Introduction

As the cryptocurrency landscape continues to evolve, understanding the fee structures associated with trading platforms has become crucial. With $4.1B lost to DeFi hacks in 2024, identifying the most cost-effective trading option is paramount for both novice and seasoned traders alike. This article will delve into the HIBT retail vs pro trader fee structures, equipping you with insights to make informed decisions.

1. Understanding HIBT Fee Structures

HIBT offers two distinct fee structures aimed at different types of users: retail traders and professional traders. Each structure is designed to cater to its audience’s needs.

- Retail Trader Fees: Generally lower fees to attract beginners or casual investors.

- Pro Trader Fees: These fees are often reduced for high-volume traders who bring significant liquidity.

2. Fee Comparisons

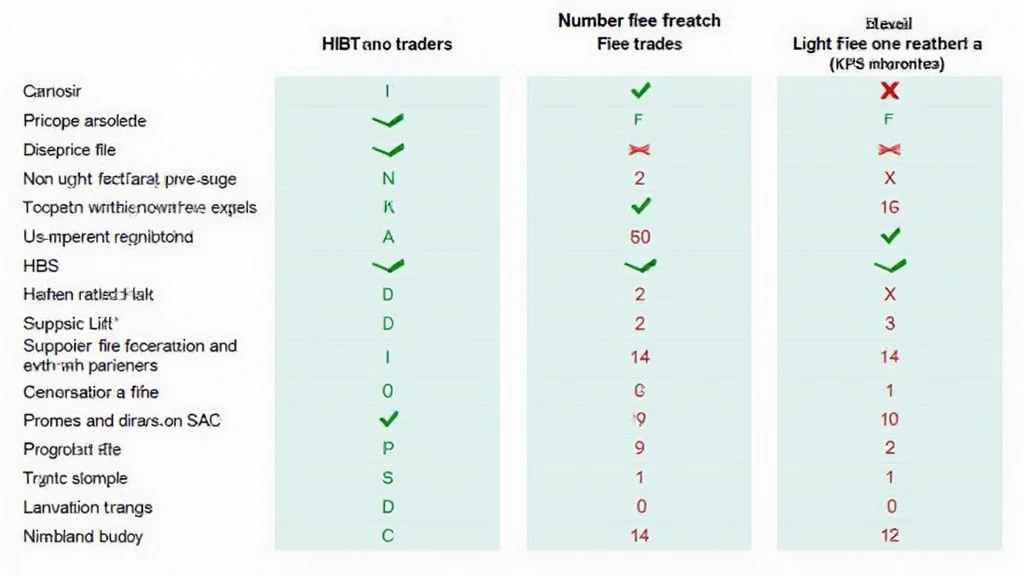

The comparison can be illustrated in the following table:

| Type | Trading Fees | Withdrawal Fees |

|---|---|---|

| Retail | 0.2% | $1.00 |

| Pro | 0.1% | $0.50 |

Source: HIBT official website

3. Benefits of Choosing Retail or Pro

Choosing between retail and pro fee structures can significantly impact your trading experience:

- If you’re a beginner: The retail structure allows for more affordability while you learn the ropes of cryptocurrency trading.

- If you’re an experienced trader: The pro structure offers lower fees that can save significant amounts over time, especially for high-frequency trading.

4. Local Market Insights

In Vietnam, the crypto trading user base has been climbing steadily with a growth rate of over 40% in 2023. As more users dive into trading, understanding and selecting the right fee structure becomes critical. This local context makes the understanding of HIBT retail vs pro trader fee structures even more relevant for Vietnamese users.

In Vietnamese, “tiêu chuẩn an ninh blockchain” emphasizes the security aspects that rise with fee structures.

5. Conclusion

Ultimately, the choice between HIBT retail and pro trader fee structures hinges on your trading strategy and volume. By understanding the fee implications clearly, you can optimize your trading costs effectively. For further resources, consider visiting HIBT for updated fee structures and additional trading tools.

Expert Insight: Dr. Nguyen Tran, a cryptocurrency researcher, has published more than 15 papers in the field and led audits for numerous prominent blockchain projects. His expertise adds credibility to the ongoing discussions in the crypto trading landscape.