Why Analyze Cryptocurrency Market Sentiment?

With over 5.6 million cryptocurrency holders worldwide, many struggle to understand the market’s emotional drivers. Market sentiment analysis helps investors grasp how perceptions and emotions can impact demand for digital currencies. Have you ever wondered why prices fluctuate so wildly in a matter of hours? Understanding sentiment can offer key insights into price movements and trading opportunities.

Understanding Market Sentiment: The Basics

To put it simply, think of the cryptocurrency market like a bustling farmers’ market. As different cryptocurrencies, like Bitcoin and Ethereum, are showcased, traders and investors—akin to market-goers—react to news, social media buzz, and economic indicators. This collective behavior can create bullish or bearish trends:

- Bullish Sentiment: Optimism can lead to increased investment.

- Bearish Sentiment: Pessimism often correlates with sell-offs.

Learning how to interpret these sentiments is crucial for any trader interested in digital currency trading.

Key Factors Influencing Cryptocurrency Sentiment

Market sentiment doesn’t just arise from trading activity; it’s built on various factors:

- News Events: Major announcements, like regulatory changes, can spark drastic sentiment shifts.

- Social Media Activity: Sentiment analysis tools often scan platforms like Twitter or Reddit to gauge public opinion.

- Market Data: Insights from previous transactions provide context to current sentiment.

For example, **according to the 2025 Chainalysis report**, the Asia-Pacific region expects a **40% increase** in trading volume, a factor likely to influence overall market sentiment significantly.

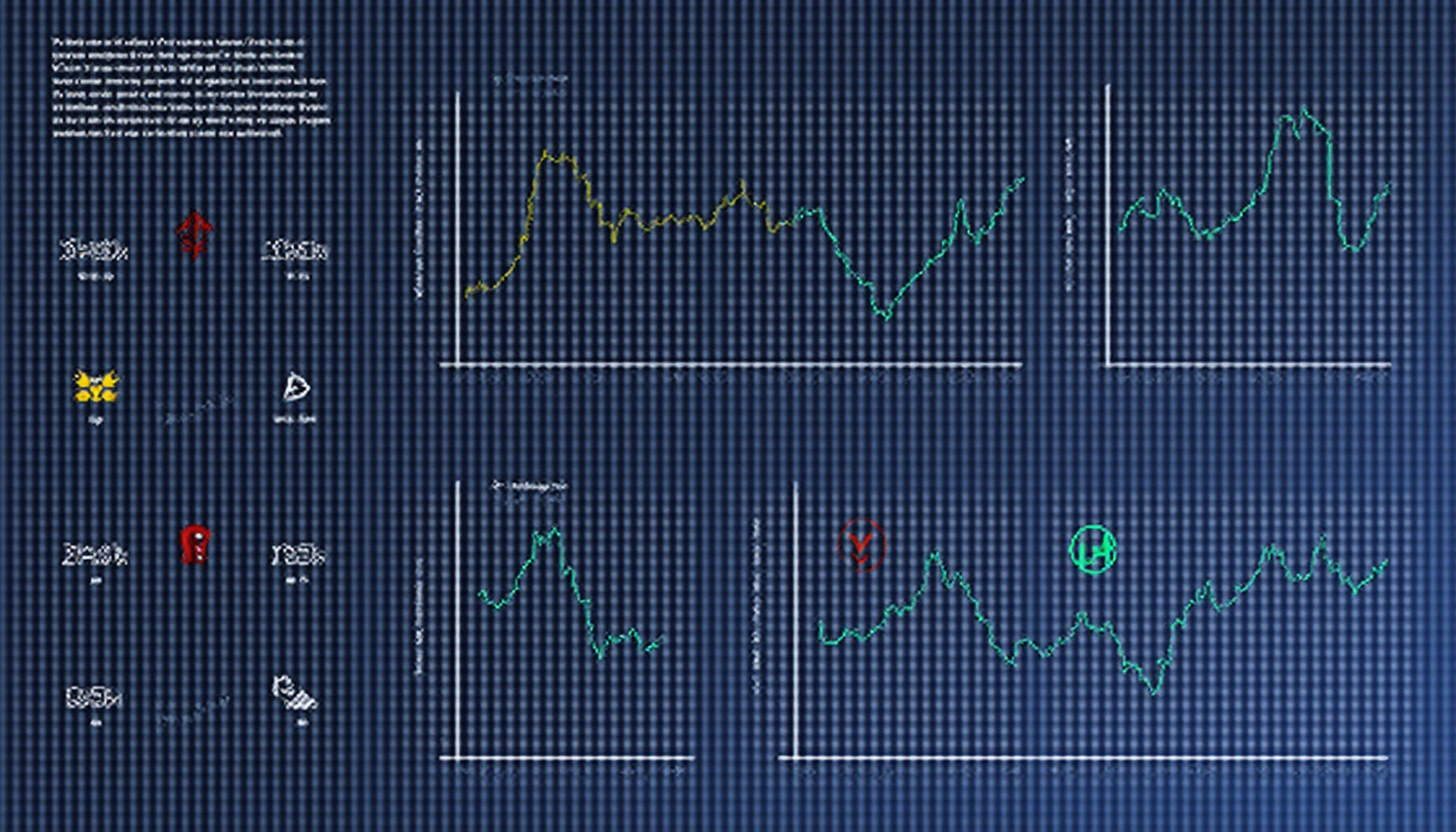

Tools for Analyzing Market Sentiment

If you’re asking yourself, “How can I evaluate cryptocurrency sentiment effectively?” you’re in luck! Here are some effective tools:

- Social Sentiment Analysis Tools: Platforms such as LunarCRUSH offer extensive metrics on how cryptocurrencies are perceived across social channels.

- Technical Analysis Tools: Combine sentiment data with technical indicators for a comprehensive view.

- Market News Aggregators: Websites like CoinDesk curate and analyze news to help shape your understanding of market moods.

Utilizing these tools equips you with the knowledge to make better trading decisions, especially regarding how to safely store cryptocurrency and manage risks.

Predicting Future Sentiment Trends

Looking forward, the key to a successful investment strategy in 2025 lies in understanding evolving market sentiment. For instance, top altcoins of 2025 may emerge from trends in decentralized finance (DeFi) and non-fungible tokens (NFTs). Keeping an eye on investor sentiment can give you an edge in identifying the next big opportunities.

Conclusion: Take Action Today!

In summary, analyzing cryptocurrency market sentiment is vital for anyone looking to thrive in the ever-changing world of digital currencies. Whether you’re a seasoned investor or just starting, understanding the emotional climate can help you navigate the market effectively. For more insights, check out our safe wallet guides and stay informed about the latest trends!