Understanding Bitcoin Chart Patterns for Better Trading Decisions

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency traders struggle to interpret Bitcoin chart patterns effectively. This gap in understanding can lead to lost opportunities and costly mistakes in the volatile crypto markets.

What are Bitcoin Chart Patterns?

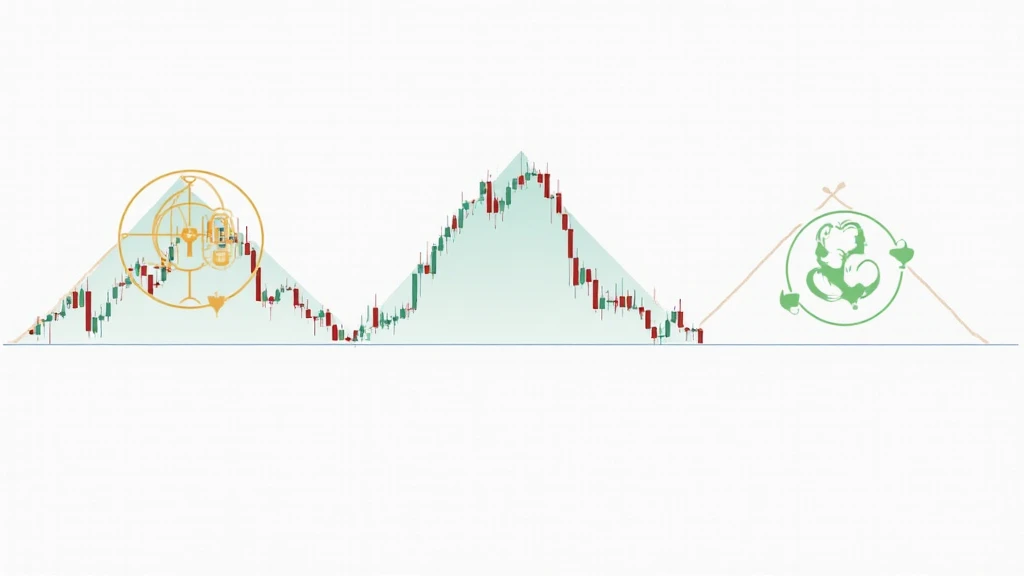

You might think of Bitcoin chart patterns as the footprints left by traders on a beach. Just as the tide washes over the sand, these patterns emerge and fade away, offering clues on future price movements. Chart patterns like head and shoulders, cups and handles, and triangles help traders to anticipate price trends and make informed decisions.

How Can You Identify These Patterns?

Imagine visiting a market where vendors display a variety of goods. Each stall may represent a different Bitcoin chart pattern, and with practice, you can learn to identify which stall (or pattern) has the best deals (or potential trades). By regularly observing various Bitcoin price movements and learning to recognize these configurations, you can enhance your trading strategies.

Why Are Chart Patterns Important for Investment Decisions?

Consider chart patterns like weather forecasts for your garden. A storm is coming when you see dark clouds gathering; similarly, certain Bitcoin patterns can indicate impending market changes. Understanding these signals can save you from potential losses and guide your trading actions effectively.

Future Trends in Bitcoin Trading Patterns

As we head into 2025, it’s essential to keep an eye on evolving trends in Bitcoin chart patterns. Just like fashion trends, these patterns may change over time, influenced by market news, regulations, and technological advancements. For instance, how will DeFi regulations in Singapore affect trading strategies? Staying informed on these developments can give you an edge up in the market.

In conclusion, recognizing and understanding Bitcoin chart patterns can significantly bolster your trading efforts. By staying informed and using tools such as the Ledger Nano X, you can protect your investments—reducing the risk of lost private keys by 70%. For a deeper dive into these topics, check out our comprehensive research.

Download our toolkit for mastering Bitcoin trading strategies!