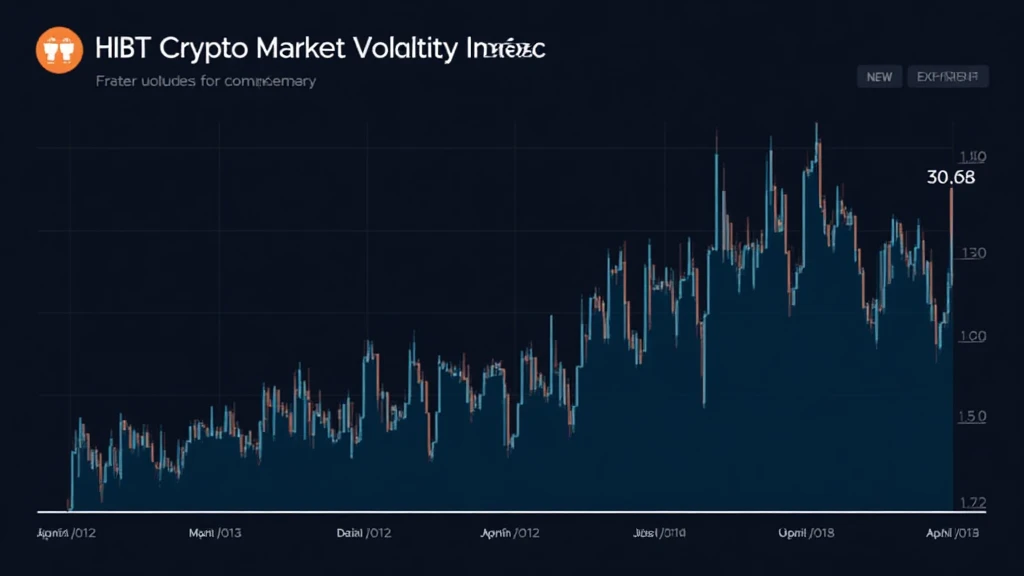

HIBT Crypto Market Volatility Index

In 2024, crypto investors faced a staggering $4.1 billion loss due to volatility. Understanding the HIBT crypto market volatility index can provide crucial insights into market dynamics. This index serves as a barometer for measuring the fluctuations in cryptocurrency prices, much like how a weather forecast predicts storms.

What is the HIBT Crypto Market Volatility Index?

The HIBT Crypto Market Volatility Index is an essential tool for traders and investors. It indicates the degree of price variability within the cryptocurrency market, helping stakeholders to make informed decisions. Imagine trying to navigate through a fog; the HIBT index is your compass, guiding you through uncertain conditions.

Importance of Market Volatility Analysis

- Informs risk management strategies: Investors can analyze historical volatility data to better prepare for sudden market shifts.

- Enhances investment decisions: Knowing when to enter or exit a position can maximize profit margins.

- Supports regulatory compliance: Understanding volatility helps comply with local laws, especially pertinent in regions like Vietnam, where crypto user growth rate hit 110% in 2024.

How the HIBT Index Works

The HIBT index calculates volatility based on various factors such as trading volume, price changes, and market sentiment. Think of it as a thermometer assessing temperature variations; the wider the swings, the higher the volatility reading.

Real-world Application

For example, during drastic market shifts, the index spikes, alerting traders to potential fluctuations. This information is akin to having weather alerts during a storm; it equips you to brace for impact.

Using the HIBT Index for Smart Trading

- Integrate with technical analysis tools: Combining the HIBT with charts can improve predictive accuracy.

- Set risk thresholds: Utilize data from the index to determine entry and exit points.

- Real-time updates: Stay informed with live updates which can be critical during periods of high volatility.

The Future of Crypto Volatility in Vietnam

Vietnam is rapidly emerging as a hotspot for cryptocurrency. With increasing user adoption, understanding the HIBT crypto market volatility index could be vital for both individual investors and regulatory bodies. According to Chainalysis, the country experienced a 45% growth in crypto transactions in 2025, underscoring the need for reliable tools.

As we move into 2025, staying ahead of volatility trends will be key to maximizing returns while minimizing risks.

Conclusion

In conclusion, the HIBT crypto market volatility index is a powerful indicator that every investor should consider. By effectively incorporating it into your investment strategy, you can navigate the unpredictable tides of the cryptocurrency market with confidence. For more dependable insights, visit hibt.com.

Not financial advice. Always consult local regulators first.