2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable to security issues. This has become a pressing concern in the crypto world, especially as more traders rely on these bridges for transactions involving multiple blockchains. In this article, we’ll delve into the significance of the HIBT price simulator and other essential insights to bolster your understanding of cross-chain interactions.

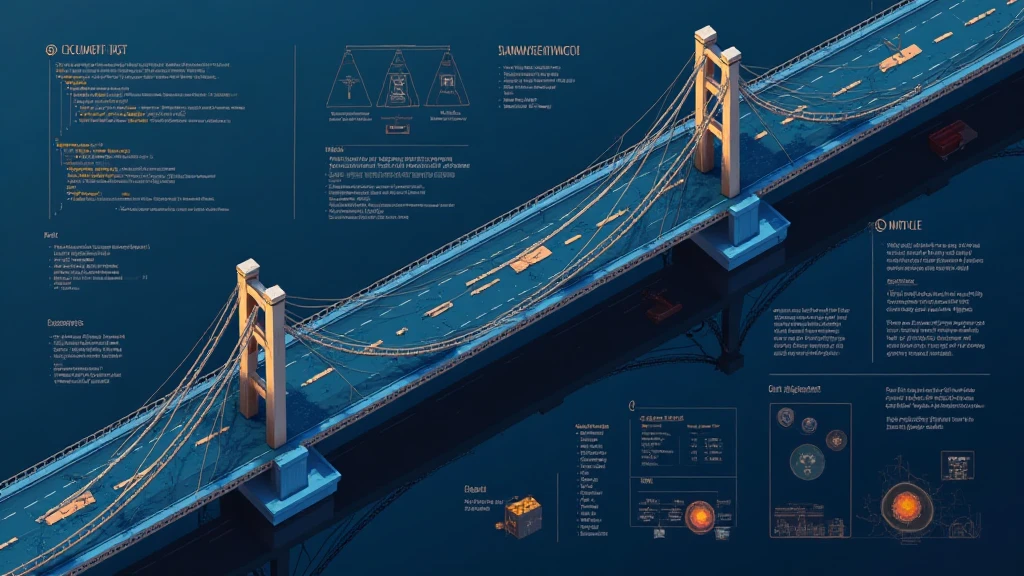

What Are Cross-Chain Bridges?

Think of cross-chain bridges like currency exchange booths at an airport. Just as you can trade your dollars for euros, these bridges allow you to swap assets from one blockchain to another. This technology promotes interoperability, but with increased concerns regarding security. The HIBT price simulator can help users understand potential value shifts in their trades across different chains.

Understanding Vulnerabilities in Cross-Chain Systems

In the crypto landscape, each bridge works differently, much like different banks have varying exchange rates. However, many of these bridges have been found to have loopholes that hackers exploit, leading to significant financial losses. Monitoring potential pitfalls, especially through simulation tools like HIBT price simulator, is essential for safeguarding assets.

The Impact of Zero-Knowledge Proofs on Security

Imagine trying to prove you have enough money to make a purchase without revealing all your bank details; that’s similar to what zero-knowledge proofs do. They enhance security by ensuring that transactions are validated without exposing their underlying information. Integrating this technology into cross-chain systems could drastically reduce vulnerabilities. Tools such as the HIBT price simulator are crucial for assessing how these improvements affect asset valuations in real-time.

Future Trends in Cross-Chain Interoperability

As we look to the future, especially into 2025, regulations in areas like Singapore are shaping DeFi landscapes. With clearer guidelines, we anticipate safer and more robust cross-chain bridges. Engaging with the HIBT price simulator can better prepare traders to navigate these evolving regulations effectively, ensuring more strategic decision-making.

In conclusion, with the increasing use of cross-chain bridges, awareness of their vulnerabilities and the tools available to mitigate risks is more important than ever. To enhance your trading strategies and secure your assets, consider leveraging the HIBT price simulator.

Download our comprehensive toolkit to help navigate cross-chain transactions and safeguard your investments.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority (e.g., MAS/SEC) before acting on any information provided.

For more insights, visit hibt.com for our cross-chain security white paper and other resources. Stay informed with cryptosaviours.