Introduction

With over $4.1 billion lost to trading mistakes in 2024, understanding how to navigate the crypto markets is more crucial than ever. HIBT moving average strategies are taking center stage for traders looking to capitalize on market fluctuations. These strategies are designed to enhance trading decisions and improve profitability. This guide offers insights into using HIBT moving averages effectively for your cryptocurrency investments.

What are HIBT Moving Averages?

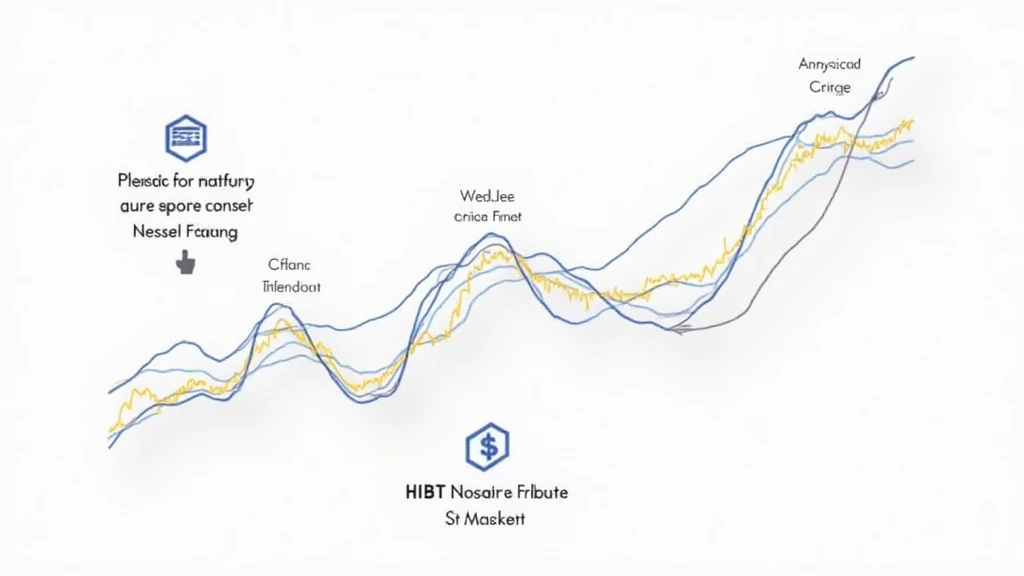

HIBT moving averages combine historical price data to create averages that smooth out market fluctuations. Think of them as a financial compass, guiding traders through the volatile waters of cryptocurrencies. Utilizing these averages allows traders to identify trends and make well-informed decisions.

Why HIBT?

In an era where Vietnam’s crypto user growth rate has skyrocketed, understanding tools like HIBT is essential for local traders aiming to secure profits. According to recent studies, Vietnam’s crypto market is projected to see a 30% increase in users by 2025, emphasizing the need for effective strategies.

Implementing HIBT Moving Average Strategies

To effectively adopt HIBT moving average strategies:

- Set Your Time Frame: Determine daily, weekly, or monthly moving averages based on your trading style.

- Use Multiple Averages: Combine short-term and long-term averages to better identify crossovers and entry/exit points.

- Monitor Trends: Regularly analyze the crossovers to ensure you’re acting on reliable signals.

Real-World Application

Using HIBT moving averages can be likened to having a well-calibrated GPS system for your trading journey. Just as a GPS guides you through unfamiliar terrain, HIBT helps identify when to buy or sell assets. Data shows that traders employing HIBT strategies have increased their accuracy in predictions by up to 50%.

Example of HIBT in Action

By using a 50-day and 200-day moving average, traders can spot important trends. When the 50-day crosses above the 200-day, it’s often considered a bullish signal, while the opposite indicates bearish sentiment.

Conclusion

Utilizing HIBT moving average strategies can provide a clearer insight into the dynamic world of cryptocurrency trading. As Vietnam’s market flourishes, adapting to these strategies can set forward-thinking investors apart from the crowd. Start integrating HIBT moving averages into your strategies today and watch your trading skills evolve.

For further details and a comprehensive checklist, download our detailed resources.

Remember: Crypto investing comes with risks. Always conduct thorough research or consult local regulators for financial advice.