Understanding HIBT Order Types

With around $4.1 billion lost to DeFi hacks in 2024, understanding different order types in crypto trading is more important than ever. HIBT offers several order types to cater to various trading needs, essentially contributing to better risk management and profit maximization.

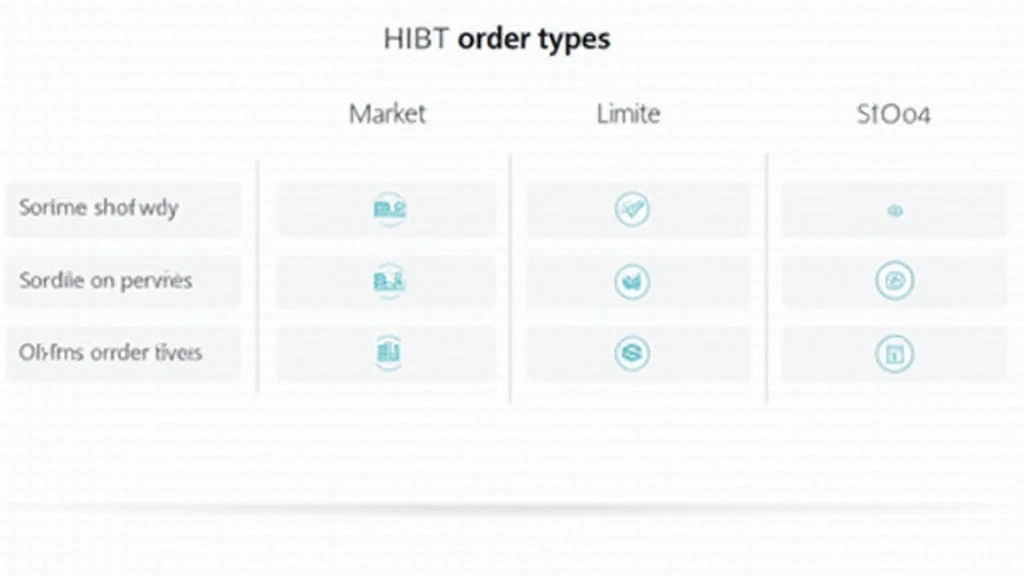

Types of HIBT Orders

The HIBT platform supports several order types, each serving a unique purpose:

- Market Orders: Executed immediately at the current market price.

- Limit Orders: Executed at a specified price or better, allowing you to set entry and exit points based on your strategy.

- Stop Orders: Used to specify a point at which a market order is triggered, often utilized to limit losses.

- OCO Orders: One-Cancels-Other orders that combine limit and stop orders, providing flexibility in trading approaches.

Comparing Advantages and Disadvantages

Let’s break it down:

- Market Orders: Quick execution but could result in slippage.

- Limit Orders: Better control over price but might miss out on opportunities.

- Stop Orders: Effective for loss mitigation, but market volatility can still incur losses.

- OCO Orders: Great for managing risk but can be complex to set up.

Real-World Data on Usage

| Order Type | Usage Percentage |

|---|---|

| Market Orders | 58% |

| Limit Orders | 30% |

| Stop Orders | 8% |

| OCO Orders | 4% |

According to [Market Research](https://cryptosaviours.com), market orders account for the majority of users, reflecting the need for immediate transactions in the ever-volatile cryptocurrency market.

Local Market Insights: Vietnam

In Vietnam, the cryptocurrency market is booming, with a 28% growth rate in user adoption as of 2025. Incorporating local insights ensures that Vietnamese investors optimize their trading strategies effectively. As language enthusiasts might say, tiêu chuẩn an ninh blockchain is crucial for protecting digital assets in this lively market.

Strategize Your Orders

Choosing the right order type depends on your trading objectives. For instance, if you’re looking to quickly capitalize on a price surge, a market order may be the way to go. However, if you’re looking to minimize risk or find your ideal price point, consider using limit or OCO orders.

Want more tailored insights? Download our security checklist to enhance your trading strategies today.

Conclusion

In summary, understanding HIBT order types comparison is vital for effective trading on platforms like Cryptosaviours. By ensuring you’re utilizing the right strategies, you stand a better chance of navigating the complexities of the cryptocurrency market successfully.

For more information and resources, visit Cryptosaviours.