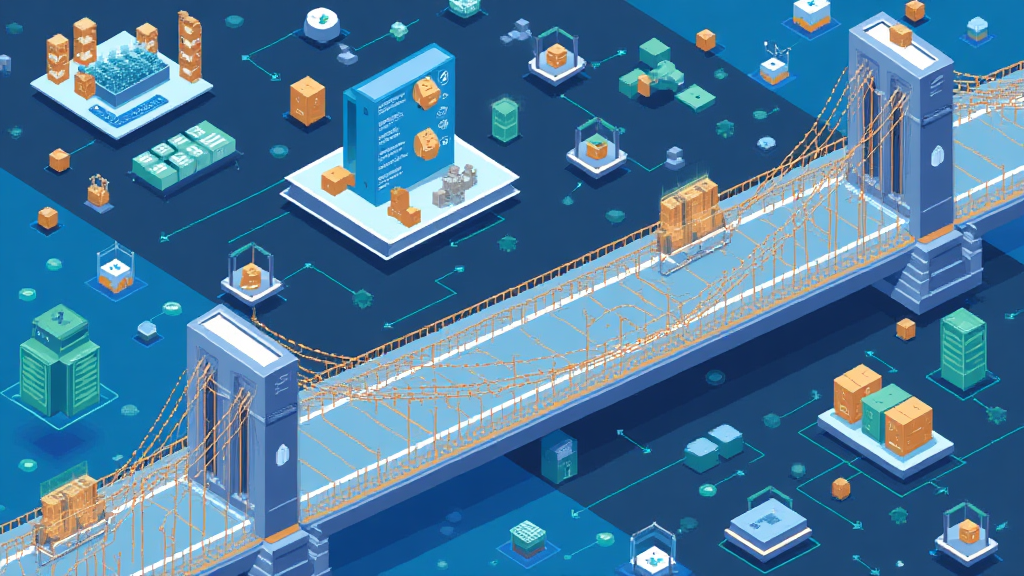

2025 Cross-Chain Bridge Security Audit Guide

In recent analysis by Chainalysis, it was reported that a staggering 73% of cross-chain bridges globally have vulnerabilities. As we look ahead to 2025, the need for robust security in the crypto space, particularly in cross-chain interoperability, becomes more critical than ever. This is where HIBT crypto front comes into play, offering solutions to these pressing issues.

What Are Cross-Chain Bridges?

Think of a cross-chain bridge like a currency exchange booth in a busy market. Just like you can swap your dollars for euros at one of those booths, cross-chain bridges allow you to move tokens between different blockchain networks. For example, you can transfer Bitcoin to Ethereum through these bridges. However, with great convenience comes great risk, as many of these bridges are quite vulnerable.

Enhancing Security Measures

To ensure safe transactions across chains, integrating zero-knowledge proofs can be a game-changer. Zero-knowledge proofs allow one party to prove to another that they know a value without revealing the value itself. If we relate this back to our exchange booth, it would be like showing you have the money without ever revealing how much you actually have. This technology can greatly enhance the security of cross-chain operations.

Understanding the Impacts of PoS Mechanism on Energy Use

As we move toward 2025, the debate around the energy consumption of Proof of Stake (PoS) mechanisms will continue. PoS consumes significantly less energy compared to Proof of Work (PoW). To illustrate, if PoW is like a factory running heavy machinery all day, PoS could be compared to a quiet coffee shop where people come in, work, and leave without all the noise and energy consumption. This shift not only benefits the environment but also caters to regulatory scrutiny.

Localizing Crypto Regulations in Dubai

For those interested in navigating the crypto scene in Dubai, understanding local regulations is essential. The Dubai cryptocurrency tax guide outlines how digital asset transactions will be treated under local laws, emphasizing compliance to mitigate risks. The regulations aim to provide a clear framework for crypto operations, ensuring that investors can participate responsibly.

In summary, as we approach 2025, understanding cross-chain bridges, employing zero-knowledge proofs, evaluating PoS mechanisms, and keeping up with local regulations—especially in regions like Dubai—are critical. For those looking to secure their digital assets, consider downloading our tool kit available at hibt.com.

Disclaimer: This article does not constitute investment advice. Please consult with local regulatory agencies (such as MAS or SEC) before making any investment decisions. Additionally, using devices like Ledger Nano X can help reduce the risk of private key exposure by up to 70%.

For deeper insights on cross-chain safety, check out our cross-chain security white paper and guidelines on blockchain risks.

By following these insights, you’ll be better equipped to navigate the evolving landscape of cryptocurrencies and ensure your investments are secure. Stay informed and prepared with cryptosaviours.