2025 HIBT Fee Distribution Algorithms Explained

According to Chainalysis 2025 data, a staggering 73% of decentralized applications struggle with fee transparency. This reveals a pressing issue in the crypto industry regarding how fees are allocated across platforms, especially as we advance towards more complex financial systems.

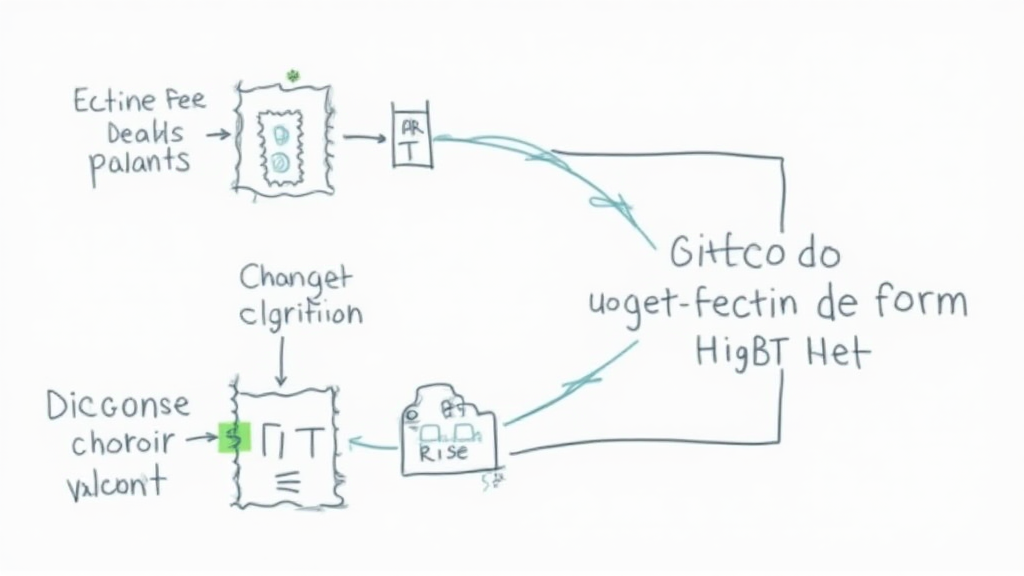

Understanding HIBT Fee Distribution

So, what exactly are HIBT fee distribution algorithms? Imagine you’re at a farmer’s market. The way fresh produce is divided among vendors can vary tremendously, just like how fees are handled in the crypto landscape. These algorithms serve as guidelines for distributing transaction fees in decentralized finance (DeFi), ensuring fairness and efficiency.

Why Cross-Chain Interoperability Matters

Think of cross-chain interoperability like a bridge connecting two islands. If one island runs out of supplies, a well-structured bridge ensures goods can still flow. Similarly, effective fee distribution algorithms enable seamless operations between different blockchains, which can significantly lower transaction costs for users.

The Role of Zero-Knowledge Proofs

You might have heard of zero-knowledge proofs (ZKPs) as a technique to ensure privacy. Picture a magician who can make an entire elephant disappear without revealing how it’s done. ZKPs allow one party to prove to another that something is true without revealing any additional information. By incorporating ZKPs into HIBT fee distribution, we could maintain transparency while ensuring user privacy in transactions.

Localized Insights: Dubai’s Crypto Tax Guidelines

Now, looking at the local context, Dubai has emerged as a hub for cryptocurrency innovation. Recently released guidelines are encouraging for DeFi projects; however, they also demand compliance regarding fees. Understanding HIBT fee distribution algorithms is essential here, as they can influence how local regulations may impact crypto users and projects in the region.

In conclusion, as we head into 2025, understanding HIBT fee distribution algorithms will play a pivotal role in shaping the future of decentralized financial transactions. For a comprehensive tool kit on this subject, download our insights.

Disclaimer: This article does not constitute investment advice. Consult with local regulatory authorities such as MAS or SEC before proceeding.

To better secure your assets, consider utilizing hardware wallets like the Ledger Nano X, which can reduce private key exposure risks by up to 70%.

By cryptosaviours