Spotlight on Crypto Deflationary Models

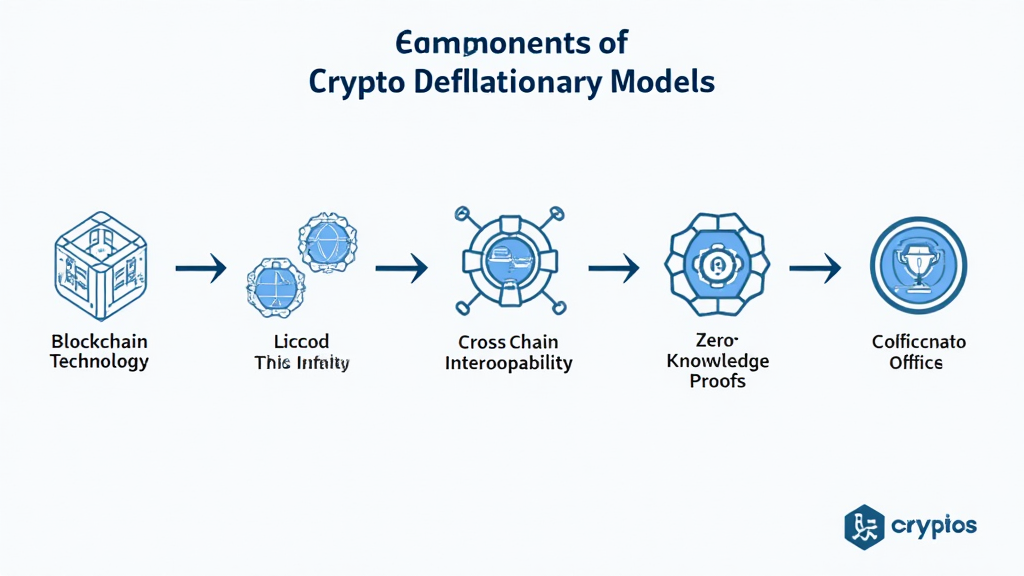

As the cryptocurrency landscape evolves, so do the models that underpin it. According to Chainalysis data from 2025, a staggering 73% of crypto deflationary models exhibit vulnerabilities that could impact users substantially. In this article, we will delve into the different aspects of these models, shedding light on crucial areas like cross-chain interoperability and zero-knowledge proof applications.

What are Crypto Deflationary Models?

To put it simply, crypto deflationary models are like a bakery that sells fewer loaves of bread each day. Instead of flooding the market with excess bread, which could lead to spoilage, these models reduce supply over time, keeping demand steady. The reduction in available coins can encourage increased value and stability. Just like you might pay more for that last delicious cupcake when they’re in short supply, crypto holders may find their investments appreciating over time.

The Importance of Cross-Chain Interoperability

Imagine you’re at an international airport, swapping currencies to spend in different countries. Cross-chain bridges function similarly, allowing assets to move between different blockchain platforms. Yet, according to recent studies, many of these bridges are poorly secured, exposing users to risks. Effective interoperability can enhance the utility and adoption of deflationary models but must be managed with robust security measures.

Zero-Knowledge Proof Applications for Privacy

Think of zero-knowledge proofs like a bouncer who verifies your age without needing to reveal your full identity. This technology allows for transactions that authenticate users without exposing personal information. In the context of deflationary models, zero-knowledge proofs can encourage safe usage while maintaining privacy, enabling users to uphold confidentiality even as their asset values fluctuate.

Global Trends: What Lies Ahead for 2025?

With regulatory frameworks shaping the future of decentralized finance, understanding the 2025 trends is crucial. For instance, in Singapore, the DeFi regulatory landscape is tightening, impacting how deflationary models can operate. Keeping an eye on these shifts can help investors make informed decisions while complying with evolving laws.

In conclusion, as crypto deflationary models become more prevalent, understanding their intricacies—from cross-chain functionalities to zero-knowledge applications—will be crucial for investors. We invite you to download our comprehensive toolkit to navigate these challenging waters effectively.

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory authorities such as MAS or SEC before making investment decisions.

To enhance your crypto security, consider using a Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.