Introduction: Understanding Open Interest in Crypto Futures

In the rapidly evolving world of cryptocurrencies, keeping track of open interest in futures contracts is crucial. Reports indicate that open interest in HIBT crypto futures has surged to unprecedented levels, reflecting growing investor interest. As of early 2025, the open interest reached $1.5 billion, a 30% increase from the previous year. This drastic rise raises significant questions about market dynamics and investor sentiment.

The Mechanics of Open Interest

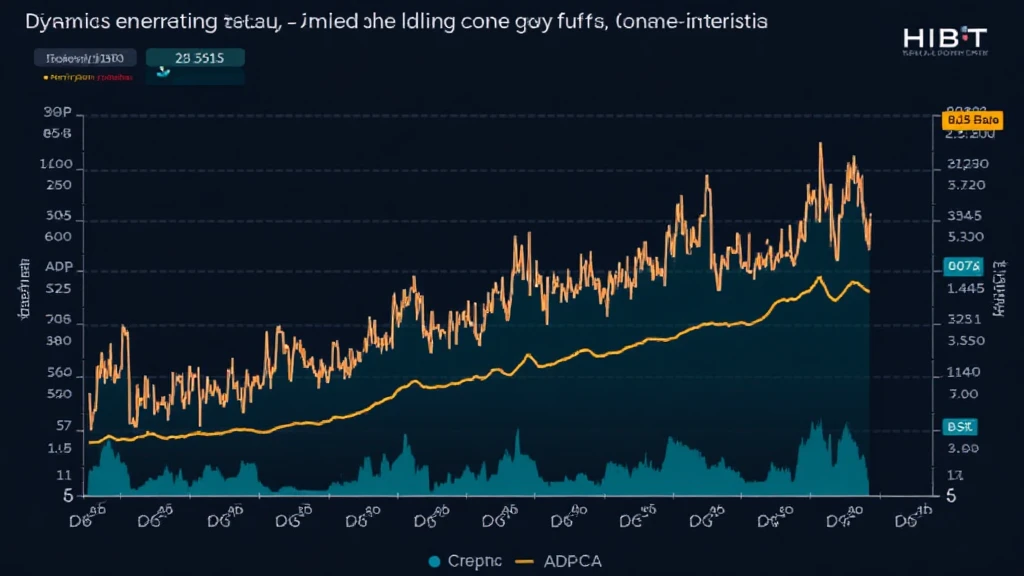

Open interest refers to the total number of outstanding contracts that have not been settled. Think of it like the number of bank vaults still holding deposits. Lately, the trend associated with HIBT crypto futures showcases a volatile yet promising landscape. When open interest rises alongside price, it indicates new money entering the market. Conversely, when prices drop but open interest remains stagnant, it signals potential market manipulation or uncertainty.

Correlation with Price Movements

The correlation between HIBT crypto futures open interest and market price is intriguing. Historical data suggests that increasing open interest often correlates with upward price movements. For example, in Q1 of 2025, HIBT’s price rallied by approximately 20% in tandem with rising open interest levels. This trend can be instrumental for traders looking to capitalize on potential market movements.

Vietnam’s Growing Role in the Crypto Landscape

Vietnam, ranked among the top countries for cryptocurrency adoption, is seeing a notable growth rate of over 40% in user registrations within the past year. This boom contributes directly to the increasing HIBT futures open interest. Interest from Vietnamese investors has shifted from traditional assets towards digital currencies, highlighting a vast shift in investment strategies. For instance, regulators are beginning to recognize the need for clear guidelines, as outlined in the HIBT compliance report.

Impact of Local Regulations

As more Vietnamese engage with HIBT futures, the role of governmental policies grows essential. Compliance measures, such as those advocated by local authorities focusing on tiêu chuẩn an ninh blockchain, are likely to reshape the ecosystem. Traders should stay updated on these changes to adapt their strategies accordingly.

Strategies for Engaging with HIBT Futures

To navigate the open interest trends effectively, consider the following strategies:

- Monitor open interest levels regularly to gauge market sentiment.

- Utilize technical indicators alongside open interest for more precise trading signals.

- Stay informed about local regulations impacting HIBT futures in Vietnam.

- Leverage trading platforms that offer extensive analytical tools to assess trends.

Conclusion: The Future of HIBT Crypto Futures

In summary, the trends in HIBT crypto futures open interest are significant indicators of market health and investor sentiment. As Vietnam becomes increasingly integrated into the global cryptocurrency market, understanding these dynamics will be key for traders. Analyzing HIBT futures could potentially lead to better investment decisions—particularly as adoption rates increase. As always, ensure your strategies align with current regulatory landscapes to maintain compliance while maximizing profits. For further insights, check out the resources available on HIBT’s official website.