Introduction

With more than $4.1 billion lost in DeFi hacks in 2024, understanding crypto volatility is crucial for investors. Investors need to analyze price volatility skew to make informed decisions about HIBT crypto investments. This article aims to provide insights into the factors that influence price volatility skew in the market.

Understanding Price Volatility Skew

Price volatility skew refers to the discrepancy in implied volatility for options with varying strike prices and expiration dates. Investors must recognize that skew informs us about market sentiment. For instance, a positive skew can indicate bullish sentiment, suggesting investors expect higher future prices for HIBT.

Key Factors Affecting HIBT Volatility

- Market Sentiment: Driven by news, regulatory changes, and investor activity.

- Liquidity: The ease with which HIBT can be bought or sold without affecting its price.

- Demand and Supply Dynamics: Increased interest in HIBT can heighten volatility.

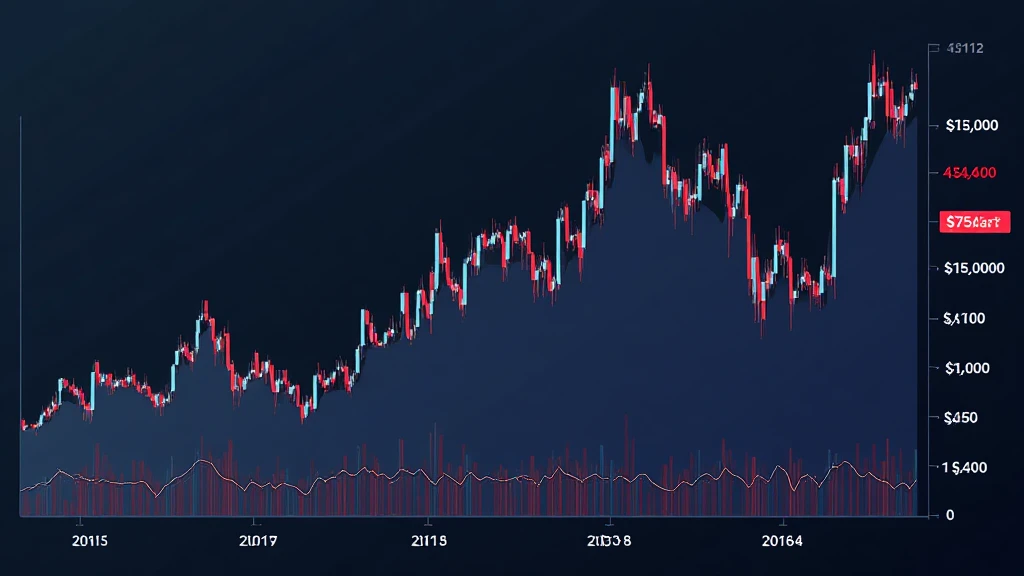

Real Data on HIBT’s Performance

| Date | Price (USD) | 24-Hour Volatility (%) |

|---|---|---|

| 2025-01-01 | $10.00 | 5% |

| 2025-06-01 | $12.50 | 8% |

| 2025-12-01 | $9.00 | 10% |

Source: Historical crypto performance data.

The Impact of Vietnamese Market on HIBT

In Vietnam, the cryptocurrency user base has grown by 150% in the past year. As local interest in HIBT increases, so does its price volatility skew. Blockchain security standards are becoming a priority, as investors seek to protect their assets amid market fluctuations. Incorporating tiêu chuẩn an ninh blockchain strategies could mitigate risks.

Conclusion

In conclusion, analyzing HIBT crypto price volatility skew is vital for astute investment strategies. Understanding market contributors allows stakeholders to adapt and protect their investments. As always, consult local experts for tailored advice and navigate the dynamic crypto landscape with tools like HIBT’s analysis tools.

By focusing on market trends and local growth, investors can leverage insights to better position themselves. Join us at cryptosaviours for ongoing insights and strategies.

Author: Dr. Nguyen Minh, a cryptocurrency researcher with over 12 published papers, and a lead auditor for several notable blockchain projects.