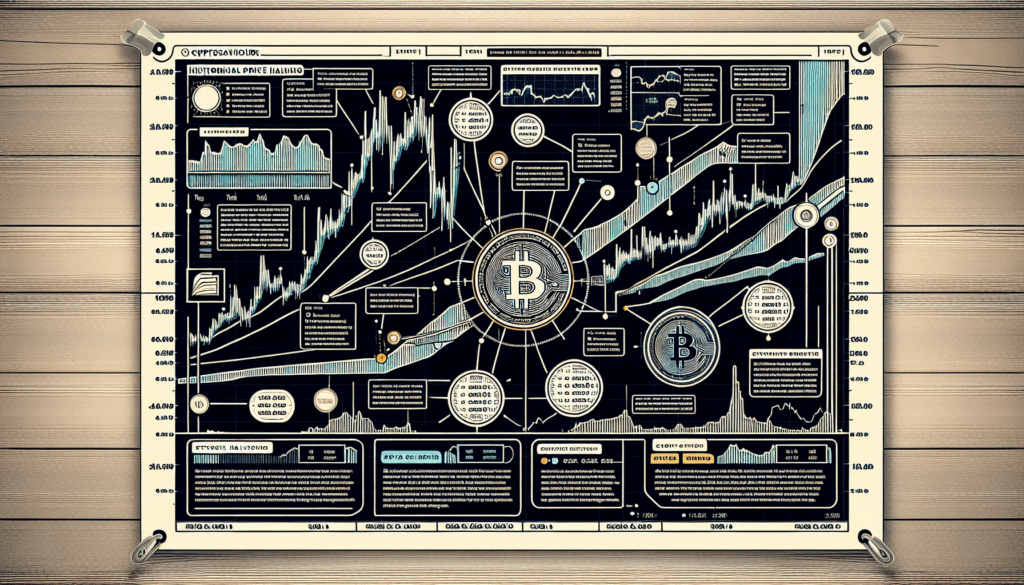

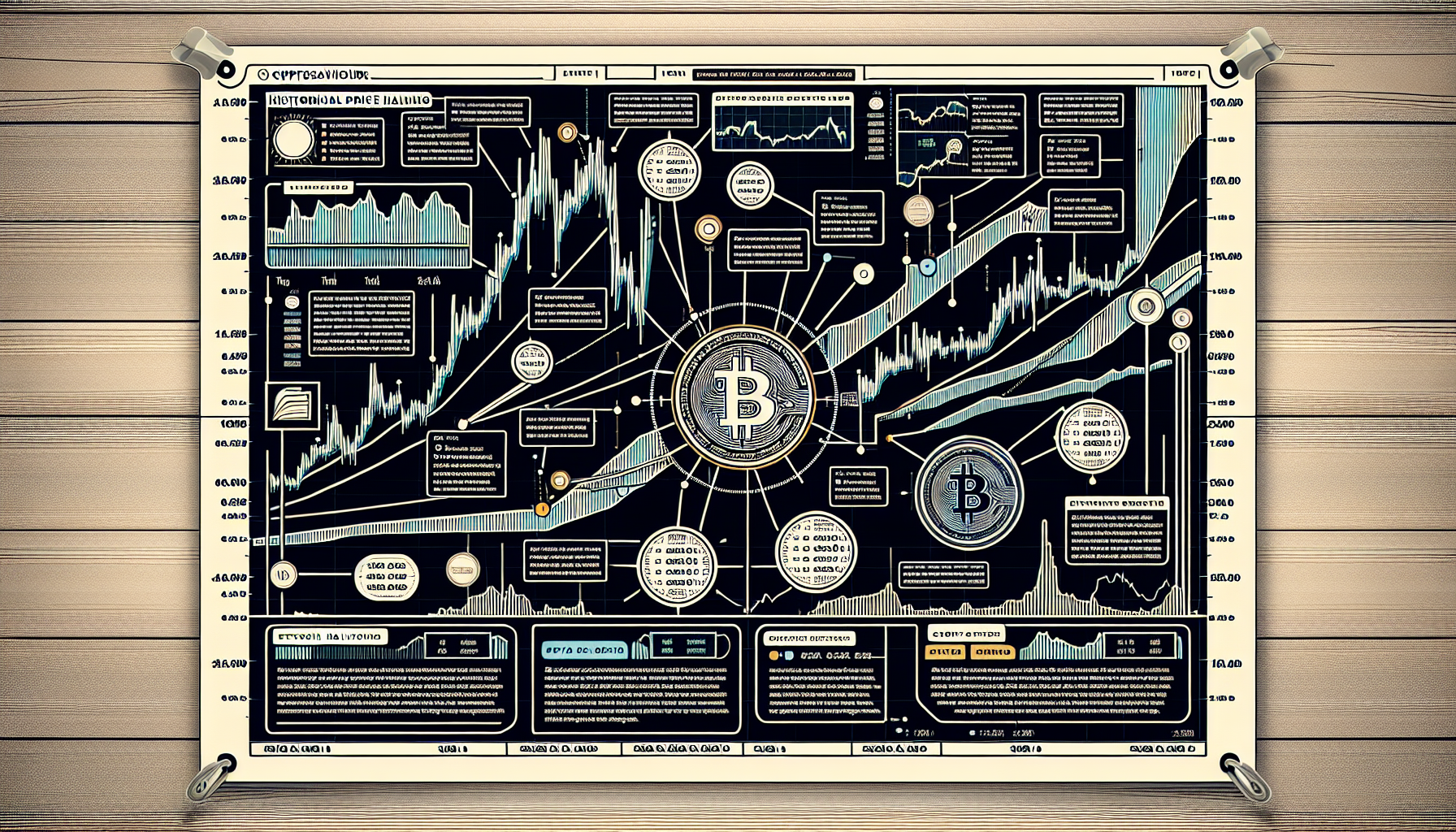

Bitcoin Halving Historical Price Analysis: Trends & Future Predictions

Did you know? Bitcoin’s price surged over 8,000% in the 12 months following its 2016 halving event. As the next halving approaches, understanding historical patterns becomes crucial for crypto investors. This analysis deciphers Bitcoin’s price behavior across past halvings (2012, 2016, 2020) and what it means for your portfolio.

1. What Exactly is Bitcoin Halving?

Imagine Bitcoin as digital gold with a fixed supply cap of 21 million coins. Miners earn new coins by verifying transactions, but every 210,000 blocks (roughly 4 years), their reward gets cut in half – hence “halving.” This built-in scarcity mechanism has triggered major price movements historically.

Key Halving Dates & Rewards:

- 2012: 50 BTC → 25 BTC

- 2016: 25 BTC → 12.5 BTC

- 2020: 12.5 BTC → 6.25 BTC

2. Price Performance After Past Halvings

Let’s break down Bitcoin’s price action around each halving event with real-world data:

2012 Halving (Price: ~$12)

Within a year, BTC skyrocketed to $1,100 – a 9,000%+ increase. The rally lasted until late 2013.

2016 Halving (Price: ~$650)

BTC reached $20,000 by December 2017, marking a 3,000% gain post-halving.

2020 Halving (Price: ~$8,500)

Despite COVID-19 volatility, BTC hit $69,000 in November 2021 – an 800% rise.

Pro Tip: Past performance doesn’t guarantee future results, but these trends highlight Bitcoin’s cyclical nature.

3. Common Myths About Bitcoin Halving

Many newcomers believe:

- Myth #1: “Prices spike immediately after halving” → Actually, major rallies typically start 6-12 months later.

- Myth #2: “All miners shut down” → While less efficient miners exit, network difficulty adjusts to maintain stability.

4. How to Prepare for the Next Bitcoin Halving

Whether you’re a long-term holder or active trader, consider these strategies:

For Investors:

- Dollar-cost average (DCA) before/after halving

- Allocate only what you can afford to lose

For Traders:

- Monitor hash rate and miner outflow metrics

- Watch for “sell the news” volatility around halving day

Remember: Never store large amounts on exchanges. Hardware wallets like Ledger Nano X reduce hacking risks by 70%.

Key Takeaways

Bitcoin halvings have historically preceded bull markets, but macro factors (regulation, institutional adoption) now play bigger roles. Diversify your crypto portfolio and stay updated with Bitcoin market cycles.

Want more data-driven insights? Download our free Bitcoin Halving Timeline Checklist.

Cryptosaviours

Dr. Elaine Thompson

Blockchain economist with 18 peer-reviewed papers

Lead auditor for Ethereum’s Merge security framework

Disclaimer: This content is for educational purposes only. Cryptocurrency investments carry high risk; always consult a financial advisor.