Understanding Crypto Tax Software Costs

As the crypto market continues to thrive, tax obligations become more complex. In 2024 alone, $4.1B was lost due to DeFi hacks, highlighting the importance of secure financial management. This article will delve into HIBT crypto tax software cost comparisons, helping you navigate the options available on the market.

Why Choose HIBT?

HIBT stands out among crypto tax software providers due to its user-friendly interface and extensive features. For many Vietnamese users, the growing adoption of cryptocurrencies corresponds with an increasing demand for reliable tax tools, as demonstrated by a 75% growth rate in crypto adoption in Vietnam.

Cost Overview of HIBT

| Plan | Annual Cost (USD) | Features |

|---|---|---|

| Basic | $49 | Essential tax reporting |

| Standard | $99 | Includes yield tracking |

| Pro | $199 | Comprehensive features including international compliance |

Understanding these costs is vital to budget accordingly. You can download the security checklist to ensure you’re prepared for any tax-related queries.

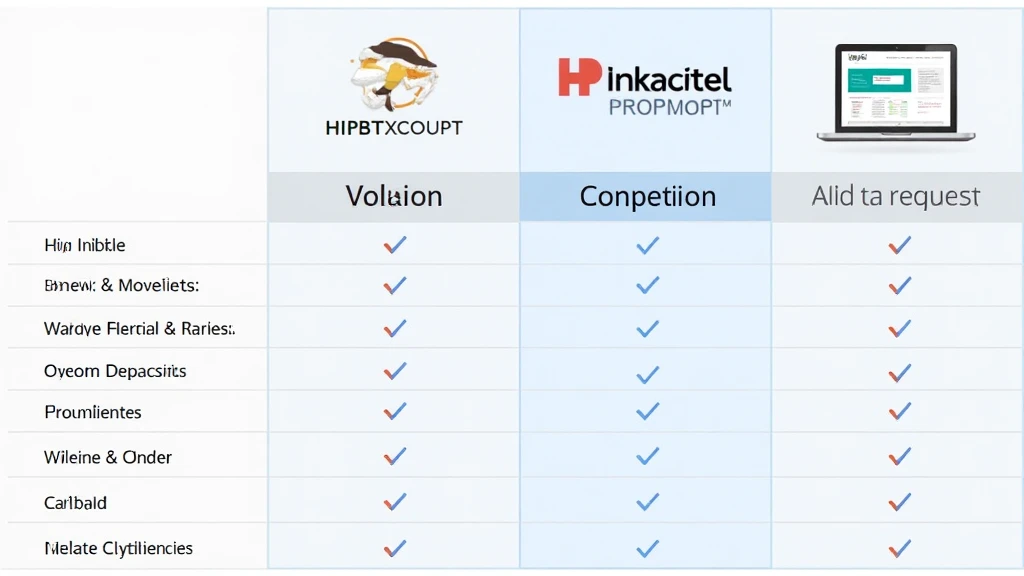

Comparison with Other Tax Solutions

When compared to alternatives like CoinTracker and CryptoTrader.Tax, HIBT offers competitive pricing. CoinTracker operates at a starting price of $49, which aligns with HIBT’s Basic Plan, but lacks certain advanced features which HIBT provides.

Real-Life Usage Scenario

Imagine managing multiple crypto assets like having a digital vault for your investment. The tax implications can feel overwhelming without proper tools. HIBT streamlines this process, making it easier for you to maintain compliance with local regulations.

Local Market Insights

As Vietnam embraces blockchain technology, the demand for tax solutions grows. Users require software that integrates local tax regulations, thus HIBT emerges as a top choice supported by its comprehensive features tailored for Vietnamese users, including tiêu chuẩn an ninh blockchain.

Conclusion

Choosing the right crypto tax software is essential for efficient tax management. HIBT stands out with its affordability, reliable features, and user-centric approach. Assessing HIBT crypto tax software cost comparisons allows you to make an informed decision tailored to your crypto journey’s needs. For further insights, visit cryptosaviours.