Why is Cryptocurrency Portfolio Stress Testing Essential?

Did you know that over 60% of cryptocurrency investors face significant losses due to market volatility? As the digital currency landscape evolves, understanding how to safeguard your investments becomes crucial. Portfolio stress testing allows investors to simulate various market conditions and evaluate their asset’s performance, enabling them to make informed decisions.

Understanding the Basics of Stress Testing

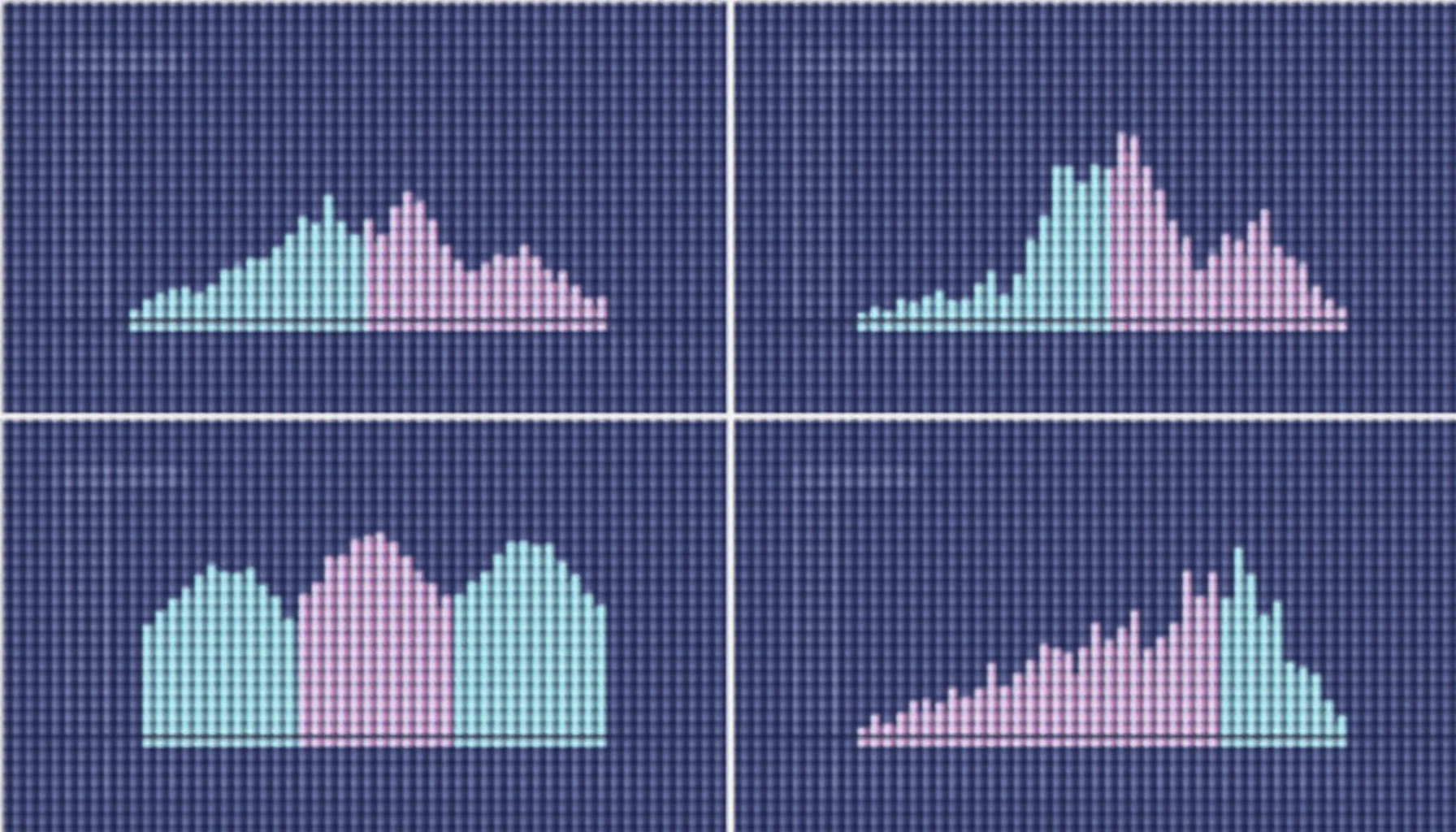

Think of stress testing as a weather forecast for your investment portfolio. Just like predicting a storm, it analyzes potential market downturns and helps investors prepare for unforeseen circumstances. By evaluating how your portfolio responds under stress, you can identify weaknesses and strategize accordingly.

- What is Stress Testing? Stress testing involves creating hypothetical scenarios (e.g., a sudden market crash) to assess the resilience of your cryptocurrency investments.

- Why Use It? It aids in risk management, allowing investors to adjust their strategies to enhance potential returns and minimize losses.

How to Conduct Stress Testing on Your Portfolio

Let’s break down stress testing into digestible steps, almost like following a recipe:

- Define your scenarios: Decide on market conditions to simulate, such as a 20% drop in Bitcoin or a regulatory crackdown in Singapore.

- Gather historical data: Use past market performance as a benchmark for your tests. Tools like Hibt.com’s Crypto Tools offer detailed analytics.

- Run simulations: Utilize software to test your portfolio’s performance across the scenarios you’ve defined.

- Analyze results: Identify which assets are most vulnerable, giving insight into potential adjustments needed.

Common Mistakes in Portfolio Stress Testing

Investors often overlook crucial factors when conducting stress tests. Here are a few common mistakes:

- Ignoring correlations: Failing to consider how assets react together in volatile markets can skew results.

- Not updating scenarios: Market conditions change; therefore, regular updates to stress scenarios are necessary for effective testing.

- Overconfidence in results: Always approach findings with caution; past performance is not indicative of future results.

Tools for Effective Stress Testing

Several platforms can enhance your testing endeavors:

- CryptoStress: Offers tailored stress testing solutions for cryptocurrency investors.

- Portfolio Management Platforms: Some tools allow built-in stress testing features—take advantage of them!

For example, using Hibt’s portfolio management tool can yield comprehensive insights.

Final Thoughts and Next Steps

In conclusion, implementing cryptocurrency portfolio stress testing can drastically improve your investment strategies by mitigating risks associated with digital currency volatility. Ensure you’re prepared for market fluctuations by embracing this essential practice, and make use of the tools available to you. Start simulating today! For more resources on cryptocurrency strategies, be sure to check out Hibt.com.

As a reminder, this article does not constitute investment advice; always consult with local regulatory bodies before making financial decisions.