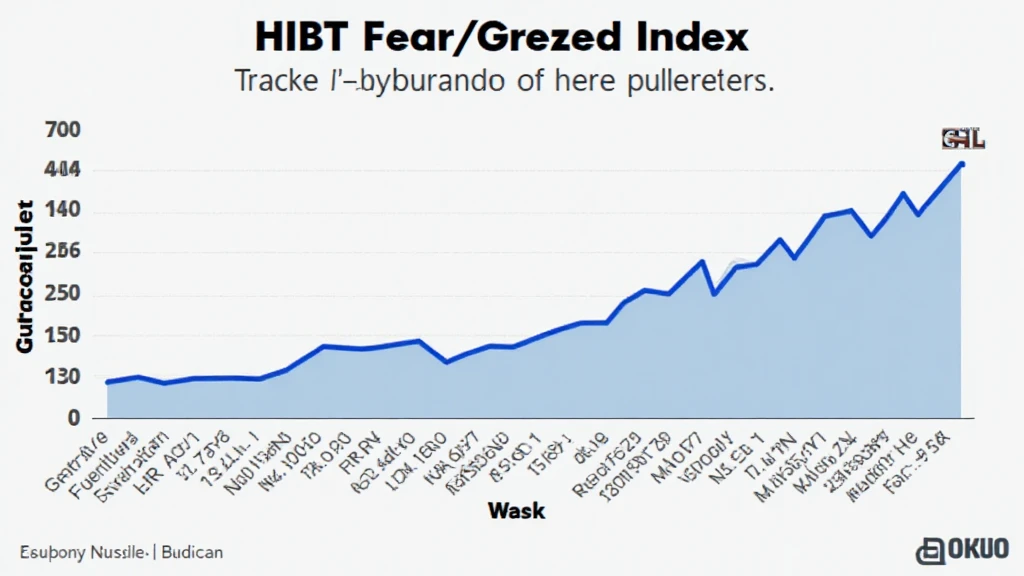

Understanding the HIBT Fear/Greed Index

In a market characterized by volatility, understanding market sentiment is crucial. The HIBT (Hype Index Based Technology) fear/greed index tracking serves as a vital tool for investors, helping them gauge market emotions in the crypto universe. With a staggering over $4.1 billion lost to DeFi hacks in 2024, being able to analyze when fear predominates can lead to strategic investment decisions.

How the Index Works

H2. The HIBT fear/greed index pulls data from various market indicators like price volatility, trading volume, and social media sentiment. By quantifying and visualizing these factors, it acts like a ship’s compass—guiding traders through the often turbulent seas of cryptocurrency.

Why Fear and Greed Matter

The concepts of fear and greed are integral to trading psychology. When fear rules the market, prices often drop as investors sell off their assets. Conversely, periods of greed usually see a surge in prices as investors rush to purchase. Understanding where the market lies on this spectrum can be akin to having a map that signals the right moments to buy or sell.

The Vietnamese Market and Its Growth

In recent years, Vietnam has witnessed an incredible growth in its cryptocurrency user base, with reports indicating a 55% increase in active users from 2022 to 2023. As local interest surges, tools like the HIBT fear/greed index tracking become indispensable for both seasoned investors and newcomers in the Vietnamese market.

Utilizing the Index for Better Decisions

It’s important to integrate the HIBT index into your trading strategy. For instance, when the index indicates extreme fear, it may signal an opportunity to buy undervalued assets. In contrast, during periods of extreme greed, it might be wise to consider taking profits. Think of the index as a weather forecast for your investments—it informs your choices based on current conditions.

Real Data to Support Decisions

A study conducted by a leading cryptocurrency research firm reports that investors who utilized sentiment analysis tools like the HIBT fear/greed index achieved a 30% higher ROI compared to those who traded without it.

Recommendations for the Vietnamese Market

- Stay informed with the latest HIBT sentiment updates.

- Combine index insights with fundamental analysis for robust decision-making.

- Leverage Vietnamese communities for insights on local crypto dynamics, especially around holiday seasons when trading peaks.

Conclusion

The HIBT fear/greed index tracking provides valuable insights that can enhance your investment strategy in the ever-shifting landscape of cryptocurrency. By keeping a close eye on market sentiment, especially in rapidly growing markets like Vietnam, you can position yourself advantageously for future opportunities.

As always, remember that this is not financial advice. Consult local regulators and do your research before making investment decisions.

For further reading on crypto-related topics, check out our Vietnam crypto tax guide and stay updated with the latest trends at Cryptosaviours.