conversely, a “death cross” occurs when the 50-day moving average falls below the 200-day moving average, suggesting a bearish trend.

Momentum Indicators

Momentum indicators like the Relative Strength Index (RSI) can help traders gauge whether an asset is overbought or oversold. An RSI above 70 typically indicates overbought conditions, while an RSI below 30 suggests oversold conditions.

Using such indicators can offer insights into potential entry and exit points for Bitcoin investments. However, it’s important to combine technical analysis with fundamental analysis for a comprehensive approach.

Market Sentiment and Adoption Rates: Key Indicators for Bitcoin’s 2025 Performance

Market sentiment and adoption rates fundamentally influence Bitcoin’s price dynamics. Understanding how these factors interact will provide essential insights into Bitcoin’s potential trajectory leading up to 2025.

Social Media Influence

In today’s digital age, social media plays a significant role in shaping public perception and sentiment toward cryptocurrencies. Twitter, Reddit, and other platforms have become hotbeds of discussions around Bitcoin.

Trends and hashtags can create waves of enthusiasm or skepticism among investors. Monitoring these conversations can provide valuable insights into prevailing market sentiment and potential price movements.

Institutional Investment Trends

The growing trend of institutional investment in Bitcoin reflects a changing narrative around cryptocurrencies. With reputable firms and hedge funds allocating resources to Bitcoin, mainstream acceptance is gradually solidifying.

If this trend persists, it could foster greater confidence and attract additional investments, positively impacting Bitcoin’s price in 2025.

Retail Adoption Rates

Retail adoption is just as crucial as institutional investment. Increased ease of access to Bitcoin through user-friendly wallets and exchanges can encourage everyday investors to participate in the market.

Furthermore, educational initiatives aimed at demystifying cryptocurrency could bolster retail interest. If retail adoption rates continue to rise heading into 2025, they could add significant fuel to Bitcoin’s price.

Risks and Challenges: Navigating Uncertainty in the Bitcoin Market by 2025

Despite the promising outlook for Bitcoin, several risks and challenges could hinder its potential growth. This section will address the uncertainties faced by investors navigating the Bitcoin market leading up to 2025.

Regulatory Hurdles

As mentioned earlier, the evolving regulatory landscape poses a considerable risk for Bitcoin. Governments may impose stricter regulations limiting trading and usage, which could dampen enthusiasm and ultimately affect prices.

Staying abreast of legislative proposals and potential crackdowns in key markets will be vital for investors looking to navigate this uncertain terrain.

Technological Vulnerabilities

While advancements in technology can bolster Bitcoin’s infrastructure, vulnerabilities persist. Hackings, software bugs, and network exploits present constant threats to Bitcoin’s security and reliability.

Moreover, potential scalability issues could hinder Bitcoin’s ability to process transactions efficiently, impacting its attractiveness as a payment method.

Market Manipulation

Cryptocurrency markets are often subject to manipulation, and Bitcoin is no exception. Large players or “whales” can significantly influence prices, creating volatility that can catch smaller investors off guard.

Being aware of these dynamics is crucial for maintaining a well-rounded perspective on Bitcoin’s price movements and avoiding unnecessary losses.

Conclusion

The landscape of Bitcoin price prediction for 2025 is complex and influenced by numerous interrelated factors. Historical performance, supply-demand dynamics, technological advancements, and regulatory landscapes all contribute to potential price trajectories. While expert forecasts vary widely, the consensus leans toward optimism tempered with caution, underscoring the importance of conducting thorough research and remaining adaptable in response to emerging trends. For anyone invested in Bitcoin or considering entry into the cryptocurrency market, understanding these nuances will be vital for navigating the ever-evolving Bitcoin ecosystem.