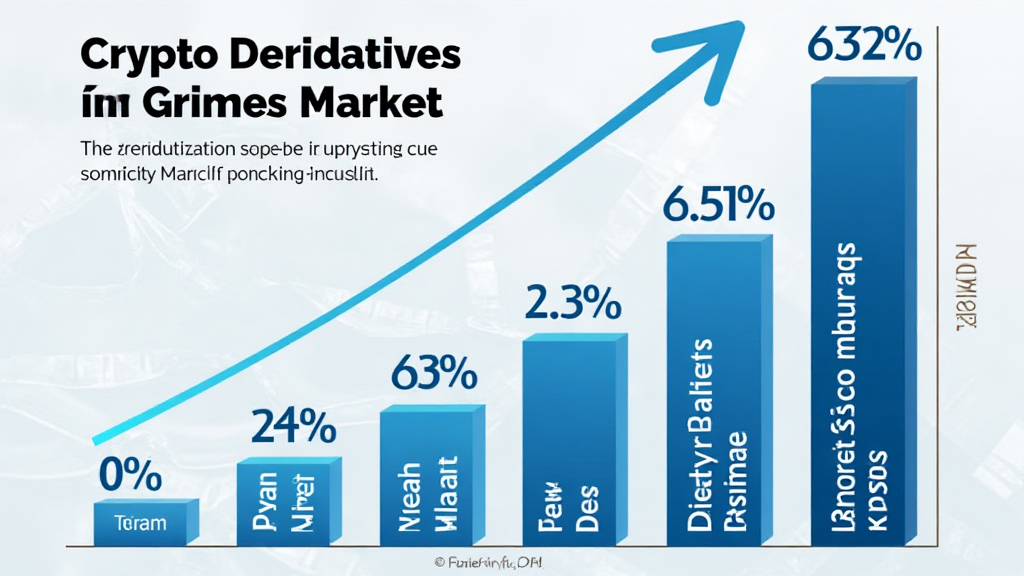

2025 Crypto Derivatives Market Size Insights

According to recent data from Chainalysis, the crypto derivatives market is experiencing remarkable growth, projected to reach a market size of $X billion by 2025. This rapid expansion hints at the increasing popularity among traders and investors alike, but it also comes with risks.

What Are Crypto Derivatives?

To put it simply, crypto derivatives are financial contracts whose values are derived from the price movements of underlying cryptocurrencies. Think of them like betting on the weather—while it might be sunny today, your bet on tomorrow’s forecast can yield big returns or losses based on actual conditions.

2025 Trends in the Crypto Derivatives Market

With the market evolving, you might be wondering what the emerging trends look like. For instance, we’re seeing a rise in decentralized derivatives platforms. This shift is akin to buying fruits directly from a farmer instead of going through multiple vendors, ensuring better prices and fresher products.

Risks in Trading Crypto Derivatives

Like any financial tool, trading in crypto derivatives poses specific risks. You’ve likely come across horror stories of traders losing their funds due to market volatility. Just as you wouldn’t invest all your savings into one gamble at a casino, diversification is key in the derivatives space.

Regulatory Changes Impacting the Market

In regions like Singapore, regulations are expected to develop significantly by 2025. This means that while markets may expand, they will also be more controlled. It’s like adding rules to a game; while it might limit some fun, it certainly creates fairness in play.

In conclusion, while the crypto derivatives market size is set to grow, being informed about trends, risks, and regulations is crucial. For those looking to navigate this space, consider downloading our tools for better strategies! Check out our resources here.