2025 Guide to HIBT Market Maker Algorithms in DeFi

According to Chainalysis data from 2025, a staggering 73% of DeFi protocols face vulnerabilities, emphasizing the critical need for robust solutions like HIBT market maker algorithms. These algorithms can enhance liquidity and security, revolutionizing trading as we know it.

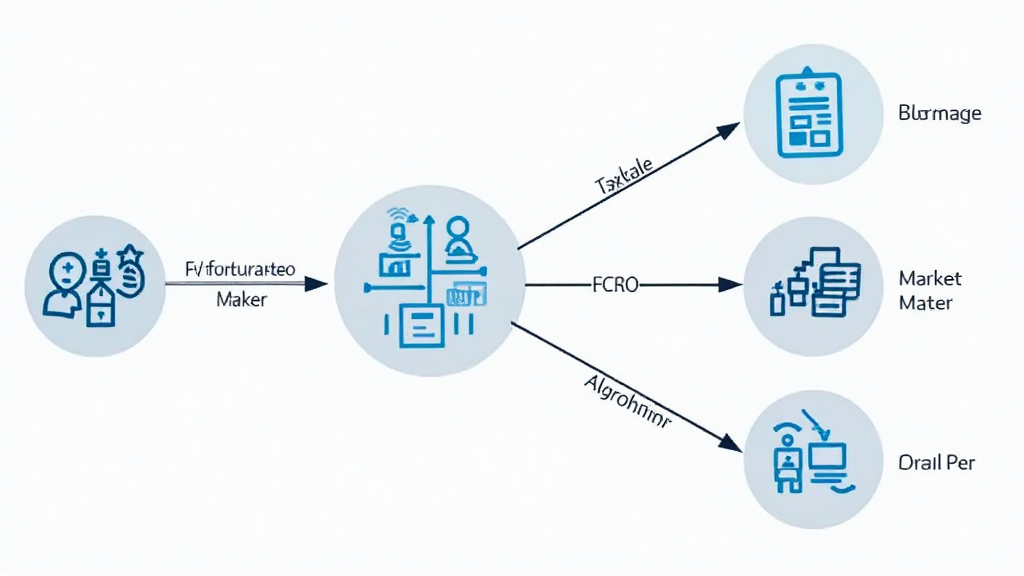

What are HIBT Market Maker Algorithms?

Imagine a bustling marketplace where vendors exchange goods—this is how market makers operate within the crypto ecosystem. HIBT market maker algorithms act like those knowledgeable vendors, ensuring that there’s always a buyer or seller available for trades. With these algorithms, traders can always find liquidity, similar to how you quickly find fresh produce in a well-organized market.

How Do They Enhance Cross-Chain Interoperability?

Cross-chain interoperability is like having a multilingual guide at a global fair. HIBT market maker algorithms facilitate seamless exchange between different blockchains, ensuring that users can easily trade assets across platforms without hurdles. This process is essential for the further development of decentralized finance, enhancing user experience and encouraging participation.

What Role Do They Play in Zero-Knowledge Proof Applications?

Think of zero-knowledge proofs as a magic trick where you prove you have something without revealing it. HIBT market maker algorithms can leverage these proofs to enhance privacy in transactions, allowing users to trade anonymously while still ensuring that the trades are valid and verifiable. This capability could lead to a more secure trading environment in 2025.

Looking Ahead: The Future of HIBT Market Maker Algorithms

As we move further into 2025, the evolution of HIBT market maker algorithms will be crucial for regulatory compliance, especially in regions like Singapore with its emerging DeFi regulations. These algorithms will need to adapt to new rules to ensure that they continue to provide safe and effective trading environments.

In conclusion, understanding HIBT market maker algorithms is essential for anyone involved in the crypto space. As we face increasing regulatory scrutiny and technological advancements, tools like the Ledger Nano X can help mitigate risks, reducing private key vulnerabilities by up to 70%. For more insights, feel free to download our toolkit on trading strategies.

Stay informed and ready for the changes ahead with HIBT resources. For further reading on decentralized finance, check out our white paper on cross-chain security.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authorities such as MAS or SEC before engaging in any trading activities.