Understanding HIBT Crypto Futures

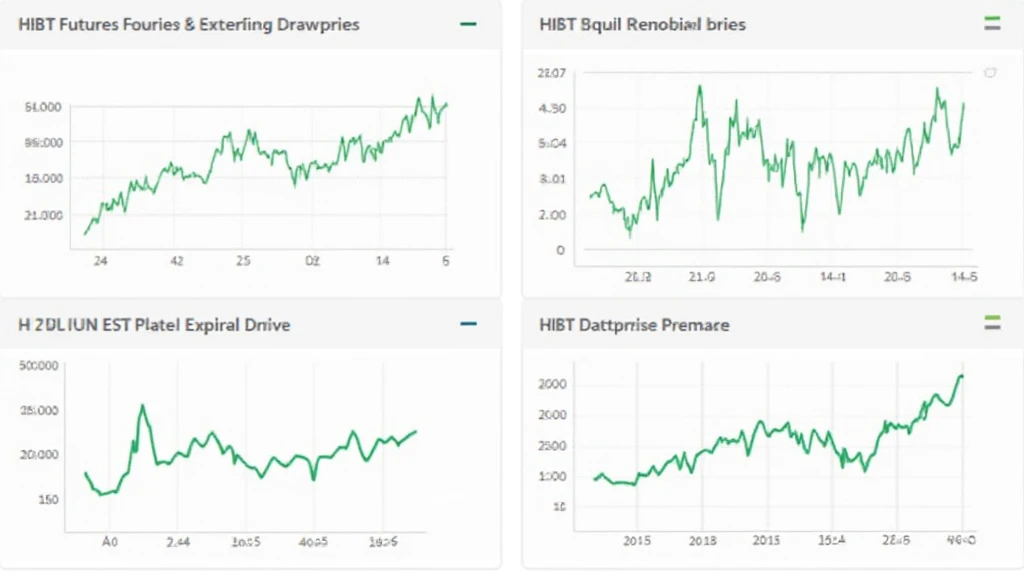

As the crypto market continues to evolve, traders are realizing the importance of HIBT crypto futures expiration dates. In fact, according to Chainalysis data from 2025, a staggering 73% of crypto futures face liquidity challenges at expiration. This creates urgency for traders to strategize effectively.

How Futures Expiration Affects Trading

Imagine you’re at a local currency exchange. The operator knows when each form of currency will be in demand, and they adjust their offerings accordingly. Similarly, understanding HIBT crypto futures expiration dates helps traders anticipate price fluctuations right before the contracts expire. This knowledge can mean the difference between profit and loss.

Strategies for Managing Expiration Dates

Many traders look for signals in market trends as expiry dates approach. Picture this: you see a clear indication that a shipment of your favorite fruit is arriving soon. You would likely buy more before prices rise, right? Traders can utilize similar tactics by monitoring market sentiment around the HIBT crypto futures expiration dates to capitalize on potential gains.

Regional Considerations for Crypto Futures

It’s essential to factor in local regulations. For instance, the Dubai cryptocurrency taxation guide outlines specific implications for futures trading. Just as you might adapt your cooking to local ingredients, understanding your region’s rules is vital in navigating the crypto landscape, especially concerning expiration strategies.

Conclusion

In summary, HIBT crypto futures expiration dates play a critical role in trading decisions. To navigate potential risks and rewards, it’s important for traders to stay informed and adapt their strategies. For more insights, download our toolkit today!

View our cryptocurrency safety whitepaper and learn more about your trading options.

Risk Disclaimer: This article does not constitute investment advice. Always consult local regulatory agencies like MAS or SEC before making trading decisions.

Secure your assets with Ledger Nano X, which can reduce the risk of private key leaks by up to 70%!