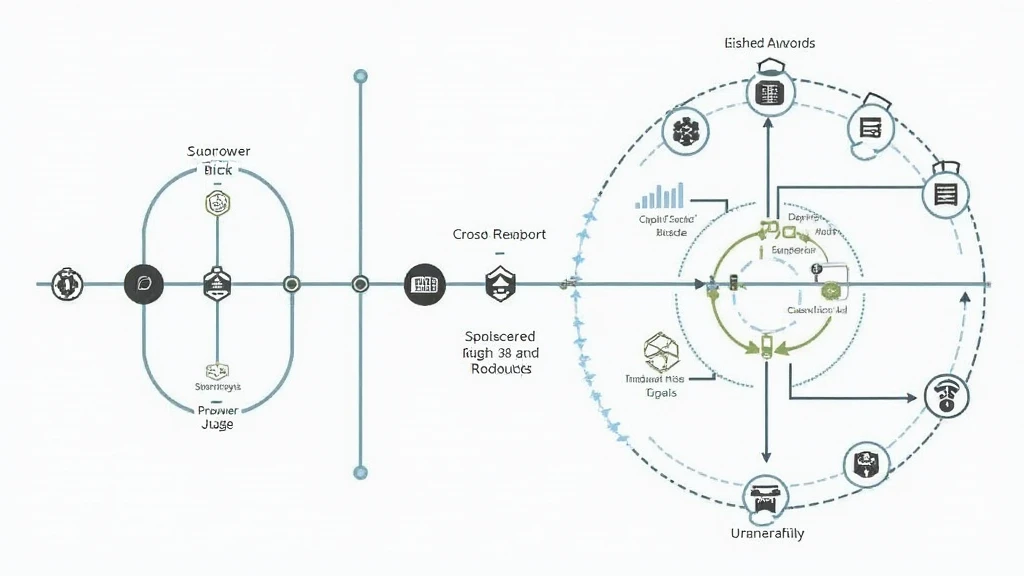

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a staggering 73% of cross-chain bridges worldwide have vulnerabilities. This alarming statistic raises questions about the security and efficiency of cryptocurrency transactions. With the rise of decentralized finance (DeFi), the importance of cross-chain interoperability is more critical than ever, particularly as we approach regulatory changes in places like Dubai. Let’s take a deeper look at key issues and solutions that can help mitigate risks in this evolving landscape.

Understanding Cross-Chain Bridges: A Market Stall Analogy

Think of cross-chain bridges like currency exchange stalls at a market. You know how when you want to buy something in another country, you need to exchange your currency? That’s exactly how a cross-chain bridge works, allowing two distinct blockchain networks to communicate and transact with one another. But, just like some exchange stalls might not have the best rates or could even be scams, some bridges have vulnerabilities that could jeopardize your crypto assets.

The Impact of Zero-Knowledge Proofs

Zero-knowledge proofs might sound complex, but they’re similar to showing someone a magic trick without revealing how it’s done. In the crypto world, this technology allows you to prove you have certain information without revealing the information itself. This can enhance security by ensuring that transactions on cross-chain bridges are private and verified, thus reducing the potential for fraud. By utilizing zero-knowledge proofs, we can help ensure a safer transaction environment.

Preparatory Measures for Users

As more users dive into DeFi, it’s essential that they understand how to protect their assets. For instance, ledger devices like the Ledger Nano X can reduce the risk of private key leaks by 70%. This is crucial when engaging with cross-chain bridges. Always remember, protecting your coins is as important as trading them. Just like you wouldn’t leave cash lying around in a market, you shouldn’t compromise the security of your crypto.

Future Regulations in Locations Like Singapore

As we look ahead to 2025 and beyond, regulatory trends such as those emerging in Singapore will likely bring more clarity to the DeFi landscape. The Monetary Authority of Singapore (MAS) has actively sought to regulate the DeFi sector to ensure user protection and market integrity. Understanding these regulatory frameworks is essential for users and developers alike as compliance will become a crucial aspect of operating in the crypto market.

In summary, navigating the complex waters of cross-chain compatibility and security is crucial for safeguarding investments in the crypto realm. By leveraging technological advancements and staying informed about regulatory trends, users can confidently engage in the DeFi space. For more practical resources and guidelines tailored to your needs, download our toolkit to enhance your understanding.

Disclaimer: This article is not intended as investment advice. Please consult local regulatory bodies such as the MAS or SEC prior to taking any action.

Stay informed with cryptosaviours.