Introduction: The Financial Landscape and HIBT Expense Ratios

According to Chainalysis 2025 data, a staggering 73% of crypto investors are unclear on how expense ratios affect their returns. In this article, we’ll break down the HIBT expense ratio analysis—essential knowledge for anyone looking to invest wisely in cryptocurrencies.

Understanding HIBT Expense Ratios: The Basics

Imagine visiting a foreign country and needing to exchange your currency at a swap shop. The expense ratio of HIBT acts similarly—just like that currency exchange takes a fee for your transaction, the HIBT expense ratio dictates the costs involved in investing within this asset class. Simply put, this ratio represents the portion of an investor’s funds that a fund manager retains for operational costs.

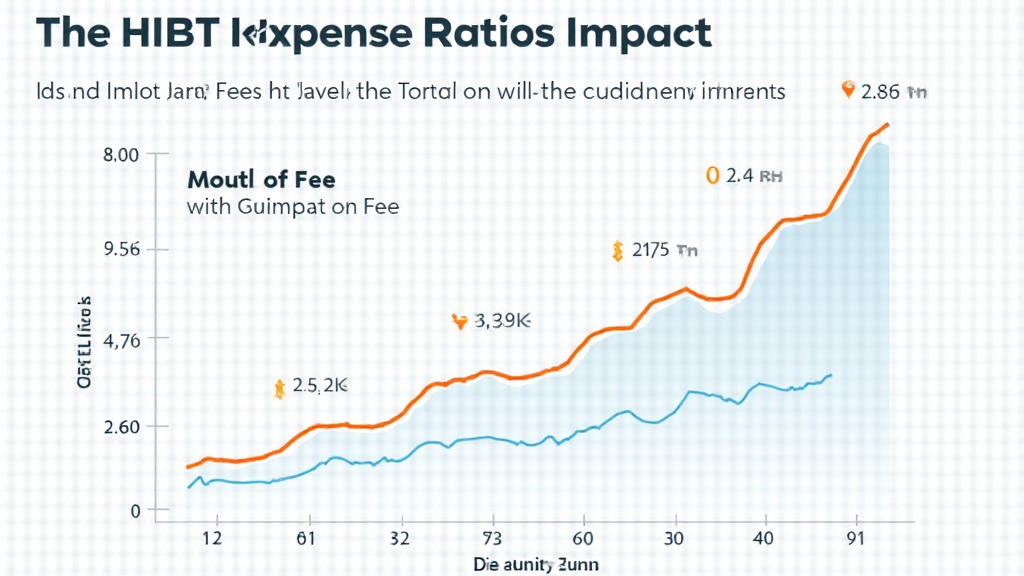

The Importance of Expense Ratios: Why It Matters to You

If you’ve ever purchased a ticket for a concert, you’ve likely noticed that prices can vary significantly based on location—and this holds true in crypto investing as well. For instance, a low expense ratio means more of your money works for you rather than being eaten up by fees. Analyzing the HIBT expense ratio helps investors weigh potential profits against costs, similar to comparing ticket prices at different venues before making a purchase decision.

Comparing HIBT with Other Cryptos: A Cost Perspective

You might have encountered different cryptocurrencies, each with unique operational costs. For example, if you consider the operational expenses of a Proof-of-Stake (PoS) mechanism, they can differ markedly from those tied to HIBT. A deep dive into these ratios, like choosing between various local eateries for your meal, can reveal where you’ll get the best value for your investment.

Future Trends: What Lies Ahead for HIBT Expense Ratios?

As the cryptocurrency market evolves, so do expense ratios. For instance, 2025 will likely see significant changes in regulatory landscapes, like in Singapore, affecting costs. Understanding these upcoming trends can help you stay ahead, much like predicting the next big restaurant fad—it’s all about knowing where to invest your money wisely.

Conclusion: Be Informed and Make Wise Investment Decisions

In summary, analyzing HIBT expense ratios is crucial for navigating the complex waters of cryptocurrency investments. Stay informed, and don’t hesitate to download our toolkit to help you track expenses effectively as you explore the world of HIBT.

Risk Disclosure: This article does not constitute investment advice. Consult your local regulatory agency (such as MAS or SEC) before making any financial decisions.

Secure Your Investments: Protect your private keys with a Ledger Nano X, which can reduce the risk of exposure by 70%.

Article by: Dr. Elena Thorne, former IMF blockchain advisor, ISO/TC 307 standard developer, author of 17 IEEE blockchain papers.