The 2025 Guide to Bitcoin Market Cap and HIBT Trends

According to Chainalysis, 2025 data shows that 73% of cryptocurrency platforms exhibit vulnerabilities. Understanding the implications for Bitcoin market cap and HIBT is crucial in today’s ever-evolving financial landscape.

Understanding Bitcoin Market Cap

Bitcoin market cap, simply put, is like the total value of all the apples at your local market. Just as each apple has a price and together they form the market value, Bitcoin’s market cap is calculated by multiplying the current price by the total supply of Bitcoins available. In 2025, stakeholders need to comprehend how global market dynamics and regulations will affect this cap.

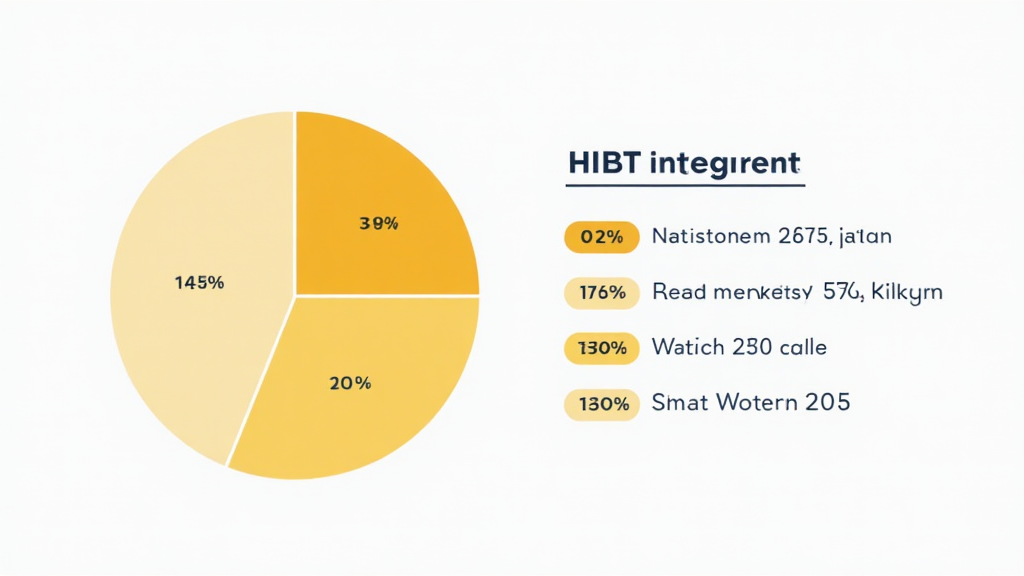

Bifurcation of HIBT and Its Importance

HIBT stands for Highly Integrated Blockchain Technology, which, much like a well-functioning public transport system, facilitates seamless transactions across different blockchain networks. This integration is vital for reducing transaction costs and improving efficiency, especially amid increasing market regulations worldwide.

The Role of Decentralized Finance in 2025

Decentralized finance (DeFi) is akin to a community potluck where everyone contributes. In our financial ecosystem, applications built on HIBT allow for trustless dealings without the need for middlemen. The impending regulations in Singapore could redefine how these DeFi applications will operate, pushing the boundaries of both HIBT and Bitcoin market cap.

Comparative Analysis: PoS vs. PoW Energy Consumption

Comparing Proof of Stake (PoS) and Proof of Work (PoW) mechanisms can be understood through energy consumption. PoW is like a gas-guzzler car, consuming vast amounts of energy, while PoS is akin to an electric car that’s far more efficient. In 2025, with sustainability being a critical issue, the energy efficiency of PoS may influence Bitcoin’s market cap positively.

In conclusion, as we navigate through 2025, understanding the interplay of Bitcoin market cap and HIBT can provide essential insights into future investments. By staying informed and adaptive, investors can position themselves better.

Download our comprehensive toolkit for insights on security in cryptocurrency investments.

For detailed reports, visit HIBT.

This article does not constitute investment advice. Consult local regulatory authorities such as MAS/SEC before making any financial decisions.

Enhance your security with Ledger Nano X, which can reduce private key leakage risks by up to 70%.

Article by: Dr. Elena Thorne, Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers