Understanding HIBT Crypto Price Momentum

As the cryptocurrency market continues to evolve, understanding the HIBT crypto price momentum is crucial for investors. In 2024 alone, over $4.1 billion was lost due to hacks in the DeFi sector, making it imperative to grasp how price movements work. This article aims to provide essential insights into using RSI indicators to gauge momentum effectively.

What is Price Momentum?

Price momentum refers to the speed at which the price of an asset moves in a particular direction. For cryptocurrencies like HIBT, this is often influenced by trading volume, overall market sentiment, and technical analysis. In Vietnam, the cryptocurrency user growth rate has reached an impressive 40% in the last year, reflecting the increasing interest in analyzing price movements.

Using RSI Indicators

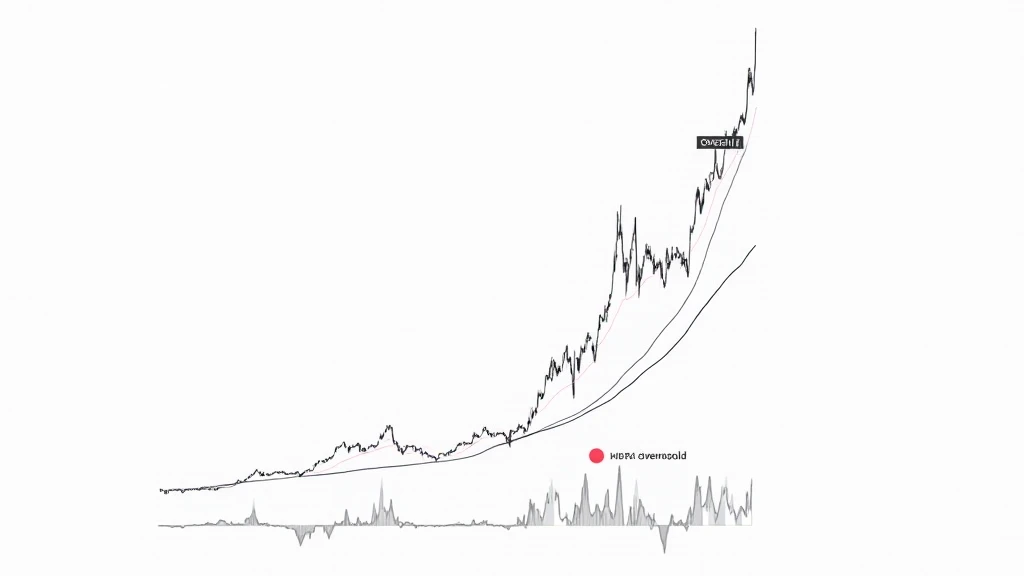

The Relative Strength Index (RSI) is a popular tool used by traders to evaluate the momentum of an asset. It operates on a scale of 0 to 100, where readings above 70 indicate overbought conditions and below 30 suggest oversold conditions. Understanding these indicators can help investors make informed decisions regarding their HIBT holdings.

Analyzing HIBT with RSI

- When to Buy: A reading below 30 is a sign that HIBT may be undervalued, thus presenting a buying opportunity.

- When to Sell: Conversely, a reading above 70 could indicate that HIBT is overvalued, suggesting it might be time to consider selling.

Real World Applications

Imagine a bank vault designed to store digital assets securely. Just like that vault, using RSI indicators can help protect your investments by timing your entries and exits wisely. Here’s a simple table showing hypothetical price points and corresponding RSI values:

| Price Point | RSI Value |

|---|---|

| $1.50 | 25 |

| $3.00 | 75 |

| $2.00 | 50 |

These values can provide a starting point for evaluating HIBT’s price momentum and making informed trades. Explore more insights on trading strategies here.

Conclusion

By utilizing RSI indicators, investors can gain valuable insights into the HIBT crypto price momentum. Understanding market dynamics and employing effective technical analysis tools are essential in navigating the volatile world of cryptocurrency. It’s advisable to continuously monitor market trends and consult local authorities, as this article is not financial advice. For more details, be sure to check out similar articles like our Vietnam Crypto Tax Guide for deeper insights. For anyone diving into the crypto market, remember to do your due diligence.