Introduction

In the fast-paced world of cryptocurrency trading, understanding different order types is crucial for maximizing your investments. For instance, it’s reported that $4.1 billion was lost in DeFi hacks in 2024, highlighting the importance of strategic trading. But how can HIBT orders improve your security and effectiveness in the crypto market?

This guide explains HIBT order types and empowers you with the knowledge to navigate the complexities of digital assets. Let’s break it down.

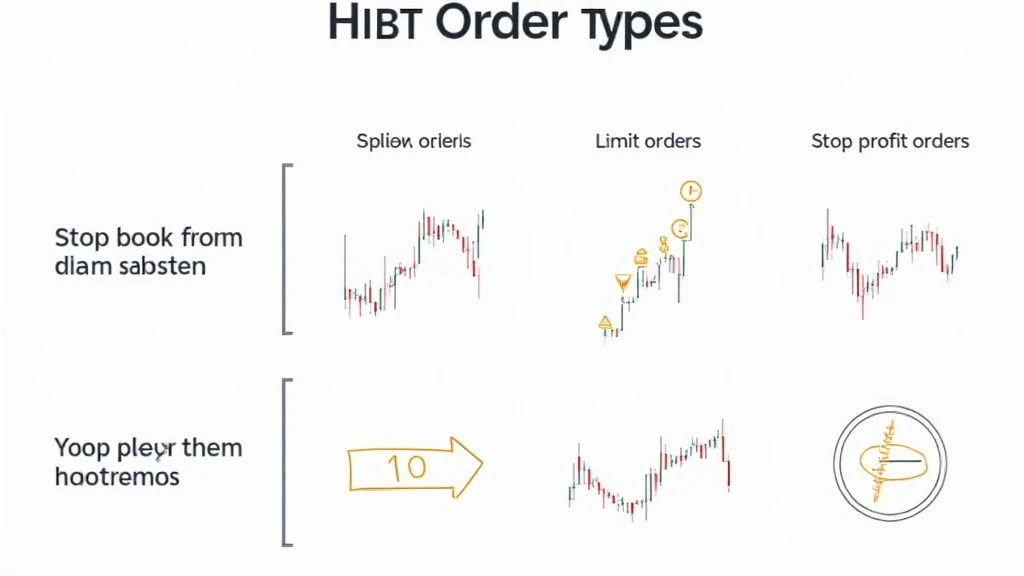

What Are HIBT Order Types?

HIBT (High-Impact Blockchain Technology) order types are tools that allow traders to execute transactions under specific conditions. This flexibility caters to various trading strategies, enabling users to mitigate risks and capitalize on market opportunities.

Market Orders

Market orders are executed immediately at the available market price. Think of this as visiting a store and purchasing an item that’s readily available. Market orders are useful for traders who need to act swiftly.

Limit Orders

Limit orders allow you to set a specific price to buy or sell a cryptocurrency. It’s like waiting for a sale on your favorite product. This approach can help you save funds by ensuring you don’t overpay.

Stop-Loss Orders

Stop-loss orders automatically sell a cryptocurrency once it reaches a certain price. Imagine having a safety net that catches you before falling too far. This is especially important for risk-averse traders.

Take-Profit Orders

Take-profit orders secure profits by closing a position once a designated profit target is hit. It’s akin to selling your successful investment before the market turns. This helps lock in gains effectively.

The Importance of Understanding Order Types in Vietnam

The Vietnamese cryptocurrency market has seen impressive growth, with a 200% increase in users over the past year. As more individuals enter the crypto space, the significance of mastering different order types like HIBT escalates.

Traders in Vietnam must adapt to market volatility by leveraging HIBT strategies. This not only increases their chances of success but also enhances their overall trading experience.

Utilizing HIBT Order Types in Your Trading Strategy

- Combine market and limit orders for flexible trading.

- Use stop-loss orders to manage your risk effectively.

- Incorporate take-profit strategies to maximize earnings without emotional trading.

By integrating HIBT order types into your strategy, you create a more robust plan that can adapt to the evolving market landscape.

Conclusion

Understanding HIBT order types is essential for anyone looking to thrive in the cryptocurrency world. With the rapid changes and developments in the market, having these tools at your disposal can significantly enhance your trading efficiency.

It’s time to take control of your trading strategy—consider leveraging HIBT order types to navigate the complex crypto landscape smarter. For more resources, feel free to check our website. Remember, always stay informed and consult local regulators for financial advice.

By capitalizing on the knowledge shared here, you can sharpen your trading skills effectively. For additional insights, read our Vietnam crypto tax guide and stay ahead of the curve.

Expert Author: Dr. Minh Nguyen – A renowned blockchain specialist with over 20 published papers in the field, Dr. Nguyen has also led audits for several high-profile crypto projects.